Zcash just fell off a cliff. The privacy coin broke critical support and now faces a potential 30% plunge to $253. Yet large holders are buying aggressively through the wreckage.

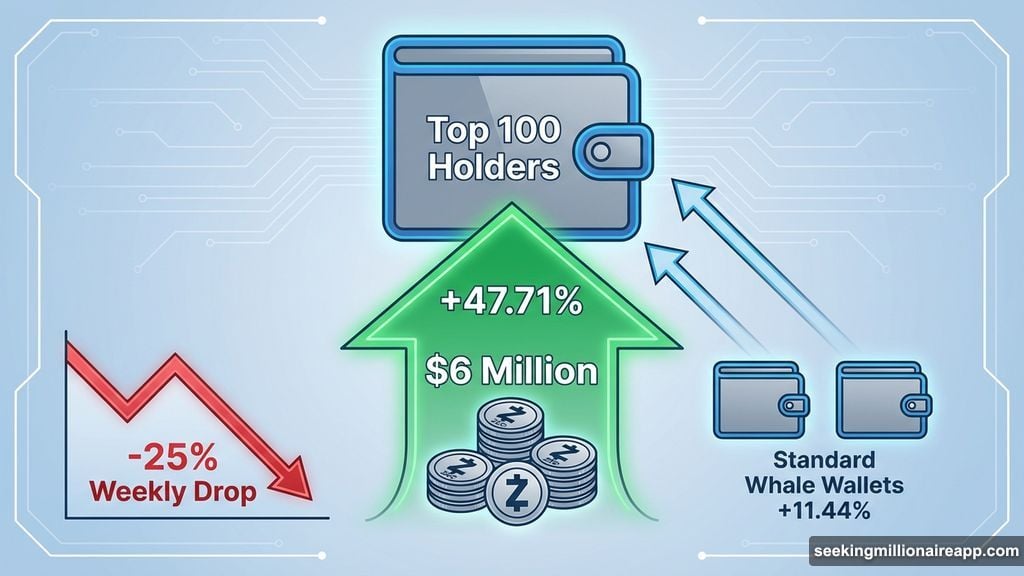

Something doesn’t add up. When whales accumulate $6 million in coins during a 25% weekly drop, they usually stop the bleeding. Not this time. So what broke the usual market mechanics, and can ZEC recover before hitting the full downside target?

The Chart Pattern Tells a Brutal Story

Zcash activated a textbook head-and-shoulders breakdown on the 12-hour chart. The pattern completed when price slipped below the neckline near $381.

Here’s how the math works. Measure from the head peak down to the neckline. Then project that distance from the breakdown point. That calculation lands at $253, representing over 30% downside from current levels.

But the technical damage runs deeper than one pattern. ZEC also lost its 200-period exponential moving average on the same timeframe. EMAs weight recent prices more heavily than simple moving averages, making them better trend indicators.

Losing the 200 EMA often flips a level from support to resistance. Plus, the 20-period EMA just crossed below the 100-period EMA. This bearish crossover shows short-term momentum deteriorating faster than the broader trend.

So Zcash now faces three bearish signals firing simultaneously. The breakdown pattern, the EMA loss, and the momentum crossover all point toward further weakness. Technical traders see these setups and adjust positions accordingly.

Sentiment Collapsed Over 90% in Days

The trigger? A governance shock that crushed community confidence.

Zcash’s positive sentiment metric imploded from nearly 90 down to roughly 5 within days. That’s a collapse of more than 90%. For context, sentiment measures social discussion, community engagement, and overall market mood around a specific coin.

This isn’t the first time ZEC responded dramatically to sentiment shifts. Back on December 27, positive sentiment peaked locally. Within 48 hours, Zcash rallied from approximately $511 to $550—an 8% gain driven primarily by improved mood.

Now the exact opposite happened. As sentiment evaporated, bids thinned out fast. Without buyers willing to step in, price slipped straight through support levels into breakdown territory.

The governance issue that sparked this collapse involved community disagreement over protocol direction. Details matter less than the result: investors lost confidence in Zcash leadership and voted with their wallets.

Whales Bought $6 Million During the Crash

Yet large holders took the opposite side of this trade.

Over the past seven days, the top 100 Zcash holders increased their balances by 47.71%. That translates to roughly 15,000 ZEC added to their wallets. Standard whale wallets—addresses holding significant but not extreme amounts—increased holdings by 11.44%, adding approximately 2,000 ZEC worth about $780,000.

Combined, these large players accumulated close to 17,000 ZEC during the decline. At current prices around $355, that represents roughly $6 million in buying pressure.

Public figure wallets also increased holdings by nearly 20%. Meanwhile, retail traders did the opposite. Exchange balances rose, showing smaller holders were likely panic-selling into the weakness.

This creates an unusual market split. Long-term holders and whales are buying quietly while sentiment-driven participants flee. Typically, whale accumulation slows or stops a decline. Not this time.

The buying did provide some support—preventing an immediate capitulation to $253—but it hasn’t reversed the breakdown. That suggests the selling pressure from collapsed sentiment is overwhelming even substantial whale buying.

Three Scenarios From Here

Zcash now sits at a clear decision point. The next move depends on which force wins: technical momentum or whale accumulation.

Bearish case: If ZEC breaks cleanly below $361, the breakdown thesis strengthens. Next support sits at $326, followed by the full pattern target near $253. That $253 level represents a 30% drop from current prices and marks the projected completion of the head-and-shoulders pattern.

Bullish invalidation: The bearish setup can still be canceled, but conditions are strict. Zcash must reclaim and hold above the 200-period EMA, currently near $407. The last time ZEC reclaimed this level in early December, it rallied more than 40% and formed the pattern’s left shoulder.

Above the EMA, resistance clusters at $436 and $482. Clearing these levels would signal sentiment stabilization and renewed buying interest.

Current reality: For now, Zcash remains trapped between technical damage and quiet accumulation. The breakdown pattern has activated. Whether it fully plays out depends on how quickly sentiment recovers.

If whale buying continues while retail capitulation slows, ZEC could stabilize above $350 and attempt a recovery toward the invalidation zone. But if another wave of selling pressure hits, those whale bids might not be enough to prevent a test of $253.

The governance drama that sparked this collapse won’t resolve overnight. Until community confidence rebuilds, technical levels will dominate price action. Watch that $361 support closely. A break below it confirms the bears are in control.