The crypto market just shook off last week’s slump. In fact, total market cap jumped $55.8 billion in 24 hours.

Bitcoin climbed back above $91,500. Altcoins are waking up too. And Monero? It just smashed through to a new all-time high near $600. So what’s driving this sudden shift in sentiment?

South Korea Just Changed Everything

Big news dropped from Seoul. South Korea’s Financial Services Commission finalized rules allowing listed companies and professional investors to trade crypto.

That ends a nine-year ban on corporate participation. Nine years. Companies watched from the sidelines while retail investors piled in. Now they can finally join.

The timing matters. This policy aligns with South Korea’s 2026 Economic Growth Strategy. Plus, regulators recently approved spot crypto ETFs. Seoul is signaling serious institutional support for digital assets.

Total Market Cap Finds Support

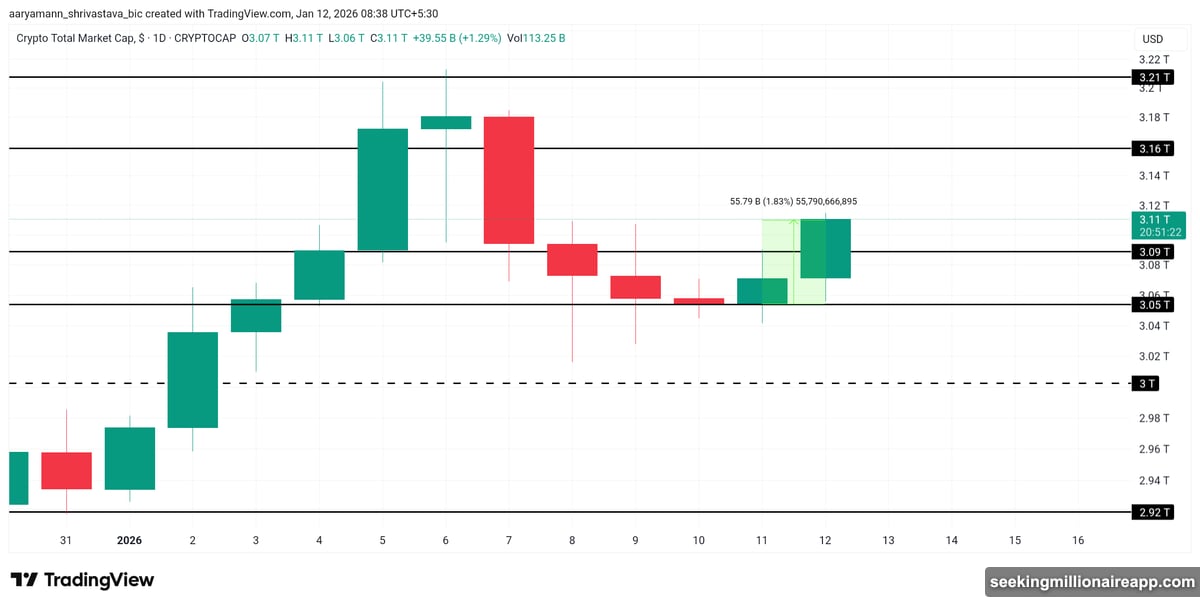

The total crypto market cap now stands at $3.11 trillion. That’s well above the crucial $3.09 trillion support zone. Markets held this level despite last week’s bearish pressure.

Rising capital inflows suggest improving sentiment. However, broader conviction remains fragile. The recent volatility left investors cautious about declaring victory too early.

The next key test sits at $3.16 trillion. Breaking through that resistance would confirm the recovery. It would also erase most of last week’s losses and potentially trigger fresh momentum.

But downside risks haven’t disappeared. A resurgence of profit-taking could push markets back below $3.09 trillion. Losing that support would likely send the total market cap toward $3.05 trillion.

Bitcoin Targets $93K Resistance

Bitcoin recovered to $92,324 at press time. The bounce came after several days of downside pressure that threatened to push BTC below $90,000.

The move above $91,511 shifts focus toward the $93,471 resistance zone. Securing this level as support opens a clearer path toward $95,000. Technical structure is improving as buying interest returns.

Short-term sentiment is stabilizing. However, Bitcoin needs sustained bullish momentum to maintain the recovery. Failure to hold above $91,511 would quickly weaken the outlook.

A drop back below that level could reintroduce selling pressure. Under such conditions, Bitcoin may revisit the $90,000 support area. That would invalidate the near-term bullish thesis and restore downside risk.

Monero Makes History With 24% Rally

Monero emerged as the day’s top performer. XMR surged over 24% in the past 24 hours, reaching $586. The privacy-focused altcoin is benefiting from renewed interest in anonymous transactions.

The rally pushed Monero to an intraday high of $599.80. That marks a new all-time high. Rising volume and strong demand indicate genuine buying conviction, not just short-term speculation.

Privacy coins have faced regulatory scrutiny for years. Yet Monero continues to attract users who prioritize transaction anonymity. The latest surge suggests this demand remains robust despite ongoing compliance concerns.

But the steep rally introduces profit-taking risks. If investors begin locking in gains, XMR could slip below the $560 level. A breakdown there would expose the price to deeper losses, potentially dragging Monero toward $500.

Coinbase Threatens to Pull Bill Support

Meanwhile, regulatory drama is brewing in Washington. Coinbase may withdraw support for a proposed U.S. crypto market structure bill. The reason? Potential restrictions on stablecoin rewards.

According to Bloomberg, the exchange is increasing lobbying efforts as lawmakers prepare to advance the bill. Coinbase argues that stablecoin rewards are crucial to its business model.

The company supports disclosure rules around stablecoin rewards. But it opposes broader restrictions that would limit how exchanges structure these products. This standoff could delay federal crypto legislation that the industry desperately wants.

Stablecoin rewards let users earn yield on dollar-denominated crypto holdings. These products compete directly with traditional savings accounts. Banks don’t like that competition. Now their political influence may shape the final legislation.

Market Structure Still Fragile

This recovery looks promising. But it’s too early to declare the correction over. Markets remain sensitive to macro pressure and profit-taking.

Bitcoin needs to clear $93,471 decisively. The total market cap must reclaim $3.16 trillion. And volume needs to stay elevated to confirm sustained buying interest.

South Korea’s regulatory clarity helps. So does renewed interest in altcoins like Monero. Yet the crypto market still trades below its recent highs. Bulls have work to do before restoring the uptrend.

Watch the $91,511 level for Bitcoin. Watch the $3.09 trillion support for total market cap. Those zones will determine whether this bounce extends or fades like previous failed rallies.

The next few days matter. Either buyers step up with conviction, or sellers regain control. Crypto markets rarely stay in neutral for long.