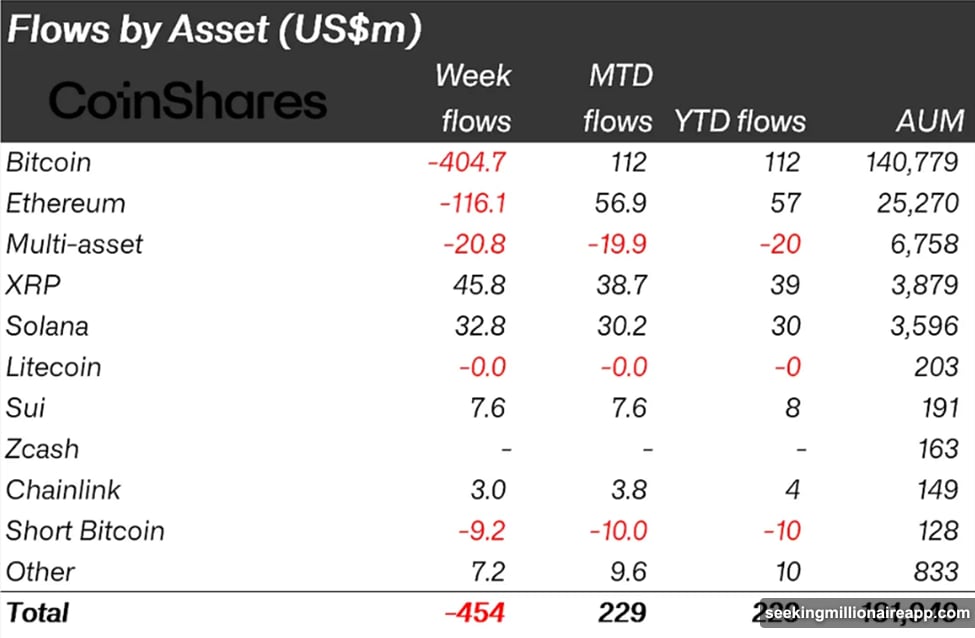

Crypto investors lost big last week. Digital asset funds saw $454 million walk out the door, nearly wiping out the entire $1.5 billion that flowed in earlier this month.

What killed the momentum? The Federal Reserve basically told everyone to stop expecting a March rate cut. So investors hit the exit button hard.

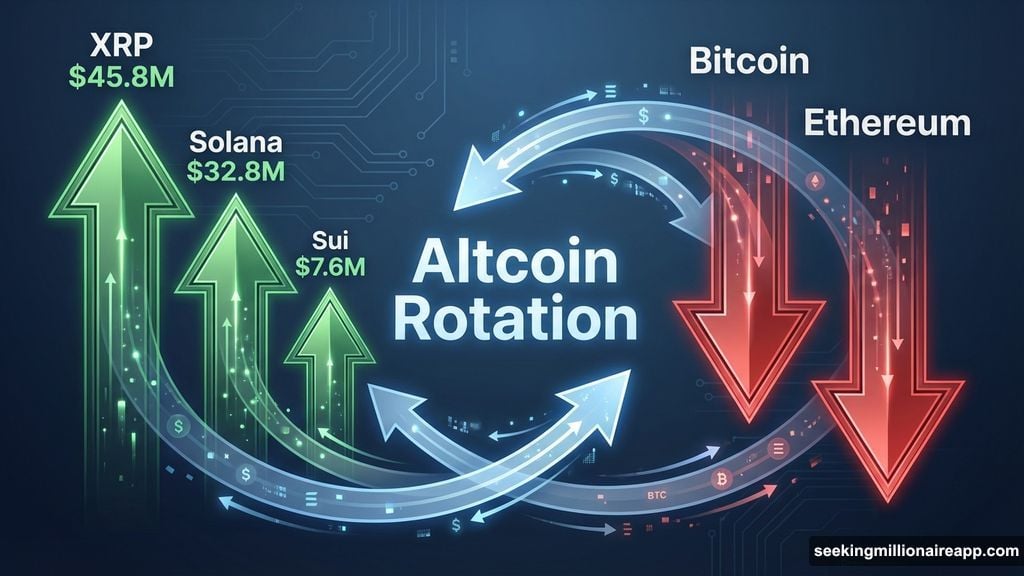

But here’s where it gets interesting. While Bitcoin and Ethereum got hammered, certain altcoins actually attracted fresh money. That tells us something important about where smart money is moving right now.

The Fed Just Changed Everything

Rate cut expectations collapsed last week. The CME FedWatch Tool now shows only a 5% chance the Fed cuts rates in January. March odds? Pretty much zero.

That’s a brutal shift from early January optimism. Remember, the year started with $1.3 billion flowing into crypto funds over just four days. Then Friday hit, and reality set in.

Investors realized the Fed isn’t backing down on its current policy stance. Recent macro data made that crystal clear. So they started pulling money out fast.

The timing couldn’t be worse. Crypto thrives when borrowing costs drop and liquidity increases. Higher rates for longer means neither of those things happens.

Bitcoin and Ethereum Got Crushed

Bitcoin bore the brunt of the damage. Investors yanked $405 million from Bitcoin products last week alone. That’s massive.

Even short-Bitcoin products saw $9.2 million in outflows. Usually, when Bitcoin drops, short positions increase. Not this time. That mixed signal suggests confusion about where prices head next.

Ethereum didn’t fare much better. Withdrawals hit $116 million. Plus, multi-asset products lost another $21 million as investors fled diversified crypto exposure.

Smaller tokens like Binance and Aave also saw exits. Binance products lost $3.7 million, while Aave shed $1.7 million. Nothing escaped the selling pressure.

US Investors Led the Retreat

The United States drove most of the outflows. American investors pulled $569 million from crypto funds last week. That’s more than the global total, meaning other regions actually added money.

This geographic split matters. Other countries are still warming up to crypto investment products. Meanwhile, US investors are reacting to domestic monetary policy signals.

The contrast shows how macro factors hit different markets. Fed policy dominates US thinking. But investors in other regions focus on local adoption trends and regulatory developments.

Still, the US remains the largest crypto investment market. When American money exits, global totals reflect that movement heavily.

Three Altcoins Bucked the Trend

Despite widespread selling, three altcoins attracted significant inflows. XRP led with $45.8 million in new investments. Solana grabbed $32.8 million. And Sui, a newer layer-1 blockchain, pulled in $7.6 million.

This rotation tells an important story. Investors aren’t abandoning crypto entirely. They’re just getting pickier about where they allocate capital.

XRP benefits from ongoing legal clarity and institutional partnerships. Solana continues proving itself as a high-performance blockchain with growing developer activity. Sui represents a bet on next-generation infrastructure.

This pattern started earlier in January. Even before last week’s chaos, investors were already favoring Ethereum, XRP, and Solana over Bitcoin. The trend just accelerated.

2025 Set the Stage for This Shift

Last year’s numbers explain current behavior. Global crypto funds attracted $47.2 billion in 2025, almost matching 2024’s record of $48.7 billion.

But the allocation shifted dramatically. Ethereum led with $12.7 billion in inflows, up 138% year-over-year. XRP surged 500% to $3.7 billion. Solana skyrocketed 1,000% to $3.6 billion.

Meanwhile, broader altcoin inflows dropped 30% YoY. Investors concentrated capital in top performers instead of spreading it across dozens of tokens.

That explains why selective altcoins still attract money during downturns. Investors developed strong convictions about specific projects. They’re not selling those positions just because macro conditions turned choppy.

Rate Policy Dominates Everything Now

Crypto’s biggest enemy right now isn’t regulation or hacks. It’s monetary policy.

When the Fed keeps rates high, borrowing costs stay elevated. That reduces speculative investment across all risk assets, including crypto. Investors shift toward safer, yield-bearing options like Treasury bonds.

The market priced in rate cuts throughout early January. Those expectations drove the $1.3 billion inflow over four trading days. Then macro data killed that narrative.

Consumer spending stayed strong. Inflation pressures persisted. The job market remained tight. All of that gives the Fed cover to maintain current rates longer than investors hoped.

So the question becomes: how long can crypto funds bleed before fresh catalysts emerge?

What Happens Next

This $454 million outflow doesn’t signal crypto’s collapse. It represents a temporary recalibration as investors adjust to new rate expectations.

Bitcoin will likely face continued pressure until Fed policy shifts or major adoption milestones occur. Ethereum might follow similar patterns, though its growing DeFi and staking ecosystem provides some support.

Altcoin rotation will probably continue. Investors will keep favoring projects with strong fundamentals, active development, and clear use cases. Generic “altcoin season” rallies seem less likely than targeted moves in specific tokens.

The bigger risk? If the Fed not only holds rates steady but signals even longer timelines for cuts. That would extend the pain across all crypto products.

For now, smart money is getting selective. They’re not fleeing crypto entirely. They’re just refusing to pay up for speculative bets until macro conditions improve. That’s probably the right call.