Bitcoin bounced back above $91,000 this week. Traders cheered. But the celebration might be premature.

Hidden beneath the price recovery sits a troubling reality. Derivatives traders piled into long positions at record levels. Plus, institutional money is quietly heading for the exits. This combination creates the perfect storm for a brutal liquidation event.

Let’s examine why this recovery might be more fragile than it appears.

Derivatives Traders Go All-In on Leverage

Bitcoin’s derivatives market turned aggressively bullish after last week’s dip below $90,000. The numbers tell a stark story.

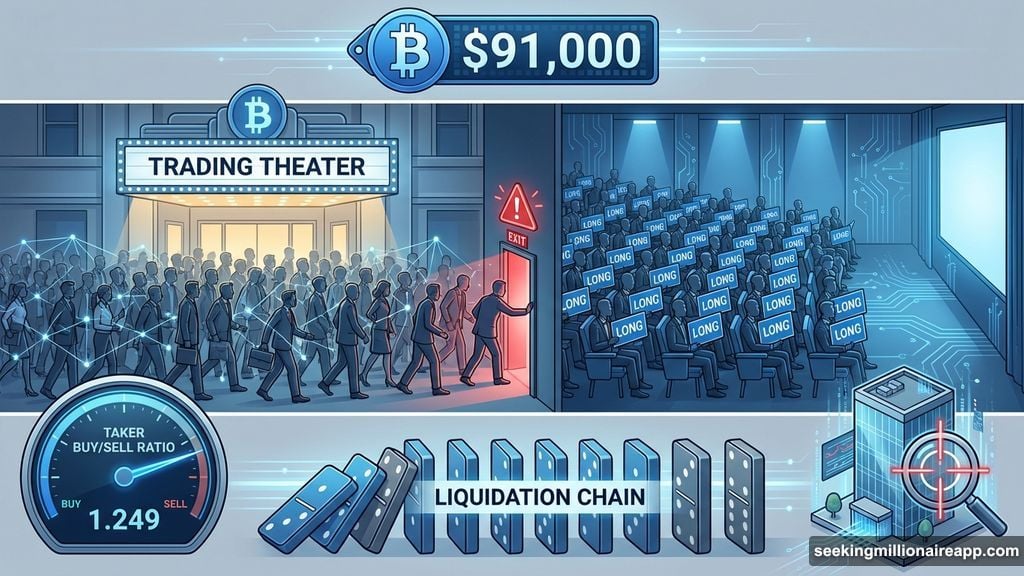

The Taker Buy/Sell Ratio hit 1.249 today. That’s the highest level since early 2019. For context, this metric tracks aggressive buying versus selling in the derivatives market. Anything above 1 means bulls dominate. Anything below 1 signals bears control the action.

So what does 1.249 actually mean? Traders are placing market buy orders at an intense pace. They’re not waiting for better prices. They’re jumping in immediately, convinced the price will keep climbing.

But here’s where it gets risky. Large traders now hold their highest concentration of long positions on record. That’s not just bullish. That’s dangerously one-sided.

Why Crowded Trades Always End Badly

Markets work best when both bulls and bears participate. However, when everyone lines up on the same side, trouble follows.

Think of it like a crowded theater. Everyone’s fine until someone yells “fire.” Then the narrow exits become a problem. Similarly, these concentrated long positions create a single point of failure.

Joao Wedson from Alphractal explained the dynamic perfectly. Exchanges actively hunt for liquidation opportunities when positions get this crowded. They don’t care about retail traders. They want the wealthy traders who positioned themselves wrong.

One modest price drop triggers a chain reaction. First, some leveraged longs get liquidated. That forced selling pushes prices lower. Lower prices trigger more liquidations. The cycle feeds on itself until positions unwind completely.

Meanwhile, Bitcoin traded at $91,299 at press time, down 0.81% over the past 24 hours. The price stability looks reassuring. But underneath, the market structure screams vulnerability.

Institutional Money Quietly Exits Stage Left

Here’s what really concerns me. While derivatives traders bet big on upside, institutional investors are backing away.

Bitcoin ETFs saw massive outflows last week. Over $681 million left these funds. Sure, Monday brought $187 million back in. But the trend is clear. Big money isn’t confident.

The data gets worse. Since October 2025’s all-time high, more than $6 billion exited spot Bitcoin ETFs. That’s the largest exodus since these products launched. These aren’t mom-and-pop investors. These are institutions with deep research teams and risk management protocols.

Plus, most ETF buyers who entered near the peak now sit underwater. The average realized price hovers around $86,000. With Bitcoin at $91,000, many holders show small gains. But they experienced the full roller coaster ride down and back up. That kind of volatility shakes confidence.

The Coinbase Premium Disappears

Another warning signal flashed this week. The Coinbase premium turned negative.

This metric compares Bitcoin prices on Coinbase versus global exchanges. When US-based traders aggressively buy on Coinbase, the premium goes positive. That signals strong American institutional demand. Negative premiums suggest the opposite. US buyers are stepping back while global traders push prices higher.

So we have derivatives traders in Asia and Europe building massive long positions. But American institutions are reducing exposure or staying on the sidelines. That geographic split in conviction raises red flags.

US markets typically drive institutional adoption. When they hesitate, it suggests something fundamental changed. Maybe regulatory concerns. Maybe portfolio rebalancing. Maybe simple profit-taking after Bitcoin’s 2024 gains. Whatever the reason, it’s not bullish.

Bitcoin Whales Are Disappearing Too

Large holder behavior tells another concerning story. Addresses holding 1,000 to 10,000 Bitcoin dropped by 220,000 Bitcoin year-over-year. That’s the fastest decline since early 2023.

Analyst CryptoBusy pointed out a similar pattern emerged in 2021-2022 before prices topped. Whales reduce holdings when they sense the market is overheated. These aren’t panic sellers. They’re sophisticated players who accumulated Bitcoin at much lower prices. Their exit suggests they see better risk-reward opportunities elsewhere.

Moreover, this happens while retail derivatives traders load up on leverage. The smart money sells to the dumb money. That rarely ends well for the dumb money.

What Happens When Leverage Unwinds

Let’s walk through a likely scenario. Bitcoin’s price stalls around current levels or drifts lower. Nothing dramatic. Just a failure to break higher.

Some overleveraged long positions hit their liquidation prices. Exchanges automatically sell those positions. That selling pressure pushes Bitcoin down another few percentage points. More liquidations trigger. The cascade accelerates.

During these events, prices can drop 10-15% in hours. Not because fundamentals changed. Simply because too many traders bet the same direction with borrowed money. The liquidation mechanics create artificial selling pressure that has nothing to do with Bitcoin’s actual value.

Then, after the leverage purges from the system, prices often recover. But the traders who got liquidated don’t benefit. They’re out of the game. Their capital is gone. Only those who stayed on the sidelines or managed risk properly survive to buy the bottom.

Thin Liquidity Makes Everything Worse

Bitcoin’s market liquidity remains uneven. Large buy or sell orders can move prices significantly, especially during low-volume periods.

Analyst Darkfost highlighted this issue. With Bitcoin liquidity periodically thin, ETF flows matter even more. When billions exit ETFs while derivatives traders pile into leverage, you get a structural imbalance. There’s not enough spot buying to support leveraged positions if sentiment shifts.

Furthermore, this liquidity problem amplifies both directions. Rallies can be explosive on light volume. But corrections can be equally violent. The current market setup favors sharp moves over gradual trends.

Three Scenarios From Here

First scenario: Bitcoin breaks convincingly above $95,000. That move would trap short sellers and validate the bullish derivatives positioning. Liquidations would hit bears instead of bulls. Institutional buyers might return if they see clear upside momentum.

Second scenario: Bitcoin consolidates around $90,000-$92,000 for several weeks. Overleveraged longs gradually get shaken out through smaller moves. Volatility declines. The market resets without a major liquidation event. This is the healthiest outcome but requires patience.

Third scenario: Bitcoin drops below $88,000. Liquidation cascades trigger. Prices fall rapidly to $80,000 or lower as leverage unwinds. Panic spreads. Then, after the flush completes, buyers emerge and prices recover. This is the painful but realistic scenario given current positioning.

Why I’m Skeptical of This Rally

Markets reward contrarians, not crowds. Right now, derivatives traders form a massive crowd on the long side. That makes me uncomfortable.

Yes, Bitcoin could absolutely rally from here. The technology keeps improving. Adoption continues. Long-term fundamentals remain solid. But none of that matters if overleveraged positions force selling in the short term.

The disconnect between derivatives positioning and spot demand tells me this rally lacks foundation. It’s built on leverage, not conviction. Leverage is temporary. Conviction lasts.

Smart traders watch positioning as closely as price. When positioning gets extreme, they prepare for reversals. Current data suggests we’re at an extreme. So despite the recent price strength, risk exceeds reward at current levels.

Watch those ETF flows closely. If institutional money returns in size, that changes the equation. Until then, this recovery feels more like a bull trap than a bull market resuming.