Lighter DEX just rolled out its new LIT staking program. The token immediately dropped 15%.

That’s not how launches are supposed to work. But in crypto, good news often triggers sell-offs. Plus, Lighter’s been fighting multiple headwinds that turned a utility upgrade into a price disaster.

What the Staking Program Actually Does

LIT holders can now stake tokens to unlock platform benefits. For every 1 LIT staked, users get permission to deposit 10 USDC into Lighter’s LLP product.

LLP is Lighter’s on-chain hedge fund offering. Previously, only premium users accessed it. Now anyone with staked LIT can participate. That’s a genuine utility expansion.

Moreover, stakers get fee discounts if they’re professional traders. High-frequency trading firms and market makers will pay less under new tier structures. Retail traders still trade for free.

Stake 100 LIT or more? You get zero-fee withdrawals and transfers. Lighter plans to add mobile staking support soon. Plus, they’ll publish APR figures once yield generation starts.

However, existing LLP holders face a deadline. They have until January 28 to stake LIT tokens. After that, staying in the pool requires staked tokens. So early adopters must adjust or exit.

Why LIT Dropped Despite Good News

Classic “sell the news” behavior hit LIT hard. Traders bought rumor, dumped at launch. That’s textbook crypto volatility.

But deeper issues made things worse. Lighter’s October mainnet launch distributed tokens to early investors and airdrop recipients. Many sold immediately. So selling pressure was already building before staking went live.

Then there’s the FUD problem. Allegations about “secret token sales” have haunted Lighter for weeks. CEO Vladimir Novakovski addressed the claims publicly through Discord. Yet the damage lingered.

In fact, trading volume cooled significantly since launch hype faded. Technical support levels broke down. That triggered more automated selling and stop-loss orders. The staking announcement landed during this vulnerable period.

Lighter tried buybacks starting January 5. Their treasury account shows protocol fees going toward token purchases. But buyback pressure couldn’t match the selling wave. So the 15% drop happened anyway.

Platform Performance vs Token Performance

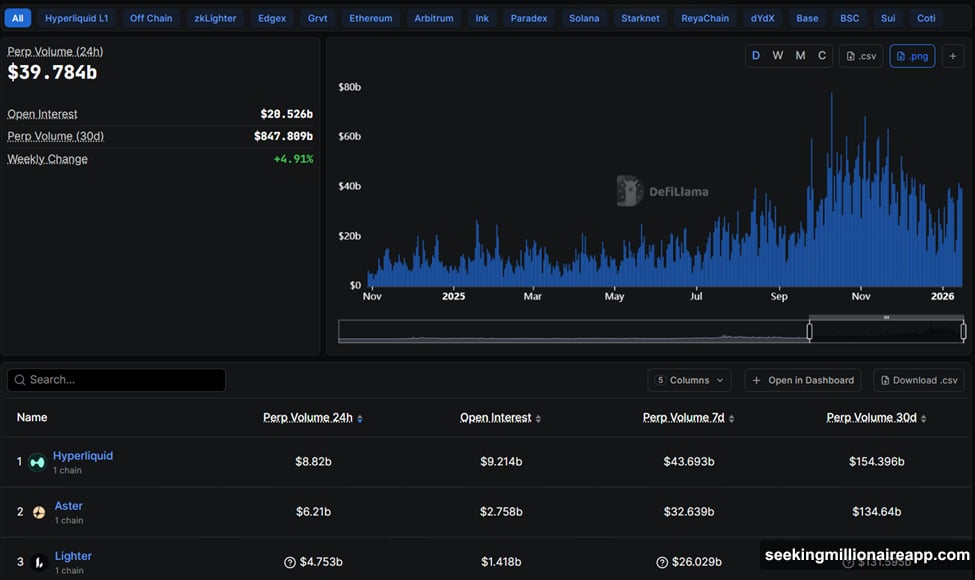

Here’s the weird part. Lighter’s exchange business is actually thriving. The platform processed nearly $5 billion in perpetual swap volume over 24 hours.

That puts Lighter third among perp exchanges. Only Aster ($6.2 billion) and Hyperliquid ($8.8 billion) handled more volume. So user activity remains strong despite token troubles.

Plus, Lighter recently closed a massive funding round. They raised $68 million at a $1.5 billion valuation. Founders Fund and Ribbit Capital co-led the round. Those are serious institutional backers.

So we’re seeing a disconnect. The exchange itself performs well. Trading volume stays healthy. Big investors write large checks. But the token price crashes on good news.

This happens when token distribution mechanics don’t align with market conditions. Early holders exit regardless of utility improvements. New buyers wait for price stability before entering. The result? Temporary downside pressure.

What This Means for LIT Holders

Staking adds real utility. Access to LLP products matters for serious traders. Fee discounts help professional users. Yield generation could provide ongoing returns.

But short-term price action tells a different story. Post-launch selling will continue until early allocations finish distributing. FUD takes time to fade. Technical damage requires rebuilding support levels.

Current LIT holders face a choice. Stake tokens and access new benefits. Or wait for price stability before committing. Neither option feels great during a 15% drawdown.

Meanwhile, Lighter’s exchange business keeps grinding. Volume stays strong. Institutional backing provides runway. The platform isn’t going anywhere. But token price and platform success don’t always move together.

The Bigger Picture on Token Launches

Lighter’s situation isn’t unique. Many projects see token dumps after utility announcements. Why? Because crypto markets price in expectations early.

Traders buy before official announcements. Then they sell when news becomes official. That’s especially true when tokens were recently distributed to early backers still seeking exits.

Plus, adding utility doesn’t automatically create buying pressure. Staking requires locking tokens. That reduces circulating supply eventually. But first, it creates short-term volatility as markets adjust.

Lighter’s staking program will likely benefit LIT long-term. Better alignment between token holders and platform users helps. Fee discounts create real value. LLP access opens new opportunities.

But right now? The market’s focused on selling pressure, not future utility. That gap between fundamentals and price action defines early-stage token markets. Patience required.