BitMine’s annual shareholder meeting in Las Vegas should have been routine. Board votes, compensation approvals, the usual corporate housekeeping.

Instead, it turned into a strategic bombshell. The company just reframed itself from “Ethereum staking proxy” into something far bigger. Plus, they’re racing toward a goal that once seemed years away.

Staking 5% of All Ethereum This Year

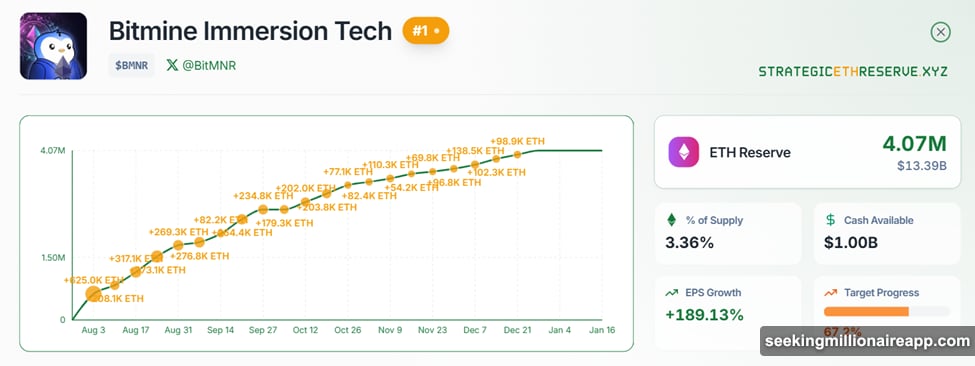

BitMine already controls 3.36% of Ethereum’s total supply. That’s 75% of the way toward their stated 5% target.

Here’s the kicker. Management now thinks they’ll hit 5% this year. Not in three years. Not eventually. This year.

The company sits on nearly $1 billion in cash with zero debt. So nothing stops them from accelerating ETH purchases when opportunities arise. Moreover, they’ve structured the balance sheet to survive crypto’s notorious volatility without forced selling.

That 5% threshold matters because of what it generates. At current ETH prices, BitMine already pulls in $400 million to $430 million annually from staking rewards and cash yield. Once they hit 5%, that jumps to $540 million to $580 million in pre-tax income.

For context, that’s recurring cash flow rivaling some of America’s most profitable companies. And BitMine does it with a relatively small team. No manufacturing. No inventory. Just Ethereum validation generating predictable revenue.

Recurring Cash Without Dilution Changes Everything

Traditional crypto companies burn through capital raising funds. BitMine built something different.

Their staking income arrives monthly, automatically, and doesn’t require issuing new shares. So every dollar earned strengthens the balance sheet instead of diluting existing shareholders.

This creates options most crypto firms lack. BitMine can reinvest in new platforms, build infrastructure, or eventually return cash to shareholders. All without taking on debt or diluting equity stakes.

But here’s where it gets interesting. Management modeled scenarios where Ethereum reaches $12,000 per token. At that price point, annual staking income would exceed $2 billion.

That’s not a guarantee. But it shows the convex upside built into their model. Higher ETH prices don’t just boost holdings value. They amplify recurring income exponentially.

The $200 Million MrBeast Deal Nobody Saw Coming

BitMine invested $200 million into Beast Industries, the media empire run by YouTube megastar MrBeast. Initial reactions ranged from confused to hostile.

Why would an Ethereum company dump nine figures into a YouTube creator? Seems random. Maybe desperate.

Then Chairman Tom Lee explained the logic. This isn’t about branding or marketing. It’s about distribution infrastructure.

“It’s our view that Ethereum, which is a smart contract platform, is the future of finance,” Lee told CNBC. “Over time, that really blurs what is a service versus what’s digital money.”

MrBeast’s reach is staggering. His videos draw more monthly viewers than the Super Bowl. He controls 450 million subscribers across platforms. In the past 90 days alone, his content generated 1.4 billion views.

Plus, Beast Industries pulled in $473 million in revenue last year. That’s not influencer pocket change. That’s a legitimate media business with massive distribution power.

Building the Largest Retail DeFi Onramp Ever

BitMine sees MrBeast’s audience as the next generation of crypto users. Gen Z, Gen Alpha, and millennials who already trust him more than traditional financial institutions.

Beast Industries plans to launch a platform offering digital items and financial services. That creates a natural bridge to Ethereum-based products like stablecoins and tokenized assets.

Instead of waiting for institutional adoption through ETFs, BitMine is betting on creator-led onboarding. Let MrBeast introduce wallets and digital ownership to 450 million subscribers. Then connect them to Ethereum infrastructure BitMine already controls.

Analyst Shanaka Anslem captured the strategy perfectly: “This isn’t a crypto company buying brand exposure. This is the construction of the largest retail DeFi onramp ever built.”

Traditional finance took decades building branch networks to reach customers. BitMine just leapfrogged that entire model with one $200 million investment.

Distribution Became Infrastructure

Tom Lee keeps emphasizing one point. MrBeast represents “probably the iconic person for Gen Z, Gen Alpha, and arguably millennial.”

That cultural capital matters in crypto more than most realize. Trust determines adoption rates. Young audiences already trust MrBeast to entertain, inform, and occasionally give away millions of dollars.

Now imagine he introduces them to Ethereum wallets or tokenized assets through his platform. The conversion rates would dwarf anything traditional crypto marketing achieves.

BitMine isn’t building a DeFi app and hoping users find it. They’re plugging directly into an existing audience that’s massive, engaged, and young enough to shape the next decade of finance.

This flips the standard playbook. Most crypto projects start with technology and struggle finding users. BitMine started with users (via MrBeast) and will connect them to technology they already own.

Community Pushback on BitMine App Plans

Not everyone loves where this is heading. During the shareholder meeting, management revealed plans for a BitMine-branded app.

Reactions from parts of the Ethereum community turned skeptical immediately. Some questioned whether BitMine should focus on staking rather than building consumer products.

“A $BMNR App?!? Is Tom Lee losing the plot? What is this??! Why are you spending our money on this??” one shareholder tweeted during the meeting.

That tension reveals something important. BitMine is pivoting from being a pure-play ETH accumulation vehicle into something more complex. Some shareholders preferred the simpler model.

But management clearly believes distribution matters more than purity. They’re building toward a world where Ethereum becomes invisible infrastructure supporting consumer-facing products.

Whether that vision pays off remains uncertain. But the strategic logic is coherent, even if execution carries risks.

Tom Lee’s Berkshire Comparison Makes Sense

The shareholder meeting suggested BitMine wants to be valued differently. Not as a single-factor ETH yield play. Instead, as a Berkshire-style holding company for the digital economy.

In that model, Ethereum staking provides the cash-generating base layer. Like insurance float for Berkshire Hathaway. Then capital allocation decisions determine long-term value creation.

The MrBeast investment represents that philosophy in action. Management took recurring cash flow from staking and deployed it toward a strategic asset that could accelerate Ethereum adoption at scale.

Plus, BitMine structured everything to survive volatility. Zero debt means no forced selling during bear markets. High liquidity provides flexibility to seize opportunities when others panic.

The company even hosted an open, live shareholder meeting with real-time Q&A. That level of transparency is rare in crypto, where most projects avoid direct accountability.

What Comes Next for BitMine and Ethereum

BitMine is racing toward 5% of Ethereum’s supply with cash reserves to get there this year. That milestone transforms them into one of the network’s most influential stakeholders.

Meanwhile, the MrBeast partnership creates optionality nobody fully understands yet. Beast Industries could become the TikTok of Web3 onboarding. Or it might struggle translating social media success into financial services.

Either way, BitMine is no longer just accumulating ETH and collecting staking rewards. They’re building infrastructure to connect the largest youth audience on the planet to Ethereum’s smart contract platform.

Traditional finance spent billions building branches and ATMs to reach customers. BitMine just bought distribution rights to 450 million subscribers for $200 million. If even 1% converts to Ethereum users, that’s 4.5 million new wallets.

The strategy is bold, unconventional, and carries significant execution risk. But the logic is sound. Distribution matters. Scale matters. And whoever controls the onramp controls the future.