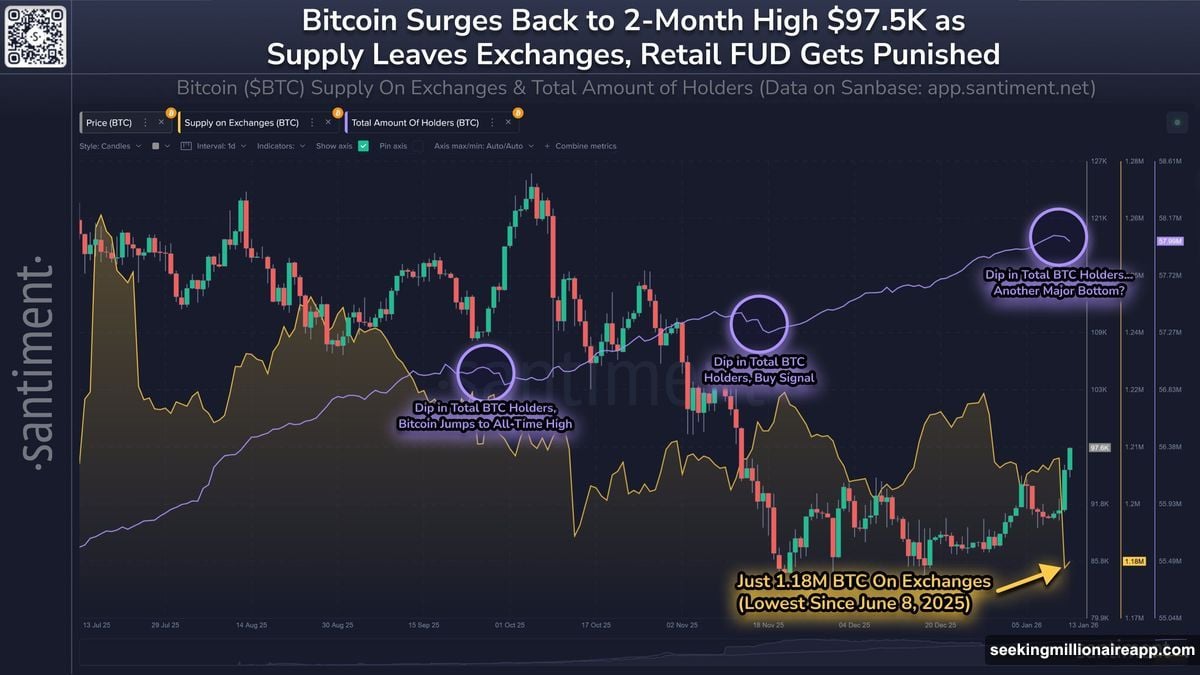

Bitcoin climbed to $97,500 this week. That’s the highest price since early November. Yet something strange happened during the rally.

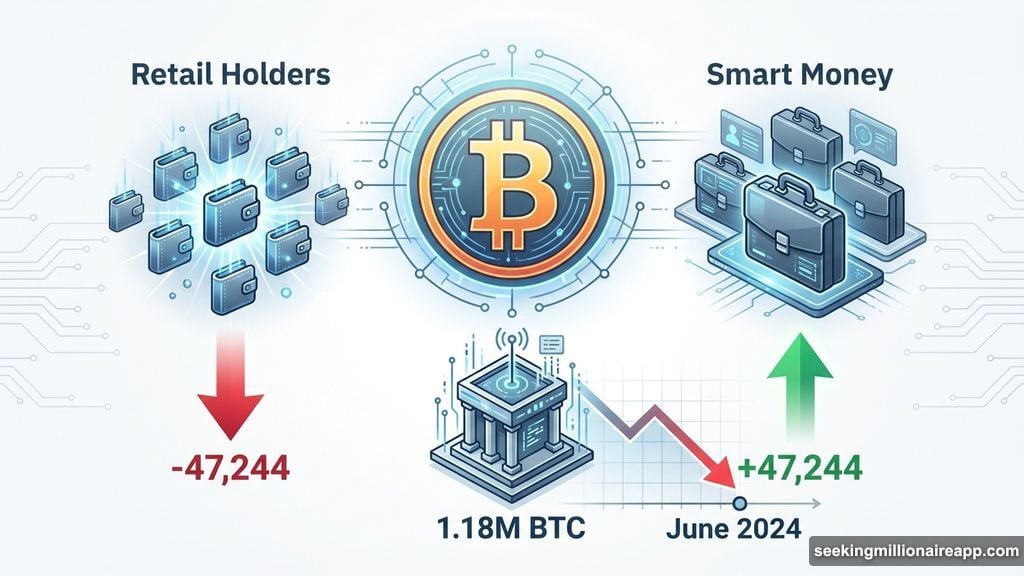

Retail investors bailed out. On-chain data shows 47,244 holders exited over three days. Meanwhile, smart money kept buying. Exchange balances dropped to seven-month lows.

This contradiction tells a story about where Bitcoin heads next. Plus, history suggests we’re at a critical inflection point.

Small Holders Panicked, Big Money Accumulated

Bitcoin holders dropped by nearly 50,000 wallets in just 72 hours. That’s retail capitulation in real time.

Why did they sell? Fear and impatience, according to Santiment’s analysis. Many investors expected faster gains. When Bitcoin consolidated instead of mooning immediately, they cut losses and walked away.

But here’s the twist. While retail fled, Bitcoin supply on exchanges fell to 1.18 million BTC. That’s the lowest level since June 2024.

Reduced exchange supply means fewer coins available for immediate selling. Buyers pulled BTC into cold storage instead of leaving it on exchanges for quick dumps. This behavior signals confidence, not panic.

In fact, this marks the third time in three months where falling exchange balances coincided with price stabilization. Each previous instance preceded a local bottom. Bitcoin bottomed near $92,000 in November. It found support again around $93,000 in December.

Now we’re testing whether the pattern holds a third time.

Short-Term Holders Are Finally Profitable Again

The Market Value to Realized Value Long/Short Difference reveals another crucial shift. Short-term holders recently flipped back into profit.

This metric compares unrealized gains between recent buyers and long-term holders. When short-term holders dominate, it means recent purchases are profitable.

Right now, short-term holder profits hit their highest levels since January 2023. That’s significant. It shows new demand entered during Bitcoin’s dip and those buyers are now sitting on gains.

However, profitability creates temptation. Short-term holders typically sell faster than diamond hands who held through multiple cycles. Rising profits among recent buyers introduces risk of profit-taking.

So far, there’s no evidence of aggressive distribution. But if Bitcoin continues climbing, those short-term gains could trigger selling pressure. That’s the double-edged sword of retail profitability.

The question becomes whether Bitcoin can break out before short-term holders start booking profits.

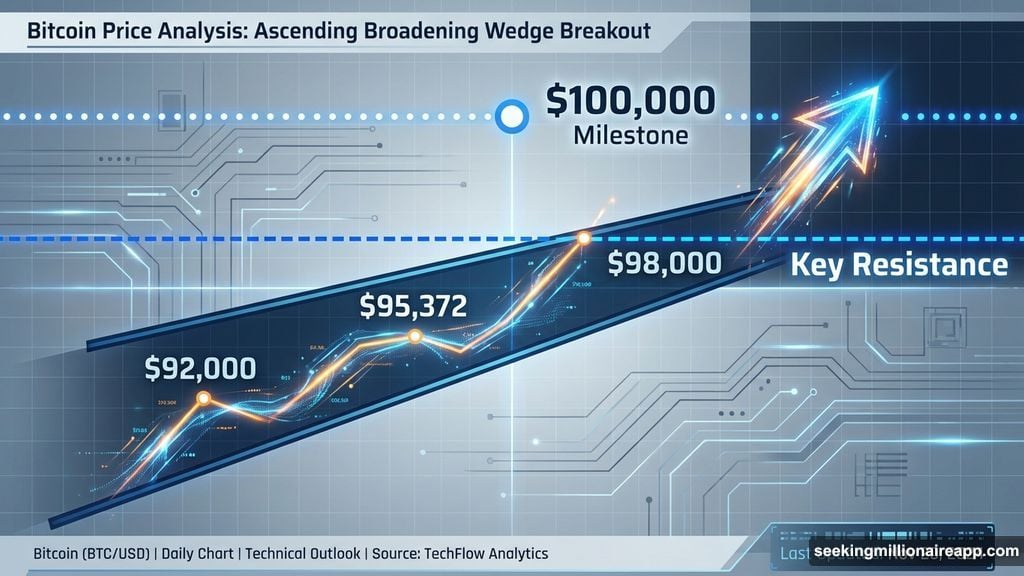

Technical Setup Points to $98,000 Breakout

Bitcoin trades near $95,372 currently. Price action forms an ascending broadening wedge on the chart.

This pattern often resolves bullish if Bitcoin breaks higher and holds. The key resistance sits at $98,000. Reclaiming that level and successfully retesting it as support would confirm the breakout.

From there, the psychological $100,000 milestone comes into view. Breaking through $98,000 would likely attract momentum traders and FOMO buyers. That could accelerate the move toward six figures.

Holding $95,000 remains critical in the near term. As long as Bitcoin defends this zone, buyers maintain control. A successful defense encourages another challenge of $98,000.

The bullish scenario depends on current conditions persisting. Stable exchange balances, continued accumulation, and short-term holders avoiding mass profit-taking all support higher prices.

The Bearish Case Still Lurks

Not everything points up. If momentum fades, Bitcoin faces real downside risk.

Should short-term holders begin booking profits aggressively, selling pressure could overwhelm buyers. Losing the $95,000 support would send Bitcoin toward $93,471 or lower.

A breakdown below that zone invalidates the bullish thesis entirely. It would also delay any breakout attempts for weeks or months. Bitcoin would need to rebuild support and confidence before challenging $98,000 again.

The retail exodus adds another concern. While whales accumulated during the recent dip, retail participation matters for sustained rallies. Without retail FOMO, Bitcoin struggles to maintain momentum above key resistance levels.

Rising short-term holder profitability could accelerate retail selling. Those who bought the dip might take profits quickly rather than holding for bigger gains. That behavior creates volatility and caps upside.

So the bearish scenario isn’t far-fetched. It requires just two things: fading momentum and profit-taking.

Third Bottom Pattern Builds Confidence

This week’s price action mirrors two previous instances from November and December. Each time, falling exchange balances coincided with Bitcoin finding a local bottom.

The pattern worked twice before. Bitcoin stabilized near $92,000 in November after exchange balances dropped. It found support around $93,000 in December when the same signal appeared.

Now exchange balances hit a seven-month low while Bitcoin tests $98,000. History suggests this could mark another bottom.

But patterns aren’t guarantees. They increase probabilities, not certainties. Bitcoin still needs to break $98,000 and hold it as support. Until that happens, the bullish thesis remains unconfirmed.

The coming days will determine whether this third bottom holds or fails.

What Smart Money Is Watching

Bitcoin sits at a critical juncture. The technical setup, on-chain metrics, and historical patterns all align toward a potential breakout.

Yet short-term holder profitability introduces real risk. Those recent buyers could book profits at any moment. That would slow momentum and possibly trigger a reversal.

Smart money watches two key levels closely. Can Bitcoin reclaim and hold $98,000? And will $95,000 support hold if selling pressure increases?

Breaking $98,000 opens the path to $100,000. Losing $95,000 support sends Bitcoin back toward $93,471 or worse. The range between these levels will determine Bitcoin’s near-term direction.

For now, the balance tips slightly bullish. Falling exchange supply, accumulation patterns, and historical precedent support higher prices. But nothing is certain until Bitcoin proves it can break out and hold.

The next few weeks will tell the story.