The crypto market just lost $15.5 billion overnight. Total market cap slipped to $3.18 trillion as investors hit the exits.

Bitcoin’s holding above $95,000 for now. But that doesn’t tell the whole story. Altcoins got hammered harder, with Monero leading the downward charge. Plus, two major news stories shook trader confidence right when the market looked shaky.

Let’s break down what actually happened and where prices might head next.

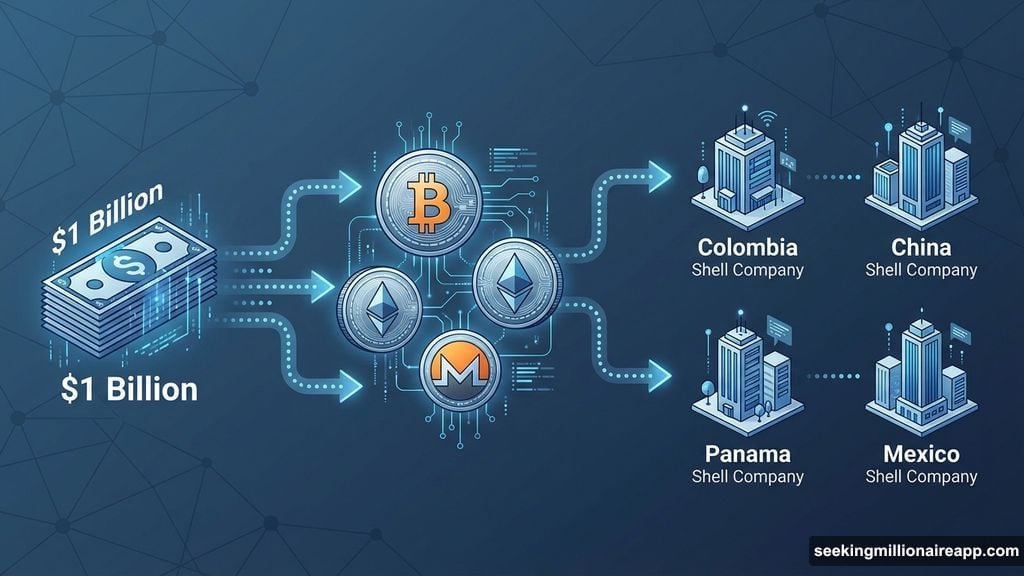

US Charges $1 Billion Crypto Laundering Scheme

The US Department of Justice just charged a Venezuelan national for allegedly laundering $1 billion through crypto exchanges. That’s billion with a “B.”

Prosecutors claim Jorge Figueira moved funds through shell companies spanning Colombia, China, Panama, and Mexico. The scheme allegedly shuffled money in and out of the US using crypto as the primary vehicle.

This type of news always spooks markets. Regulators cracking down on billion-dollar laundering operations reminds everyone that enforcement actions can freeze assets and shut down exchanges. So traders reduce exposure when headlines like this break.

Moreover, it reinforces the narrative that crypto remains under regulatory scrutiny. Whether fair or not, enforcement actions create uncertainty. And markets hate uncertainty more than almost anything else.

White House Threatens to Pull Crypto Bill Support

Here’s where things got messier. The White House is considering withdrawing support for a digital asset market structure bill.

Why? Coinbase abruptly pulled its backing for the legislation. Administration officials called the move a “rug pull” that destabilized broader crypto policy efforts. Now they’re angry enough to potentially kill the bill entirely.

This matters because clear regulatory frameworks would help institutional investors enter crypto with confidence. Without legislative clarity, big money stays on the sidelines. That limits upside potential and keeps volatility high.

So when the White House threatens to scrap the bill, it signals that regulatory progress just hit another roadblock. Traders responded by selling risk assets, including crypto.

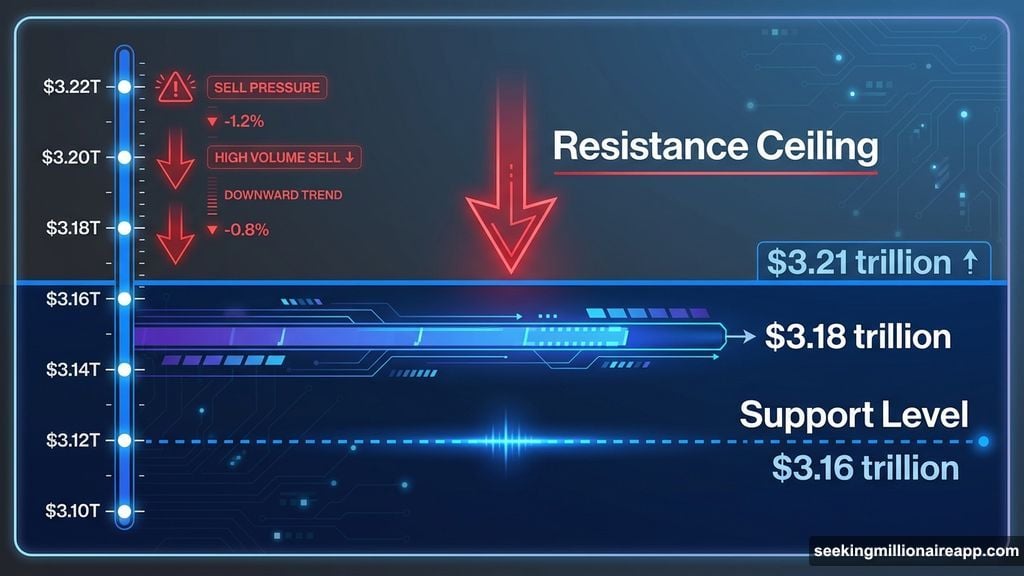

Market Cap Slides Below Key Resistance

Total crypto market cap dropped to $3.18 trillion, sitting just below the $3.21 trillion resistance level. That’s not a coincidence.

Resistance levels act like ceilings. When prices can’t break through, sellers gain confidence and push harder. That’s exactly what happened here. The market tried to clear $3.21 trillion, failed, and rolled over.

If selling pressure continues, the next support level sits at $3.16 trillion. A breakdown below that would signal stronger selling across major assets. Volatility would spike as traders cut positions and reduce exposure.

However, markets can reverse quickly. If sentiment improves over the next week, total market cap could reclaim $3.21 trillion as support. Holding that level would allow a rebound toward $3.26 trillion, stabilizing capital inflows and restoring confidence.

Bitcoin Needs a Breakout Above $98,000

Bitcoin is trading at $95,100, holding above the psychological $95,000 support level. That’s good news. But it’s not enough to confirm a bullish reversal.

BTC is trading inside an ascending broadening wedge pattern. This formation can favor upward continuation if the price pushes higher with conviction. For a valid breakout, Bitcoin must move above $98,000 and confirm that level as new support.

Current price action suggests a potential base is forming. As long as buyers defend $95,000, another attempt at $98,000 becomes likely. A successful reclaim would position Bitcoin for a move toward the $100,000 psychological target.

But downside risk hasn’t disappeared. If momentum weakens and short-term participants take profits, BTC could slip below $95,000. A decline toward $93,471 would come into focus. Losing that level would negate the bullish setup and postpone any near-term upside breakout.

Monero Crashes 8% After Hitting All-Time High

Monero dropped 8% in the last 24 hours, trading near $624. The privacy-focused cryptocurrency recently surged to a new all-time high of $800.

The pullback follows rapid gains. That’s normal after aggressive rallies driven by heightened demand. Profit-taking by long-term holders, combined with broader bearish market conditions, continues to pressure XMR price action.

Weak sentiment across altcoins is increasing downside risk. If selling persists, Monero could decline toward the $560 level, where buyers may attempt to slow further losses.

For a bullish reversal, XMR must rebound and reclaim $711 as a key support level. A successful hold above this threshold would signal renewed strength. Such a move could open the path for Monero to retest $800 and potentially establish a fresh all-time high.

What Comes Next for Crypto Markets

Markets are at a critical juncture. Bitcoin holding above $95,000 provides a floor. But without a breakout above $98,000, downside risk remains elevated.

Plus, regulatory uncertainty isn’t going away. The White House threatening to pull support for crypto legislation signals more political headwinds ahead. Enforcement actions like the $1 billion laundering case reinforce that regulators are watching closely.

Short-term traders should watch the $3.16 trillion support level for total market cap. A breakdown would increase volatility across the board. Bitcoin’s $95,000 level is equally critical. Losing that support opens the door to deeper declines.

For those with longer time horizons, these pullbacks create opportunities. Crypto remains volatile. But clear regulatory frameworks will eventually arrive. When they do, institutional money will flow in more freely.

Until then, expect chop. Expect headlines to move prices. And expect support levels to get tested repeatedly before the next major move higher begins.