Someone just lost $282 million in cryptocurrency. The worst part? They handed it over themselves.

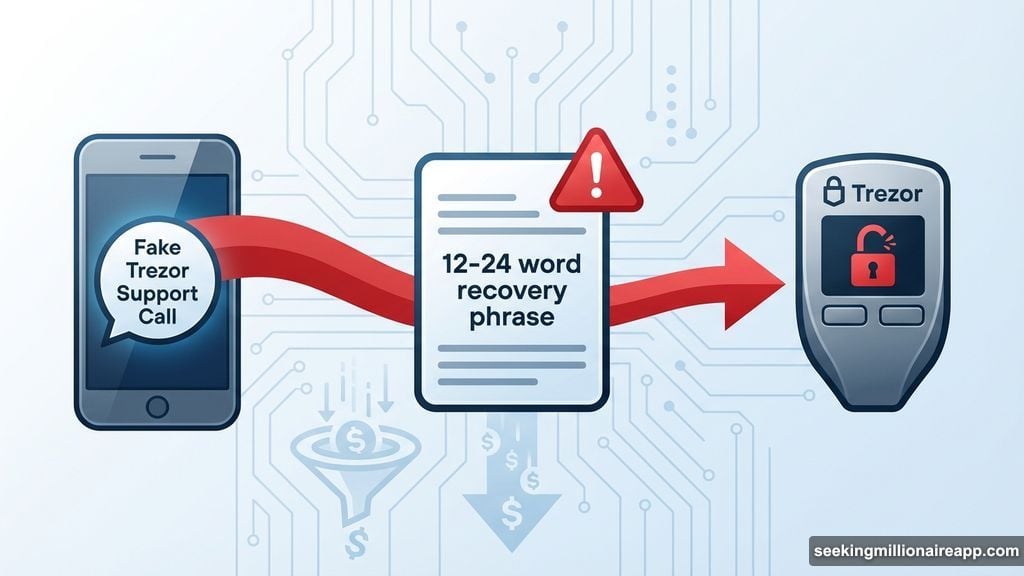

A crypto investor got tricked by scammers pretending to be Trezor customer support. The fraudsters convinced the victim to reveal their wallet’s recovery phrase. That’s basically giving away the keys to your digital vault.

Now the stolen funds are bouncing through the crypto underground. Plus, the way criminals laundered this money triggered a massive price spike in Monero, a privacy-focused cryptocurrency designed to hide transaction trails.

The Scam Was Brutally Simple

The attackers didn’t hack anything. They didn’t exploit code vulnerabilities. Instead, they just called the victim and pretended to be Trezor support staff.

Trezor makes hardware wallets used by over 2 million people. So a call from “Trezor support” seemed legitimate. But here’s the thing: real support teams never ask for recovery phrases. Ever.

Yet the victim shared their seed phrase anyway. That 12-24 word sequence controls everything in a crypto wallet. Once the scammers had it, they drained 2.05 million Litecoin and 1,459 Bitcoin instantly.

Cybersecurity firm ZeroShadow confirmed the theft on January 16. On-chain investigator ZachXBT tracked the money as it moved through various exchanges and wallets.

Criminals Turned Stolen Bitcoin Into Untraceable Monero

The hacker immediately started laundering the funds. They used Thorchain, a decentralized exchange platform, to convert Bitcoin into Ethereum, Ripple, and Litecoin.

But the real money laundering happened through Monero conversions. The attacker swapped huge amounts of stolen crypto into XMR, Monero’s native token. That’s where things get interesting.

Monero specializes in privacy. Unlike Bitcoin, which records every transaction publicly, Monero obscures sender, receiver, and amount. That makes it perfect for criminals trying to cover their tracks.

The massive buying spree pushed Monero’s price up 36% in one week. It peaked near $800 before settling around $621. So the theft accidentally created a brief windfall for Monero holders.

ZeroShadow managed to freeze over $1 million before criminals could swap it. However, most of the stolen funds already disappeared into privacy tokens.

Thorchain Keeps Enabling Money Laundering

ZachXBT specifically called out Thorchain for facilitating the laundering operation. This isn’t the first time criminals used the platform.

Thorchain operates as a decentralized exchange. That means no central authority controls it or monitors transactions. In theory, that protects user privacy. In practice, it creates a paradise for money launderers.

The platform lets users swap cryptocurrencies without identity verification. No KYC checks. No transaction limits. Just instant swaps between different blockchains.

For legitimate users, that’s convenient. For criminals stealing $282 million, it’s essential infrastructure. Yet Thorchain continues operating without meaningful safeguards.

Social Engineering Attacks Surged 1,400% Last Year

This incident reflects a broader shift in crypto crime. Hackers increasingly target people instead of code.

Blockchain analytics firm Chainalysis tracked a 1,400% year-over-year increase in impersonation scams. That’s not a typo. These attacks jumped fourteen-fold in just twelve months.

Moreover, the average loss per victim increased over 600%. Criminals are getting better at identifying high-value targets. They’re also perfecting psychological manipulation techniques.

Traditional hacking requires technical skills. Social engineering just requires acting ability and basic psychology. So more criminals are choosing the easier path.

Brand impersonation works because people trust established companies. When someone claiming to represent Trezor calls, victims assume legitimacy. That trust becomes the weapon used against them.

Three Red Flags Everyone Missed

The victim could have avoided this disaster by recognizing warning signs. First, legitimate support never initiates contact about security issues. If someone calls claiming your wallet is compromised, hang up immediately.

Second, no real company ever asks for recovery phrases. That’s the crypto equivalent of asking for your banking password. It’s an instant red flag that should trigger skepticism.

Third, creating urgency is a classic scammer tactic. If someone pressures you to act immediately without time to verify their identity, that’s manipulation. Real emergencies allow time to authenticate through official channels.

But hindsight criticism misses the point. These scams succeed because they exploit normal human psychology. Fear of losing money triggers panic. Apparent authority figures command compliance.

The Industry Shares Responsibility Here

Crypto companies need to do more than warn users about scams. They need to build systems that make these attacks impossible.

Hardware wallet makers could implement additional authentication for support interactions. Multi-signature requirements could prevent single-point-of-failure theft. Mandatory waiting periods for large transfers might give victims time to realize mistakes.

Instead, the industry prioritizes convenience over security. Fast transactions. Easy access. Minimal friction. All that convenience creates opportunities for criminals.

Decentralized exchanges like Thorchain resist regulation by design. Yet that resistance enables money laundering at massive scale. The question becomes: at what point does enabling privacy become enabling crime?

Why This Matters Beyond One Victim

A $282 million theft affects more than one investor. It damages trust in cryptocurrency as a whole. Every major heist reinforces skepticism from regulators and mainstream users.

Plus, the successful laundering through Monero demonstrates how privacy coins facilitate crime. That gives ammunition to lawmakers pushing for stricter regulations. Some countries already banned privacy-focused cryptocurrencies entirely.

The incident also exposes vulnerabilities in decentralized infrastructure. Thorchain processed hundreds of millions in stolen funds without intervention. That capability makes it attractive to criminals while painting a target for regulators.

So this single theft could trigger regulatory crackdowns affecting millions of legitimate users. The broader crypto ecosystem pays the price for individual security failures.

Nobody’s Coming to Save You

Here’s the brutal truth about cryptocurrency security: you’re on your own. No insurance protects most crypto holdings. No government agency recovers stolen digital assets. No support team can reverse unauthorized transactions.

That’s both the strength and weakness of decentralized finance. You control your money without intermediaries. But you also bear complete responsibility for protecting it.

Traditional banking offers safety nets. Credit card fraud gets disputed. Bank accounts carry deposit insurance. Cryptocurrency offers no such protections.

So every crypto holder needs to become their own security expert. Learn to recognize social engineering. Verify contacts through official channels. Never share recovery phrases. Enable all available security features.

The alternative is becoming the next $282 million lesson in what not to do.