XRP can’t catch a break. Recovery attempts keep getting rejected, and the token’s struggling to hold above critical support levels.

But here’s the twist. While price action looks bearish, investors are quietly accumulating. That creates an interesting tension between short-term weakness and potential medium-term strength.

Let’s break down what’s actually happening and where XRP might head next.

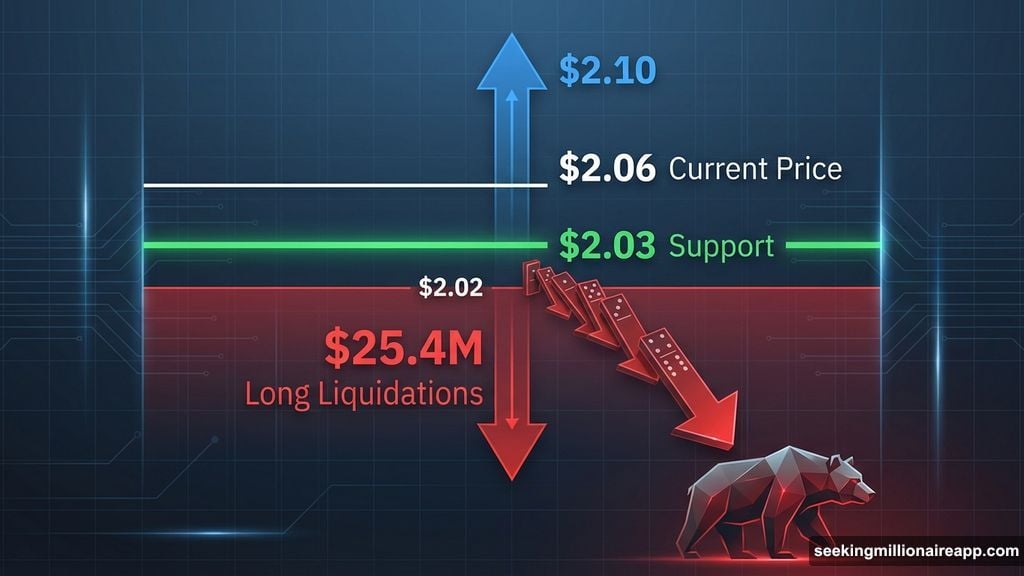

Liquidation Bomb Sits Just Below Current Price

The derivatives market tells a brutal story. According to liquidation heatmap data, roughly $25.4 million in long positions cluster near $2.02.

That’s a problem. XRP currently trades around $2.06, dangerously close to this liquidation zone. If the price slips just 2%, those forced closures trigger automatically.

Here’s how liquidation cascades work. When long positions get liquidated, exchanges sell those holdings into the market. That selling pressure drives price lower. Lower prices trigger more liquidations. More liquidations create more selling pressure.

So a small dip becomes a self-reinforcing downward spiral. Plus, short sellers watch these zones carefully. They’ll pile on once liquidations start, amplifying the move.

This setup creates asymmetric risk. Bulls have little room for error. Bears have a clear target with known trigger points.

Investors Accumulate Despite Price Weakness

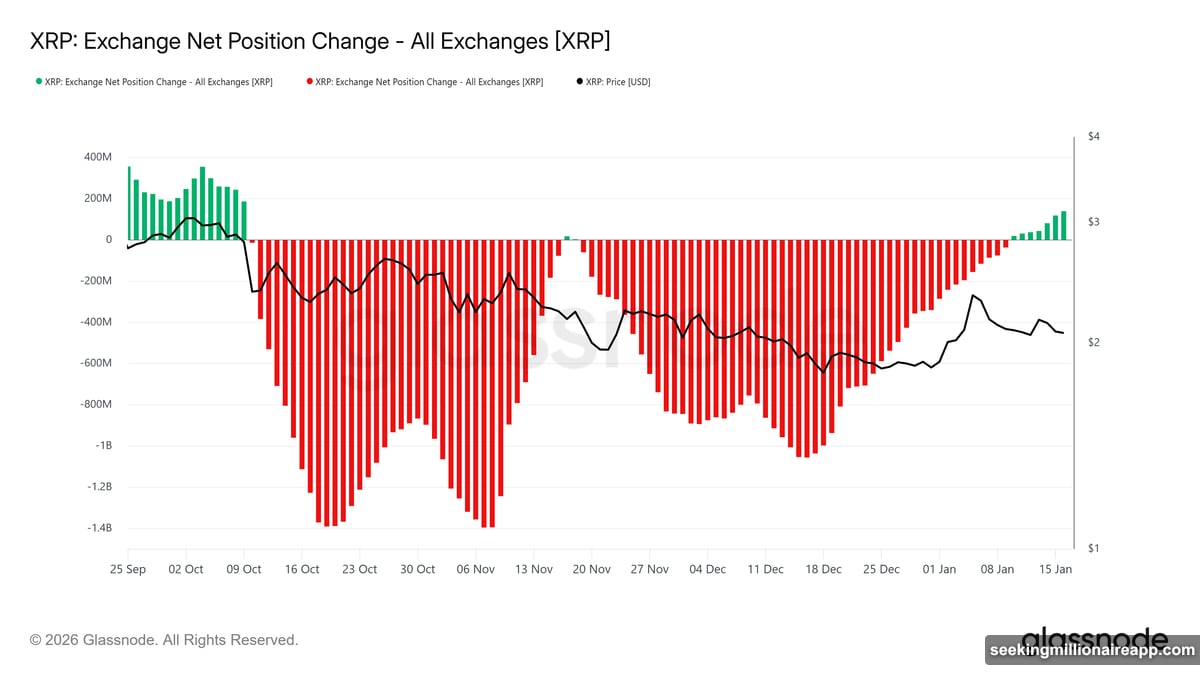

Now for the surprising part. Exchange position change data shows increasing green bars over recent days.

What does that mean? Net outflows from exchanges. Investors are moving XRP from exchanges into private wallets.

That’s typically bullish behavior. When people prepare to sell, they move tokens TO exchanges. When they plan to hold long-term, they move tokens OFF exchanges.

This marks a notable shift. For three months, XRP saw consistent selling pressure and exchange inflows. But that trend reversed recently. Accumulation replaced distribution.

One client told me their XRP holdings are completely off exchanges now. They’re betting on a recovery but don’t want to risk getting stopped out by short-term volatility. Smart move if you believe in the long-term thesis.

Moreover, this accumulation provides natural support around current levels. If enough investors keep buying the dip, they can absorb selling pressure and stabilize price.

The $2.03 Support Level Decides Everything

XRP’s price action comes down to one critical level: $2.03.

This support has held through multiple tests over recent weeks. Each time XRP dipped toward $2.03, buyers stepped in. That tells you where strong demand sits.

If $2.03 holds again, bulls get another chance. A bounce from there could push XRP above $2.10. Breaking above $2.10 would end the ten-day downtrend and shift momentum.

But if $2.03 breaks, things get ugly fast. That $25 million in liquidations triggers immediately. The forced selling would likely push XRP below the psychological $2.00 level.

Below $2.00, the next support sits at $1.93. So we’re talking about a potential 7% drop from current levels if support fails. That would completely invalidate the bullish case and invite more aggressive shorting.

Broader Market Conditions Matter More Than XRP

Here’s what frustrates XRP holders. The token’s fate doesn’t really depend on XRP-specific news or fundamentals right now.

Instead, broader crypto market conditions drive everything. Bitcoin weakness pulls XRP lower. Ethereum struggles weigh on altcoins. Macro risk-off sentiment crushes leverage across the board.

So even though XRP investors are accumulating, they might not be able to defend $2.03 if the broader market tanks. No amount of XRP-specific buying pressure can overcome a systemic crypto market selloff.

That’s the honest reality. XRP bulls are fighting against larger forces. Their accumulation helps. But it might not be enough if macro conditions deteriorate further.

Why This Recovery Feels Different

Previous XRP rallies had clear catalysts. Regulatory clarity. Partnership announcements. Broader crypto euphoria.

This attempted recovery has none of that. It’s purely technical. Investors see a price they consider cheap and accumulate. That works sometimes. But without fundamental catalysts, technical bounces often fail.

Plus, sentiment among derivatives traders remains fragile. Those $25 million in long liquidations prove that. Overleveraged bulls bet on a quick recovery. They’re about to learn why fighting the trend is expensive.

The smart money isn’t trading this bounce. They’re either accumulating spot for the long term or sitting in cash waiting for clearer signals. Short-term traders trying to catch falling knives usually just get cut.

What Happens Next

XRP sits at a critical decision point. The next 48 hours likely determine whether it holds above $2 or drops toward $1.93.

Watch the $2.03 level obsessively. A clean bounce with volume suggests buyers are serious. A weak bounce followed by lower highs means the breakdown is coming.

Also monitor Bitcoin and broader market conditions. If Bitcoin finds support and stabilizes, XRP gets breathing room. If Bitcoin breaks down, XRP probably follows regardless of XRP-specific factors.

The liquidation data creates a clear roadmap. Below $2.02, expect accelerating downside. Above $2.10, momentum shifts bullish. Between those levels? Just choppy, uncertain consolidation.

Personally, I’d want to see XRP reclaim $2.10 with conviction before getting optimistic. Until then, the path of least resistance remains down. Accumulation helps, but it’s not enough to overcome the technical damage and liquidation risks.

Choose your risk carefully. This isn’t the time for heroic long positions. Wait for confirmation before committing serious capital.