Coinbase CEO Brian Armstrong just shot down reports of a brewing war with the Trump administration. The claimed breakdown? Completely overblown, according to Armstrong.

But here’s what’s actually happening. Traditional banks are freaking out about stablecoin yields. They worry customers will abandon their low-interest savings accounts for crypto platforms offering better returns. So the White House pushed Coinbase to find a middle ground that keeps community banks happy.

Armstrong insists talks remain “super constructive.” Plus, he’s working on a compromise specifically designed to address banking sector concerns. The details drop soon.

The Real Fight: Banks vs Stablecoin Rewards

Community and regional banks see high-yield stablecoins as an existential threat. Their logic makes sense from their perspective.

Traditional savings accounts pay almost nothing. Meanwhile, crypto exchanges can offer attractive yields on dollar-pegged stablecoins. If customers figure this out, deposits could flee traditional banks in droves.

That’s what bankers call “deposit flight.” And they’re lobbying hard to prevent it. So they want restrictions on stablecoin yields baked into the CLARITY Act.

The stakes extend beyond just one company. This tension exposes the fundamental conflict between legacy finance and crypto innovation. Banks built their business model on paying customers next to nothing for deposits. Then they lend that money at higher rates. Stablecoins threaten that entire system.

CLARITY Act Hangs in the Balance

The broader legislative package aims to provide regulatory certainty for digital assets. The industry desperately wants this clarity after years of regulatory chaos.

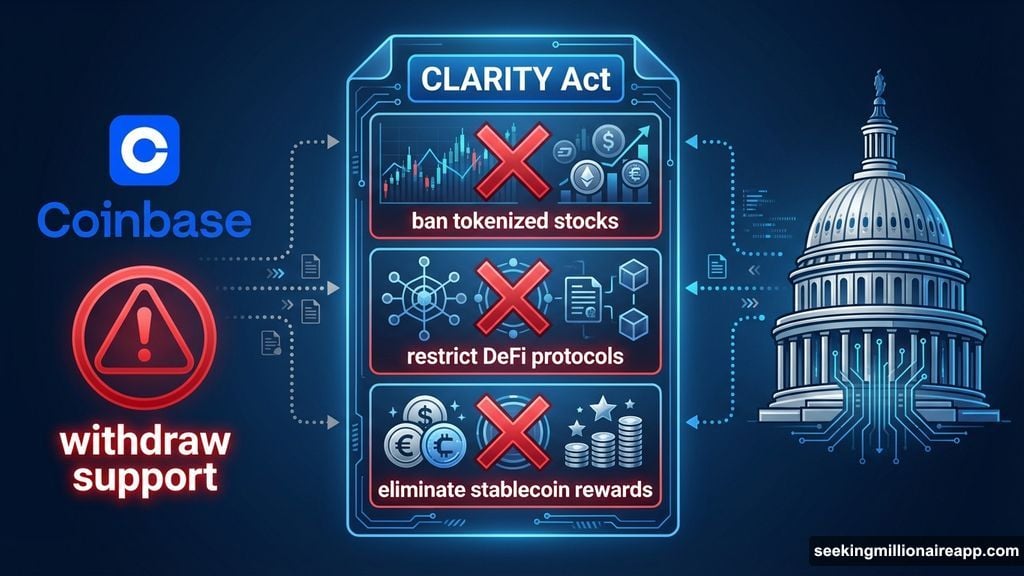

But Coinbase recently threatened to pull support for the bill. Why? Provisions that would ban tokenized stocks, restrict DeFi protocols, and eliminate stablecoin rewards.

That’s a lot of concessions for an industry that thought it finally had political momentum. The Trump administration’s crypto-friendly rhetoric suggested smoother sailing ahead. Instead, traditional banking interests are extracting major compromises.

Ripple CEO Brad Garlinghouse struck a more optimistic tone. He called the Senate’s move a “massive step forward” despite the contentious negotiations. His take: any regulatory framework beats the current uncertainty.

Still, prediction markets aren’t convinced. Polymarket traders give the bill only 41% odds of passing this year. That skepticism reflects the complex politics at play.

Armstrong’s Compromise Strategy

So what’s Coinbase cooking up to satisfy banks? Armstrong stayed vague but promised ideas that specifically help community lenders.

One possibility: tiered yield structures that prevent the highest returns from competing directly with bank deposits. Another option: volume limits that cap how much individual users can earn from stablecoin yields.

Whatever the solution, it needs to thread a narrow needle. Community banks need assurance they won’t hemorrhage deposits. But crypto users expect competitive returns that reflect actual market rates.

The crypto industry’s willingness to negotiate shows how badly it wants legislative progress. After years of hostile regulation, companies are making significant compromises for statutory clarity.

However, some wonder if these concessions undermine crypto’s core value proposition. If stablecoins can’t offer better yields than banks, what advantage do they provide beyond censorship resistance?

What This Means for Crypto Users

Restrictions on stablecoin yields would directly impact your returns. Currently, various platforms offer attractive rates on dollar-pegged assets. Those might disappear or get capped if banks win this fight.

But regulatory clarity brings benefits too. Clearer rules mean less enforcement risk, broader institutional adoption, and potentially better infrastructure. The question is whether those gains justify giving up competitive yields.

Moreover, this dispute reveals crypto’s political vulnerability. Despite growing adoption and market cap, traditional banking still wields enormous influence. Their lobbying power shapes legislation in ways that protect incumbent interests.

For users, that means watching these negotiations closely. The CLARITY Act’s final form will determine what services crypto platforms can offer going forward.

The Broader Picture

This stablecoin fight is just one battle in a larger war over financial services’ future. Traditional banks see crypto as competition that threatens their deposit base and lending margins.

So they’re fighting back through political channels. Community banks especially feel vulnerable since they can’t compete on technology or convenience. Their main advantage is regulatory protection.

Crypto companies, meanwhile, want legitimacy and clear operating rules. They’re willing to accept some restrictions in exchange for legal certainty. But they’re discovering that established industries don’t give up market share easily.

The Trump administration finds itself caught between two constituencies. Crypto supporters expect a friendly regulatory environment. But community banks represent local businesses that politicians can’t ignore.

That political reality explains why the White House is pushing Coinbase to compromise. They want both sides satisfied, which probably means neither gets everything they want.

The coming weeks will show whether Armstrong’s promised solution can bridge this gap. If not, the entire CLARITY Act could stall despite crypto’s apparent political momentum.

Watch for details on Coinbase’s banking compromise. That proposal will reveal how much the industry is willing to sacrifice for regulatory acceptance. The answer might surprise you.