Got a pile of LTC sitting around? Turns out you can borrow against it instead of selling.

Litecoin holders have been doing this quietly for years. Now, with platforms like ViaBTC making the process dead simple, more miners are pledging their coins for instant liquidity. Let’s break down how it actually works.

Why LTC Works as Collateral

Litecoin isn’t just Bitcoin’s cheaper cousin anymore. It’s become a legitimate collateral asset that lenders actually trust.

First, the liquidity is there. LTC trades consistently across major exchanges with solid volume. So when you pledge your coins, lenders know they can liquidate quickly if needed. That confidence translates to better loan terms for borrowers.

Plus, Litecoin’s faster block times mean you can move coins around without waiting forever. About 2-3 minutes per block versus Bitcoin’s 10 minutes. For miners needing quick cash to cover electricity bills or equipment costs, that speed matters.

And here’s the kicker. Transaction fees stay low even during network congestion. Moving LTC to a lending platform won’t eat up 5-10% of your collateral value like some chains might.

The Mining Angle Changes Everything

For miners specifically, using LTC as collateral for loans becomes a strategic tool rather than just emergency funding.

Mining operations run on tight margins. Equipment costs money. Electricity bills arrive monthly. But newly mined LTC takes time to accumulate enough value for major expenses. So miners face this constant tension between holding coins for potential appreciation and selling to cover immediate costs.

Collateral-backed loans solve that problem. Instead of selling freshly mined LTC at whatever the market price happens to be today, miners can pledge those coins and borrow stablecoins or fiat. Then when prices improve or cash flow stabilizes, they repay the loan and keep their LTC.

The Scrypt mining algorithm helps too. Lower energy consumption than Bitcoin means more consistent profitability. That steady flow of mined LTC creates reliable collateral that lenders appreciate.

How ViaBTC Makes This Actually Simple

Most lending platforms feel like navigating a maze. ViaBTC takes a different approach.

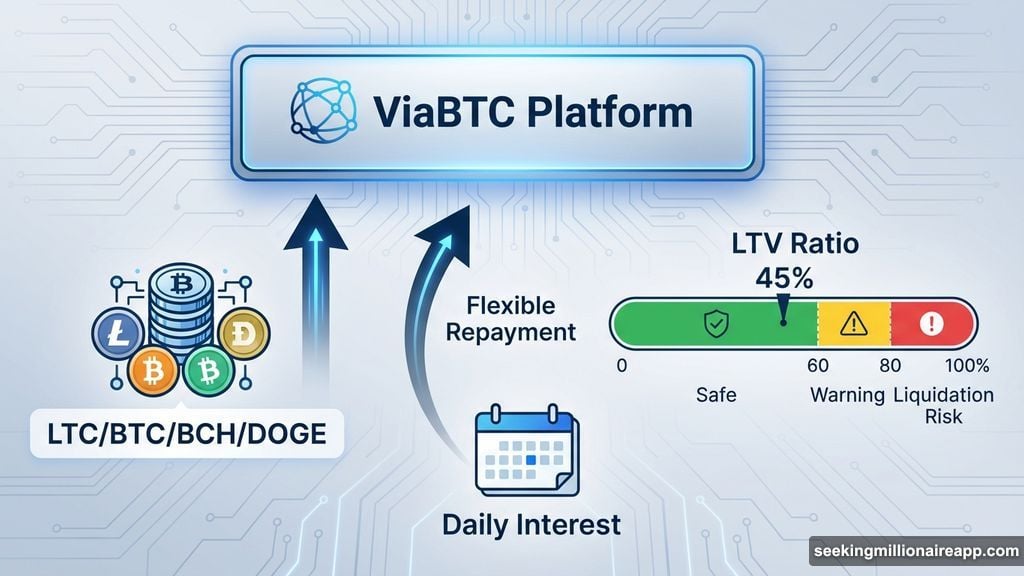

They offer collateral-backed loans for LTC, BTC, BCH, and DOGE through an interface that doesn’t require a finance degree to understand. Deposit your coins. Select how much to pledge as collateral. Receive your loan in USDT or other supported currencies. Done.

The platform calculates interest daily rather than locking you into fixed terms. So you’re not paying for time you don’t use. Repay whenever your cash flow improves. That flexibility matters when mining profitability fluctuates with network difficulty and coin prices.

They also provide real-time LTV monitoring. Loan-to-Value ratio determines your liquidation risk. If LTC price drops and your LTV creeps too high, you’ll see warnings before automatic liquidation triggers. Some platforms surprise users with sudden liquidations. ViaBTC at least gives you visibility and time to react.

Mobile app access means you can manage loans from anywhere. Check your collateral status. Add more LTC to improve your LTV. Make partial repayments. All without being chained to a desktop.

Actually Using LTC for Loans: The Process

Getting a loan against your Litecoin takes about 10 minutes if you’ve already got an account set up.

Start by creating an account on ViaBTC if you haven’t already. Basic email signup plus two-factor authentication for security. Nothing complicated there.

Then deposit your LTC. Navigate to the wallet section, select Litecoin, and copy your deposit address. Transfer from your external wallet or mining payout address. Wait for confirmations. Usually takes under 15 minutes given Litecoin’s fast blocks.

Next comes the actual loan application. Head to the crypto loans section under Finance. Select LTC as your collateral asset. Enter how many coins you want to pledge. The system shows your available borrowing amount based on current LTC price and platform LTV limits.

Minimum loan value sits at 50 USDT. So even smaller miners can access this without needing massive collateral. Review the interest rate and terms. If everything looks good, confirm the loan. Borrowed funds appear in your account almost instantly.

Managing the loan is where things get interesting. Monitor your LTV ratio regularly. If Litecoin price drops significantly, your liquidation risk increases. You can add more collateral or make partial repayments to improve your position. The platform provides liquidation price calculations so you know exactly where the danger zone starts.

The Risks Nobody Likes Talking About

Collateral-backed loans aren’t free money. They come with real liquidation risk if LTC price moves against you.

Say you pledge 100 LTC at $80 per coin for an $8,000 collateral value. You borrow $4,000 in USDT at 50% LTV. If Litecoin drops to $60, your collateral is now only worth $6,000. Your LTV jumps from 50% to 67%. Get too close to the liquidation threshold, and the platform automatically sells your LTC to repay the loan.

That’s the nightmare scenario. You lose your Litecoin at the worst possible price right when you wanted to hold for recovery. Plus you still owe any remaining loan balance if the liquidation sale doesn’t cover everything.

Interest accumulates daily too. Forget about your loan for a few months and you might owe significantly more than expected. The flexible repayment is great for borrowers who stay engaged. But it punishes anyone who takes out a loan and ignores it.

And here’s something platforms don’t advertise loudly. Their liquidation mechanisms prioritize speed over getting you the best price. When your collateral gets liquidated, you’re not getting careful market execution. You’re getting whatever bid will clear fast enough to protect the lender.

When This Strategy Actually Makes Sense

Not everyone should be using crypto as loan collateral. But for specific situations, it’s genuinely useful.

Miners facing equipment upgrades fit this perfectly. You’ve got newly mined LTC but need cash now for better ASICs. Instead of selling at current market prices and possibly missing future appreciation, pledge the coins and upgrade your hardware. If mining profitability improves, you’ll generate more LTC to repay the loan while keeping your original collateral.

Short-term cash flow gaps work too. Electricity bills come due before your mining payout clears. Borrow against LTC for a week or two. Repay when revenue arrives. The interest cost is tiny compared to shutting down operations or selling at bad timing.

But if you’re already overleveraged or unsure about Litecoin’s price stability, this adds unnecessary risk. Taking loans against volatile assets only makes sense when you have backup plans for multiple price scenarios.

The Real Value Proposition

Using LTC as collateral for loans boils down to one core benefit: accessing capital without selling your position.

For miners who believe in Litecoin’s long-term value, that’s huge. You’re generating coins through mining. You need cash for operations. Selling means locking in today’s price and missing any future gains. Borrowing means keeping your LTC while still getting the liquidity you need.

The math works especially well during bear markets. When LTC trades at multi-year lows, selling feels painful. Borrowing against those coins at conservative LTV ratios lets you weather the downturn while maintaining your long-term position.

Platforms like ViaBTC make this practical by offering reasonable terms and transparent risk management. The tools exist. The infrastructure works. Whether you use them depends on your specific situation and risk tolerance.

Just remember: borrowed money still needs repayment. Interest accumulates. Prices fluctuate. Use collateral-backed loans strategically, not desperately.