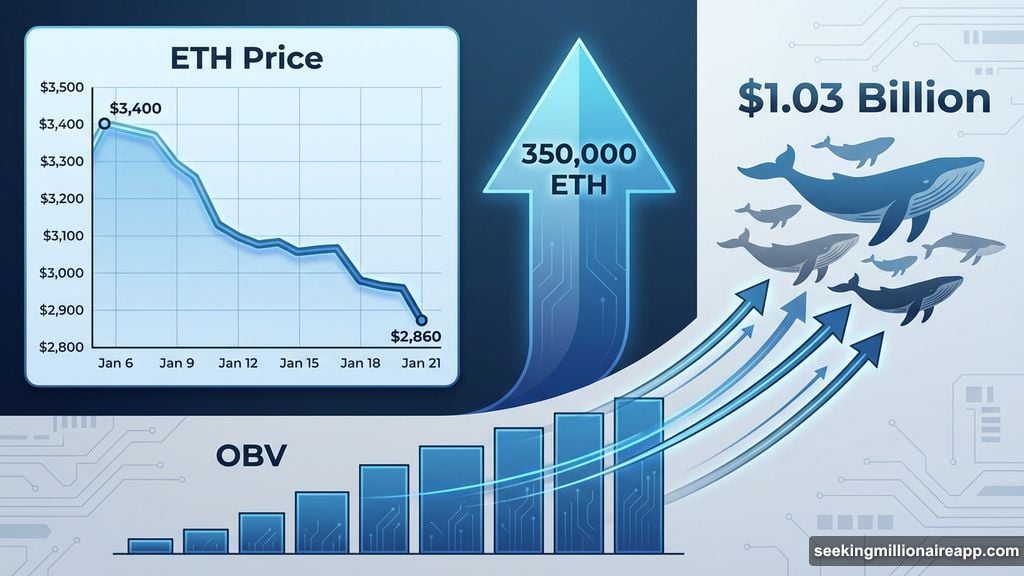

Ethereum crashed 15.6% in two weeks. Then something changed at the bottom.

Whales stepped in hard. They accumulated 350,000 ETH in just 24 hours, worth over $1 billion at current prices. Plus, network activity just reclaimed the No. 2 spot among layer-1 blockchains. So is ETH finally done bleeding, or is this just another fake-out before the next leg down?

The Setup Was Textbook Bearish

Between January 6 and January 14, Ethereum printed a classic warning signal. Price pushed to higher highs near $3,400. But the RSI momentum indicator formed lower highs instead.

That’s called bearish divergence. It means buyers were losing steam even as price climbed. And it typically precedes selloffs.

This time was no different. ETH corrected 15.6% over the next week, sliding from its January peak down to $2,860 support. That’s where things got interesting.

Volume Told a Different Story at the Bottom

While price trended lower between January 20 and January 21, something shifted beneath the surface. On-Balance Volume (OBV) started forming higher lows.

OBV tracks cumulative buying and selling pressure. When it diverges from price like this, it suggests larger players are absorbing supply rather than dumping. In other words, someone was buying the dip aggressively while smaller traders panicked.

That someone turned out to be whales. Over the past 24 hours, Ethereum supply held by whales (excluding exchange wallets) jumped from 103.73 million ETH to 104.08 million ETH.

That’s 350,000 ETH accumulated in a single day. At $2,950 per ETH, that’s $1.03 billion in fresh capital deployed near support. These whales didn’t chase the top. They waited for the correction, then stepped in when momentum reset and price tested key levels.

Network Activity Just Reclaimed Second Place

The technical setup isn’t the only thing improving. On January 23, Ethereum reclaimed the No. 2 spot in daily unique addresses among layer-1 blockchains.

It just overtook SEI, another layer-1 that’s been posting strong numbers lately thanks to gaming activity. BNB still holds the top spot. But Ethereum pushing past SEI matters because it reflects actual network usage, not just price speculation.

Daily unique addresses measure how many distinct wallets are transacting on-chain. When that number rises, it signals genuine activity, whether that’s DeFi trades, NFT mints, or protocol interactions. For weeks, SEI had been beating Ethereum on this metric. Now the dynamic just flipped.

Plus, Ethereum still outpaces all major layer-2 ecosystems in address growth. That recovery is starting to show up in social chatter too.

Social Dominance Spiked Right Before Whales Bought

Ethereum’s social dominance jumped sharply from around 0.37% to 4.43% since yesterday. It briefly peaked near 5.8% before cooling slightly.

Social dominance measures how much online conversation focuses on Ethereum compared to other crypto assets. Historically, local peaks in this metric have preceded short-term price advances for ETH.

Take January 17. A social dominance spike was followed by a 2.1% move higher over the next sessions. On January 21, another spike preceded a 3.4% upside move within 24 hours.

This doesn’t guarantee a rally. But it shows that renewed network relevance has previously translated into short-term price follow-through. And the timing lines up perfectly with when whales added over $1 billion in ETH.

The return to No. 2 in layer-1 daily unique addresses provides a fundamental reason for the surge in attention. Network activity is recovering even though price remains below recent highs.

The Next Move Comes Down to Two Levels

From here, Ethereum’s structure is straightforward. On the downside, $2,860 remains the critical support. This level marked the end of the 15.6% correction. It’s where whales stepped in aggressively and where OBV started diverging bullishly.

A clean break below $2,860 would weaken the bullish case. It would open downside toward $2,770 and lower supports, invalidating the rebound thesis entirely.

On the upside, ETH needs to clear $3,010 to confirm short-term strength. That’s just 2.6% above the current price of $2,950. A sustained move higher would then bring $3,350 into focus, a resistance zone that’s capped price since mid-January.

If that level breaks, Ethereum could target extensions near $3,490 and potentially $3,870. But failure to hold $2,860 shifts the focus back to deeper support levels.

Here’s What Worries Me

Whales buying $1 billion worth of ETH sounds bullish. Network activity reclaiming second place sounds bullish. Social dominance spiking sounds bullish. But let’s be honest about what’s missing.

Volume. The bounce from $2,860 hasn’t been accompanied by massive spot buying volume yet. OBV showed divergence, which is promising. But confirmation requires sustained volume increases, not just whale accumulation.

Moreover, Ethereum still trades 11% down on the weekly chart. That’s a significant loss even after the bounce. And $3,010 resistance sits just 2.6% away, meaning ETH needs to break through quickly or risk consolidating below it.

Plus, macro conditions haven’t exactly improved. Risk assets remain under pressure. Bitcoin is struggling to hold key support levels. And if broader crypto weakness continues, Ethereum won’t decouple for long, regardless of what whales are doing.

The whale accumulation is real. Network activity is recovering. But this isn’t a done deal yet. Ethereum needs to prove it can reclaim $3,010 and hold above $2,860 convincingly. Until then, this looks like a promising setup, not a confirmed reversal.

Watch those two levels closely. They’ll determine whether this $1 billion whale bet pays off or gets crushed by the next wave of selling.