The crypto market just lost $56 billion in two days. Bitcoin hovers dangerously close to breaking its key support level. Meanwhile, altcoins like KAIA got crushed with 20% losses in 24 hours.

What triggered this? Plus, why does the pattern forming on Bitcoin’s chart suggest things might get worse before they get better? Let’s break down what’s actually happening.

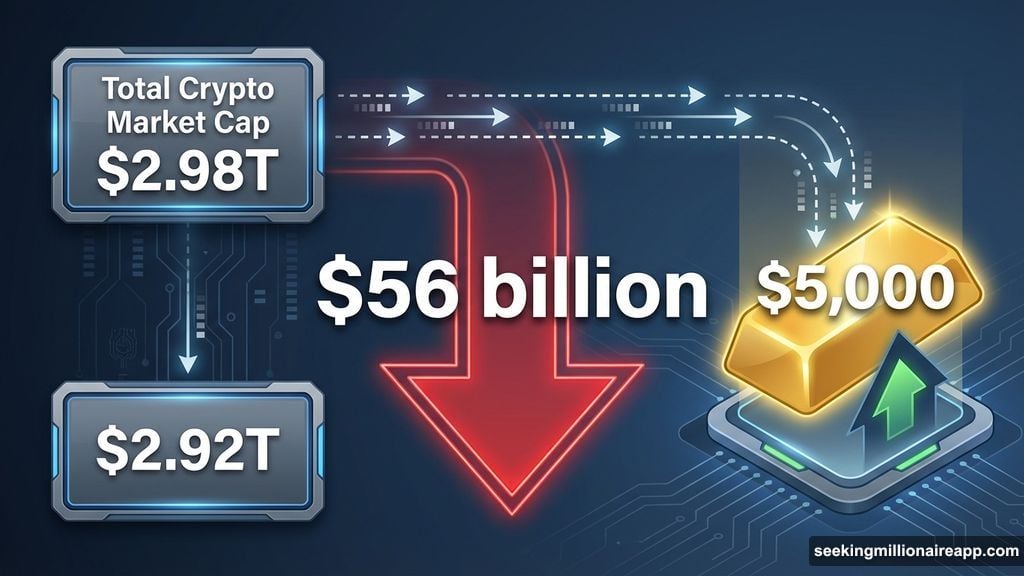

Market Cap Bleeds $56 Billion Over Weekend

Total crypto market cap dropped from near $2.98 trillion to $2.92 trillion. That’s real money evaporating fast.

But here’s the thing. Selling pressure finally started to ease Monday morning. Markets show early signs of stabilization after the brutal weekend selloff. So we might be seeing capitulation rather than the start of a longer decline.

However, macro conditions still look shaky. Gold keeps hitting new all-time highs above $5,000 per ounce. When investors rush to safe-haven assets like that, they’re usually pulling money out of risky plays like crypto.

That creates a problem. If gold continues its rally, capital won’t flow back into digital assets anytime soon. Instead, crypto faces sustained pressure as investors stay defensive.

Still, recovery isn’t impossible. If broader market sentiment improves and macro trends shift bullish, total crypto market cap could push back toward $3.00 trillion. But that requires a coordinated move higher across multiple assets.

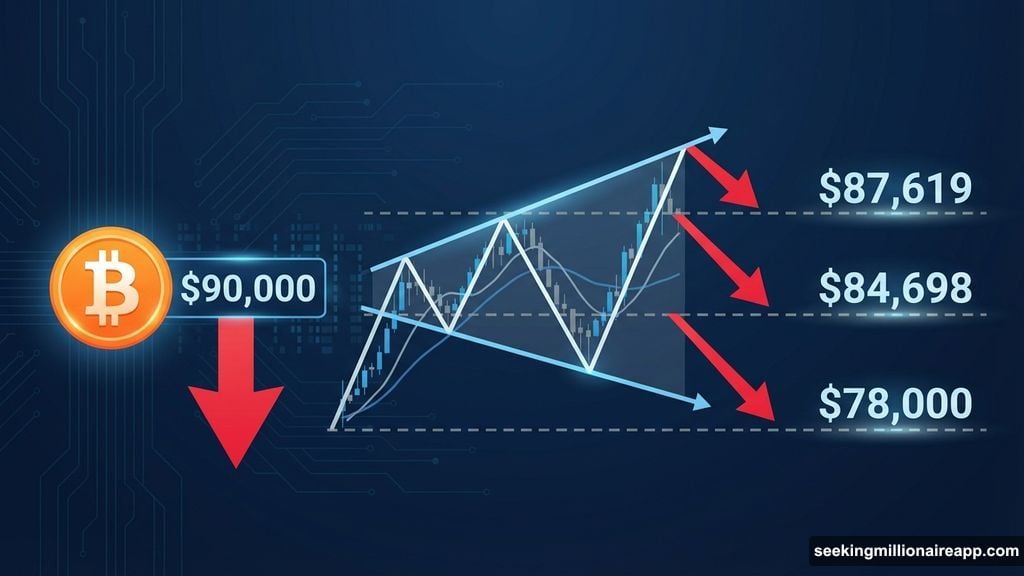

Bitcoin’s Wedge Pattern Spells Trouble

Bitcoin trades near $87,619 after getting rejected hard from $90,000 over the weekend. The price action validates a concerning technical pattern that’s been forming for two weeks.

What pattern? A broadening ascending wedge on the chart. This formation typically signals rising volatility and potential downside ahead. Technical analysts watch these wedges closely because they often precede sharp corrections.

If bearish momentum picks up and Bitcoin breaks lower from here, the next support sits at $84,698. Breaking that level would confirm the wedge breakdown and likely trigger additional selling.

Moreover, breaking support would open the door to much deeper losses. Bitcoin could slide toward the low $80,000s or even test $78,000 if panic selling accelerates.

But there’s a bullish scenario too. If buying pressure returns and lifts Bitcoin above $89,241, the bearish setup gets invalidated. Reclaiming that resistance would clear the path back above $90,000.

From there, Bitcoin could target $91,298 and potentially retest recent highs near $94,000. So the next few days matter a lot for determining Bitcoin’s short-term direction.

KAIA Crashes 20% But Holds Critical Support

KAIA got absolutely hammered with a near 20% drop in 24 hours. The altcoin now trades around $0.0762 after breaking below $0.0797 support and briefly dipping under $0.0721.

Sharp selling like this reflects the heightened volatility crushing smaller altcoins right now. When Bitcoin wobbles, altcoins usually get hit much harder. KAIA proved no exception.

Yet there’s a silver lining. KAIA continues holding above its 50-day exponential moving average. This technical level acts as short-term structural support. As long as buyers defend it, KAIA maintains hope for a recovery bounce.

If support holds, KAIA could reclaim $0.0797 fairly quickly. From there, a move toward the $0.0879 resistance zone becomes possible. That would mark a solid recovery from current beaten-down levels.

But the bearish risk remains real. If KAIA fails to hold above $0.0721 as conditions deteriorate, the price structure weakens significantly. Breaking that support would likely send KAIA tumbling toward $0.0631.

At that point, the bullish thesis gets invalidated completely. KAIA would enter a deeper corrective phase that could last weeks rather than days.

Macro Headwinds Keep Building

Two major news items highlight why crypto faces continued pressure beyond just technical patterns.

First, Japan won’t approve crypto ETFs until 2028 at the earliest. Regulators plan to add cryptocurrencies as eligible ETF assets, with Nomura and SBI expected to launch products on the Tokyo Stock Exchange. But that timeline stretches years away, removing a potential near-term catalyst.

Second, a US crypto scandal just broke involving alleged theft of over $40 million from government seizure wallets. Blockchain investigator ZachXBT traced at least $23 million to one wallet linked to thefts exceeding $90 million across 2024 and 2025.

Stories like this damage crypto’s reputation with mainstream investors. They reinforce negative perceptions about security and legitimacy. That makes it harder to attract fresh capital when markets are already struggling.

Combined with gold’s safe-haven rally, these factors create a tough environment for crypto bulls. Markets need either a major positive catalyst or significant technical support to hold before sentiment improves.

What Happens Next Matters

Bitcoin’s wedge pattern sits at a critical inflection point. The next 72 hours likely determine whether we see a relief bounce or deeper correction.

Watch for Bitcoin to either reclaim $89,241 resistance or break below $84,698 support. Those levels define the near-term range. Breaking either direction with conviction sets up the next major move.

For altcoins like KAIA, holding technical support levels becomes crucial. Failure to defend key zones could trigger cascading losses as stop-losses get hit and panic selling accelerates.

Meanwhile, macro conditions remain mixed at best. Gold’s strength suggests investors still favor safety over risk. Until that shifts, crypto faces an uphill battle attracting capital regardless of technical setups.

Smart traders stay patient here. Markets need to prove they can hold support and reverse momentum before committing significant capital to long positions.