Arctic temperatures just killed over 110 exahashes per second of Bitcoin mining power across America. That’s not a minor dip. It’s a massive network disruption.

Major mining pools pulled the plug as electricity grids buckled under extreme heating demand. Meanwhile, miners already struggling with thin profit margins faced an impossible choice: keep mining or keep the lights on for millions of households.

The cold snap exposed something critical about Bitcoin mining’s future in the United States. When the grid gets stressed, miners shut down first. Always.

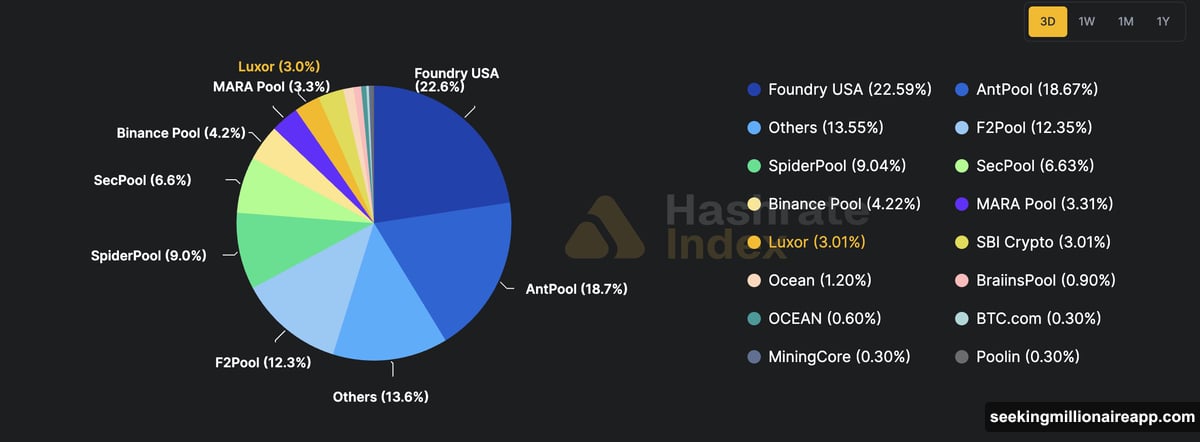

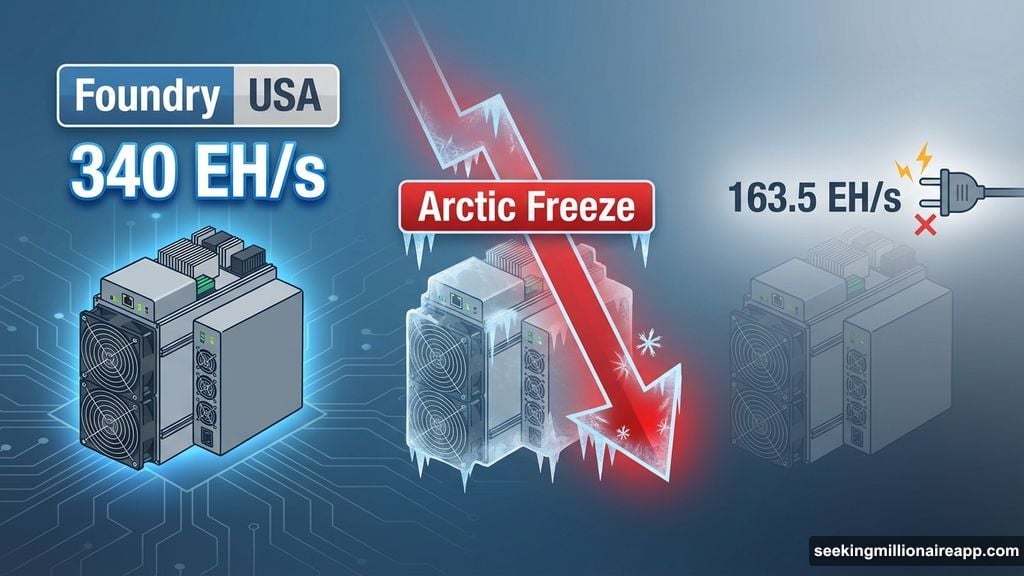

Foundry USA Loses 60% of Hashrate in Days

Foundry USA, the world’s biggest Bitcoin mining pool, watched its hashrate collapse from 340 EH/s to roughly 242 EH/s within days. Then it kept falling.

By late January, Foundry’s hashrate dropped to approximately 163.5 EH/s. That represents a staggering 60% decline from peak levels just days earlier. Block production slowed to 12-minute intervals as the network struggled to compensate.

Luxor faced similar pressure. Its hashrate tumbled from 45 EH/s to 26 EH/s before settling around 21.9 EH/s. Smaller pools like Antpool and Binance Pool also pulled back capacity.

These weren’t voluntary optimizations. These were emergency shutdowns driven by grid operators desperate to prevent blackouts. When utilities ask large power consumers to curtail usage during crises, Bitcoin miners have no choice but to comply.

Grid Operators Prioritize Homes Over Mining Rigs

The winter storm brought life-threatening conditions from Texas to New England. At least three people died. Hundreds of thousands lost power anyway.

Schools closed. Roads became impassable. Flights were canceled nationwide. Heating demand surged to levels that stressed electrical infrastructure beyond normal capacity.

Power grids issued conservation requests across multiple states. Bitcoin miners, as large flexible loads, became the obvious first target for curtailment. Shutting down mining operations frees up megawatts of capacity for residential heating without triggering widespread blackouts.

According to TheMinerMag, roughly 1.3 million mining rigs went offline during the peak of the storm. That’s about 260 EH/s of total network hashrate suddenly disappearing.

Bitcoin advocates often promote mining as a “grid stabilizer” that can ramp up or down based on electricity demand. This storm tested that theory under real pressure. Results were mixed at best.

Demand Response Programs Prove Their Value

Several publicly traded mining companies participate in utility demand response programs specifically designed for situations like this. Riot Platforms, CleanSpark, and Bitdeer all operate facilities equipped to curtail power on request.

Matthew Sigel, Head of Digital Assets Research at VanEck, highlighted this functionality during the storm. He noted that miners operating in regions served by the Tennessee Valley Authority and similar utilities can act as flexible loads during grid emergencies.

The model works in theory. Miners agree to shut down during peak demand periods in exchange for discounted electricity rates the rest of the time. Utilities get flexible capacity they can control. Miners get cheaper power when grids aren’t stressed.

But the financial impact remains brutal. Every hour a mining rig sits idle costs money. Hardware depreciates whether it’s hashing or not. Debt payments don’t pause for weather events.

Plus, when miners shut down, they miss out on Bitcoin rewards that still flow to miners operating elsewhere. Chinese miners, for example, didn’t face the same weather constraints. They kept mining while American operations sat dark.

Thin Margins Make Weather Events Catastrophic

Bitcoin mining profitability was already under severe pressure before the storm hit. CryptoQuant data shows miner reserves fell to their lowest level since 2010 in January 2026.

Why? Bitcoin prices remain subdued while electricity costs keep rising. The average cost per kilowatt-hour hit 18.07 cents in September 2025, up 10.5% since the start of that year.

Many miners now operate at or below breakeven. Forced shutdowns during extreme weather push them deep into unprofitable territory. They lose revenue from missed mining rewards while still paying fixed costs for facilities, staff, and debt service.

Some companies are pivoting strategies entirely. Bitfarms announced plans to reallocate resources toward artificial intelligence and high-performance computing. The economics of pure Bitcoin mining no longer justify the operational risk.

That’s a significant shift. When one of the larger publicly traded miners starts diversifying away from Bitcoin, it signals broader industry skepticism about future profitability.

Trump Administration’s $15 Billion Power Plan May Help

The Trump administration recently proposed a $15 billion emergency power auction plan aimed at adding new electricity generation capacity. The initiative would use tech-backed, long-term contracts to incentivize construction of new power plants.

If implemented, the plan could eventually ease pressure on miners by increasing overall grid capacity. More power available means fewer curtailment requests during peak demand periods.

But relief won’t come quickly. Building new generation capacity takes years. Permitting alone can stretch for months or longer. Construction timelines add more delays.

Meanwhile, miners face immediate challenges. They need affordable electricity access right now, not in 2028 or 2029. And they need grid operators who view mining as a beneficial flexible load rather than an expendable drain on capacity.

The Real Cost of Geographic Concentration

US Bitcoin mining grew explosively over the past few years as operations migrated away from China following that country’s mining ban. Texas became a major hub thanks to its relatively cheap electricity and business-friendly regulatory environment.

Geographic concentration creates vulnerability. When one region faces extreme weather or grid stress, a disproportionate chunk of global hashrate goes offline simultaneously. That’s exactly what happened during this storm.

Foundry USA and Luxor both serve primarily North American miners. Their hashrate declines reflect the concentrated impact of regional weather events. If mining operations were more geographically distributed, individual weather events would have less dramatic network-wide effects.

But distribution requires infrastructure, stable electricity access, and regulatory certainty. Many regions lack one or more of these prerequisites. So miners cluster where conditions seem most favorable, creating concentrated risk.

Hashrate Will Recover. Questions Remain

Bitcoin’s hashrate will bounce back once temperatures moderate and grid stress subsides. Miners will restart their rigs. Block production intervals will normalize. The network will continue functioning as designed.

But fundamental questions persist. Can Bitcoin mining remain economically viable in the United States with current electricity costs and regulatory uncertainty? Will miners diversify geographically to reduce weather-related risk? Or will operations continue clustering in a few states, accepting occasional disruptions as the cost of doing business?

Grid operators increasingly view Bitcoin miners with suspicion rather than appreciation. Yes, miners can curtail power when asked. But they also consume massive amounts of electricity during normal operations, competing with residential and commercial users for limited resources.

The next extreme weather event could trigger even more aggressive curtailment requests. Miners might face longer shutdowns or permanent restrictions on grid access during peak demand seasons.

Profitability will keep eroding unless Bitcoin prices surge or electricity costs fall. Neither seems likely in the near term. So more miners will probably follow Bitfarms toward alternative revenue streams that don’t depend entirely on cryptocurrency market volatility.

Mining will survive. But its geography, economics, and relationship with power grids will keep shifting. This storm was just another data point in that ongoing transformation.