Ethereum’s whale community can’t agree on what’s next. Some are dumping millions. Others are buying aggressively. And one dormant wallet just moved $145 million after nearly a decade of silence.

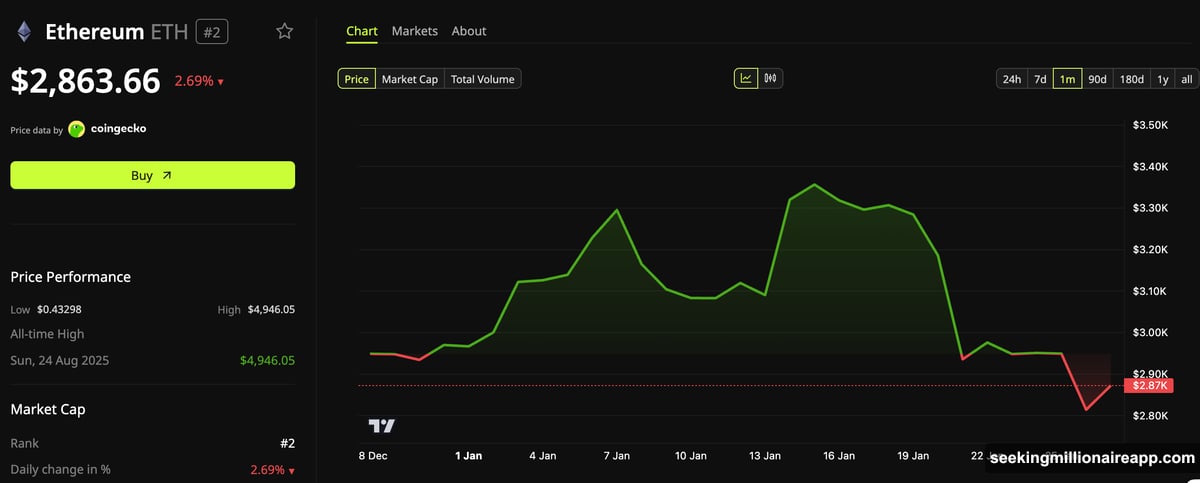

The tug-of-war comes as ETH struggles to reclaim $3,000. Year-to-date, the second-largest cryptocurrency is down nearly 5%. Plus, it’s shed over 10% in just the past week. Yet network activity tells a completely different story.

Mega Whales Scoop Up ETH While Others Exit

Large holders are making big moves in opposite directions. According to Lookonchain data, OTC whale address 0xFB7 purchased 20,000 ETH worth $56.13 million in a single transaction.

That’s not all. Over five days, the same whale accumulated 70,013 ETH. That’s roughly $203.6 million at current prices. And this whale isn’t alone.

Last week, Ethereum whales collectively added more than 350,000 ETH in just 24 hours. Meanwhile, CryptoQuant data shows exchange reserves continue dropping. That means fewer coins sitting on trading platforms ready to sell.

So the buying pressure is real. But the selling is too.

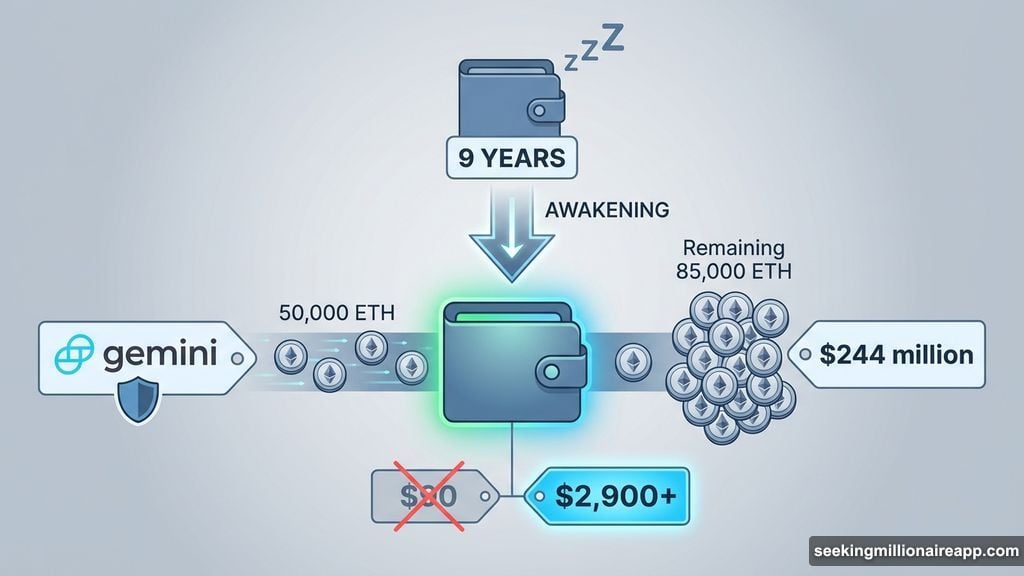

One Whale Wakes Up After 9 Years

Here’s where it gets interesting. An early Ethereum wallet that stayed dormant for 9 years suddenly moved 50,000 ETH to Gemini. That’s $145.25 million worth.

According to analyst EmberCN, this address originally withdrew 135,000 ETH from Bitfinex back when ETH traded around $90. Now? That same ETH is worth 32 times more. The wallet still holds 85,000 ETH, valued at approximately $244 million.

Large transfers to exchanges typically signal potential selling. Long-term holders moving coins often means they’re preparing to cash out, rebalance, or rotate into other assets.

Plus, another whale address (0x3c9E) earned the label “buy high, sell low” for good reason. Over three days, this wallet dumped 5,500 ETH worth about $16.02 million at an average price of $2,912.

The kicker? This same address bought 2,000 ETH just five days earlier at higher levels near $2,984. Ouch.

Capital Rotation Shows Mixed Conviction

Some whales aren’t exactly selling. They’re rotating. World Liberty Financial, backed by President Trump, shifted exposure from Bitcoin to Ethereum. The DeFi project swapped 93.77 WBTC worth $8.08 million for 2,868 ETH.

Similarly, whale address 0xeA00 offloaded 120 BTC valued at $10.68 million and rotated into 3,623 ETH. These moves suggest preference shifts rather than outright bearishness on crypto.

Still, the mixed signals from whales create uncertainty. When large holders can’t agree on direction, volatility typically follows.

Network Activity Hits Record High Despite Price Slump

Now for the bullish part. Ethereum’s network fundamentals are screaming strength despite sluggish prices.

CryptoOnchain data reveals the seven-day simple moving average of Ethereum active addresses hit an all-time high of 718,000. That’s never happened before. And it’s happening while price action remains flat.

The analysis highlighted a “distinct Bullish Divergence” between price and network activity. Translation: More people are using Ethereum than ever before, but the price hasn’t caught up yet.

Historically, similar divergences preceded upward price momentum. CryptoOnchain noted that Layer-2 adoption, renewed DeFi activity, and fresh retail interest are all driving record network engagement.

At the time of writing, Ethereum traded at $2,863.66, down 2.69% over 24 hours. However, shrinking exchange reserves and record active users suggest underlying strength.

Technical Signals Point to Potential Reversal

Technical analysts are spotting bullish patterns too. Prominent crypto analyst KALEO posted that “the worst is over” for Ethereum, pointing to chart formations suggesting a bottom.

The combination of record network usage, declining exchange supply, and accumulation by certain whales builds the case for an eventual bounce. But timing remains uncertain.

Macro conditions and broader crypto market trends will likely determine when (or if) Ethereum breaks out. For now, whales remain divided. Some see value at current levels. Others are taking profits after years of gains.

The contrast between on-chain activity and price action creates an unusual setup. Network fundamentals rarely diverge from price this dramatically for long. Something usually gives.

Whether that means prices rise to meet network activity or activity falls to match prices remains the biggest question. For now, the data suggests Ethereum’s utility and adoption continue growing regardless of short-term price swings.