Privacy coins crushed it in 2025. Then 2026 arrived and everything changed.

The coins that soared last year are now bleeding value. Yet crypto whales aren’t sitting idle. They’re making selective moves on three privacy tokens, buying some aggressively while quietly dumping others. Their choices reveal which coins might survive this correction and which face deeper trouble.

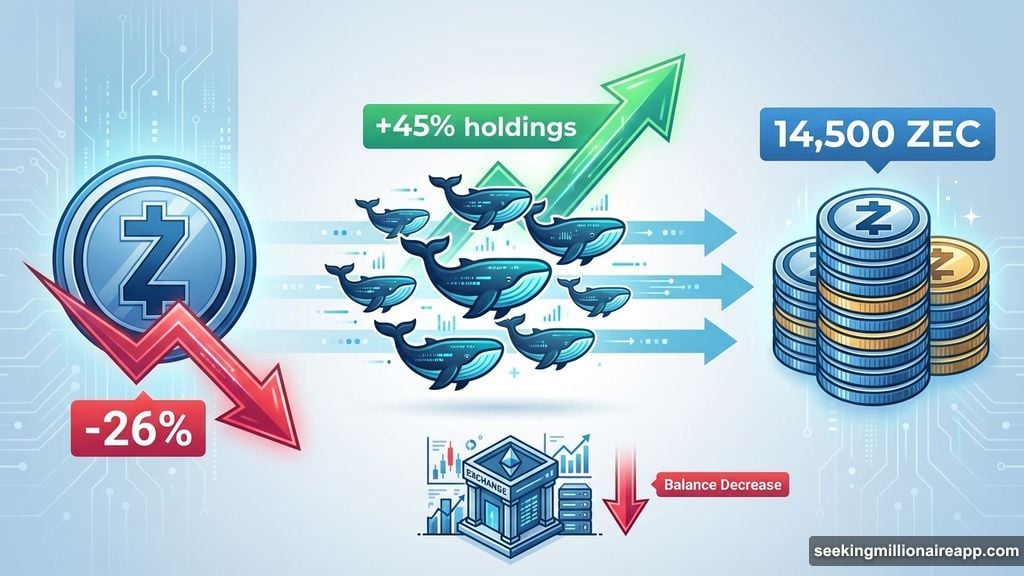

Zcash Whales Load Up After 26% Collapse

Zcash dropped 26% over the past month. Most retail holders panicked. Meanwhile, whales started accumulating.

In the last 24 hours alone, standard Zcash whales increased holdings by 45%. That pushed their balance to roughly 14,500 ZEC. Plus, the top 100 addresses raised exposure by 14.6%, adding 43,722 ZEC total.

Combined, whales grabbed approximately 6,500 ZEC worth $2.5 million at current prices. Exchange balances dropped during this period, confirming real accumulation rather than trading games.

The chart explains their timing. Since late December, ZEC traded inside a bear flag pattern that threatened a 42% downside move. But that breakdown risk is weakening now.

Zcash started pushing above the flag’s upper trendline. Moreover, hidden bullish divergence appeared between October 30 and January 25. The price formed a higher low while RSI made a lower low, signaling fading selling pressure beneath the surface.

Since that signal flashed, ZEC already rallied 24%. The key test sits at $449. Breaking cleanly above that level invalidates most bearish structure and opens room toward $561. On the flip side, losing $325 restores breakdown risk and kills the whale thesis.

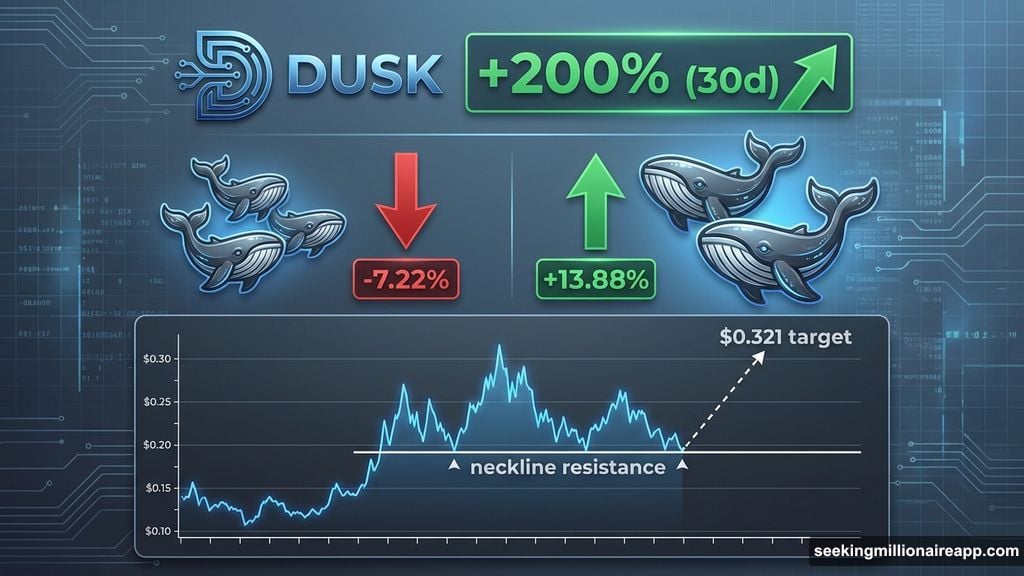

Dusk Network Sees Whale Civil War

Dusk Network remains up 200% over 30 days. But it corrected 38% in just seven days, creating a split between holder groups.

Smaller whales are trimming positions. Standard whale wallets reduced holdings by 7.22% during the recent pullback. However, top-100 addresses did the opposite, increasing their stash by 13.88% to 464.44 million DUSK.

That means mega whales added roughly 56.6 million DUSK worth $8.2 million during the correction. They’re betting on a reversal while smaller players de-risk.

The chart shows why opinions diverge. DUSK is forming a potential inverse head-and-shoulders pattern, but the neckline slopes downward. That makes a clean breakout harder to achieve.

Critical resistance sits between $0.176 and $0.190. A daily close above $0.190 confirms the pattern and projects a 68% upside toward $0.321-$0.330. Early momentum signals support this possibility.

Between January 24 and January 28, the price attempted a higher low while RSI printed a lower low. That hints at hidden bullish divergence. But the setup only holds above $0.140. Breaking below that level erases the divergence and exposes downside toward $0.098.

In short, smaller whales are taking profits after a massive run. Mega whales are positioning for a possible breakout. Until $0.190 breaks, this remains a high-risk trade rather than a confirmed trend.

COTI Whales Return After Heavy Selling

COTI fell 22% over the past month and 14% in the last seven days. The price remains trapped inside a descending channel, reflecting sustained pressure.

Yet whale behavior shifted recently. Since January 13, COTI whales dumped holdings hard, dropping from 733.46 million COTI to a low of 718.17 million. That distribution aligned with breakdown risk and kept prices weak through mid-January.

However, since January 22, whales started buying again. Holdings increased from 718.17 million to 719.1 million COTI, adding roughly 930,000 tokens. That’s modest compared to earlier selling, suggesting early positioning rather than full conviction.

The COTI price chart reveals cautious optimism. The token remains inside a descending channel, but momentum shifted. Between November 4 and January 25, the price made a lower low while RSI printed a higher low. That bullish divergence often signals fading selling pressure, even before price turns.

For the signal to matter, levels must break. A daily close above $0.019 is the first test. Clearing it opens the path toward $0.024, a potential 40% rebound that neutralizes bearish structure.

Until then, downside risk persists. Losing $0.015 extends the divergence timeline and exposes deeper levels. Whales are watching that $0.019 level closely before committing more capital.

February Separates Winners From Losers

Privacy coins entered February at a crossroads. Some show whale accumulation near key support levels. Others face internal disagreement between different holder groups.

Zcash whales bet on reversal after a 26% drop, positioning for a move toward $449. Dusk Network sees mega whales buying the dip while smaller players exit, creating a high-risk, high-reward setup around $0.190. COTI whales are testing the waters after heavy distribution, waiting for confirmation above $0.019.

The next few weeks determine which bets pay off. Privacy coins won’t all recover together. Instead, whales are picking their spots carefully, letting chart structure and momentum dictate their next moves.