Ethereum crashed hard this week. Large holders just sold nearly $3 billion worth of ETH in seven days.

That massive selling wave pushed prices down 12.7% in just two days. Plus, technical charts now point to another 16% decline ahead. So the question isn’t whether ETH drops further. It’s how far it falls before finding solid ground.

Whale Wallets Are Hemorrhaging ETH

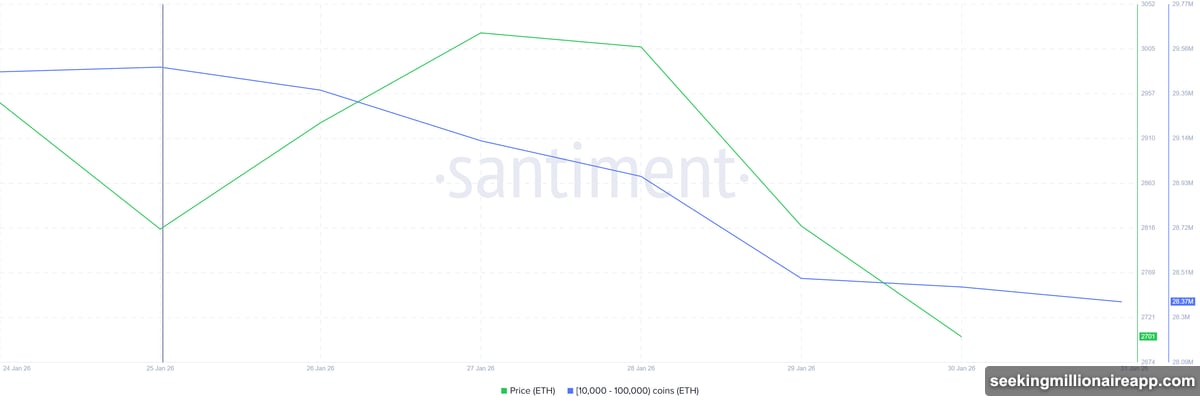

Big Ethereum holders went on a selling spree. Addresses holding between 10,000 and 100,000 ETH dumped over 1.1 million tokens last week.

At current prices, that equals $2.8 billion in selling pressure. That’s not normal portfolio rebalancing. That’s deliberate, aggressive distribution.

When whales sell this hard, spot markets struggle to absorb the supply. Buyers can’t step in fast enough. So prices slide lower as sellers find liquidity at cheaper levels.

This behavior accelerated Ethereum’s breakdown through critical support zones. The sell-off didn’t just happen alongside the decline. It actively caused the technical failure that traders are now watching with concern.

Fear Metrics Flash Warning Signals

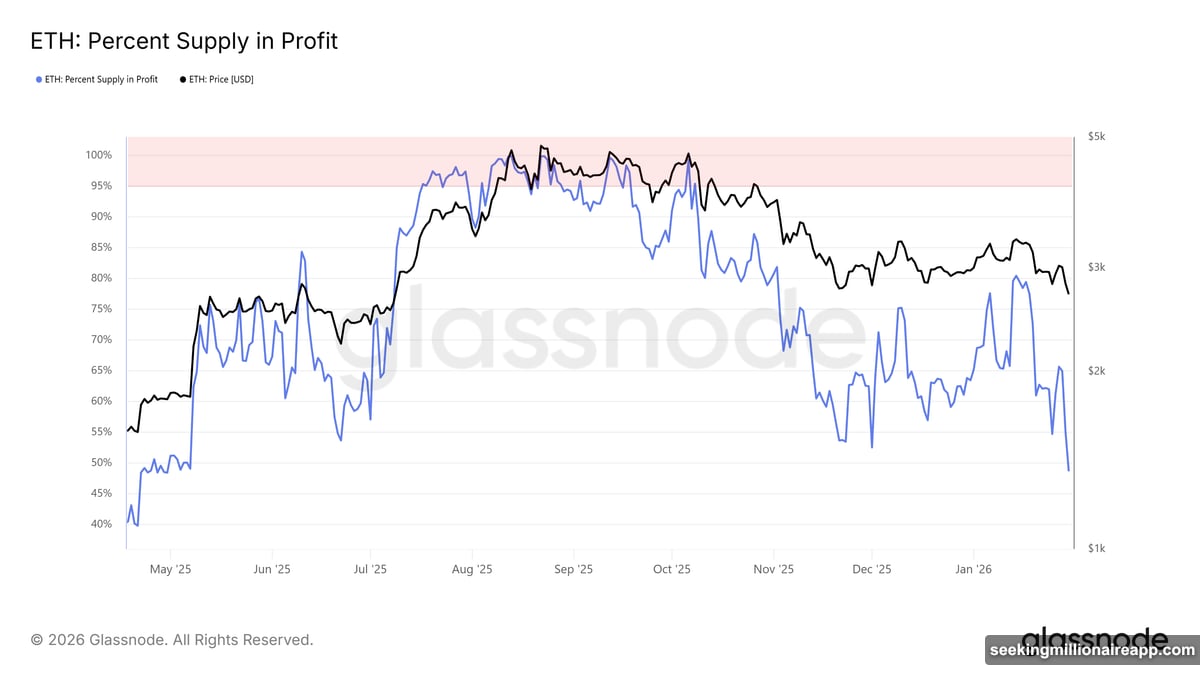

Market data reveals a troubling shift in holder psychology. The total ETH supply sitting in profit dropped below 50% this week.

When fewer than half of all holders show unrealized gains, fear typically rises. Investors holding losses often pause selling initially. They hope for recovery instead of locking in red numbers.

But here’s the problem. If prices keep falling, that hesitation breaks. Panic selling can kick in as investors rush to prevent deeper losses.

Moreover, the current setup creates a trap. Short-term stability from reduced profit-taking might feel reassuring. Yet that same condition sets up potential capitulation if support levels fail. Under those circumstances, Ethereum could face another wave of forced selling.

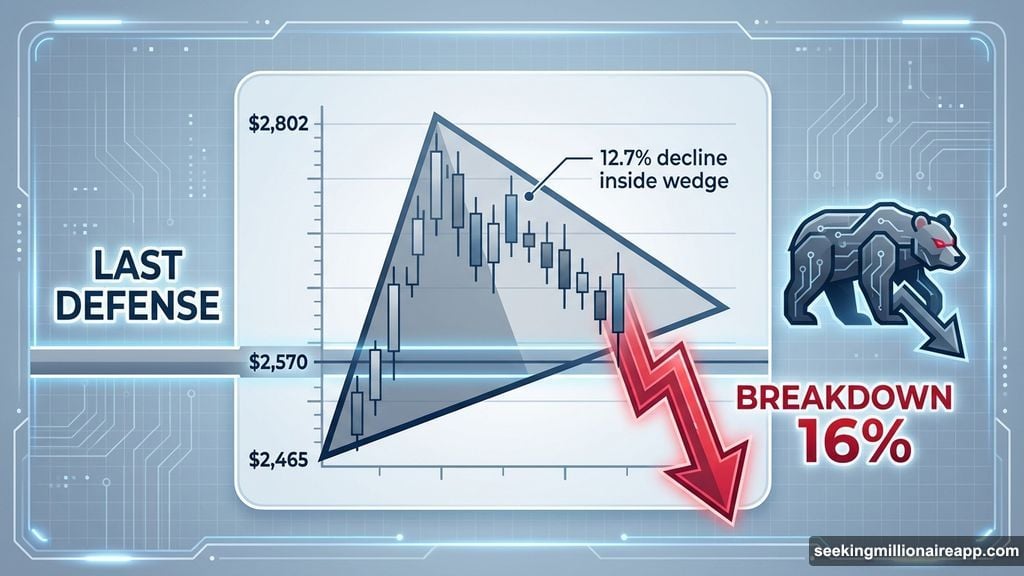

Technical Pattern Projects Deeper Pain

Ethereum trades around $2,636 right now. The asset already fell 12.7% over the past two days. That drop confirmed a bearish ascending wedge pattern on the charts.

This formation typically signals trend reversal. The breakdown projects a 16% decline from current levels. That puts the target near $2,465 if selling continues.

The pattern gained credibility when ETH lost the $2,802 support level. Technical structures often prove reliable once key supports break. As long as price stays below that former support, bears control momentum.

However, one critical level could change everything. The $2,570 support zone represents Ethereum’s last meaningful defense. If that holds, buyers might attempt a counter-move.

A sustained recovery back toward $2,802 would flip the script entirely. Reclaiming that level as support would invalidate the bearish thesis. But that scenario requires significant buying pressure that hasn’t materialized yet.

The Real Risk Nobody’s Discussing

Whale distribution at this scale doesn’t happen randomly. Large holders typically have better information and longer time horizons than retail traders.

When they aggressively reduce exposure, it signals conviction that lower prices are coming. These aren’t panic sellers. They’re calculated actors positioning for what they see ahead.

The timing matters too. Global markets face uncertainty. Macro conditions are shifting. And Ethereum’s fundamentals haven’t changed enough to justify whale confidence at current prices.

So the $2.8 billion sale isn’t just about technical levels. It reflects deeper concerns about Ethereum’s near-term prospects. Until those concerns shift or whales stop selling, recovery attempts will likely fail.

The $2,570 support is everything now. Hold that level and Ethereum might stabilize. Break it and the 16% decline projection becomes reality. Simple as that.