February’s first week brings chaos. Three major altcoins sit at critical price levels where billions in leveraged bets could get wiped out in minutes.

The setup looks dangerous. Bulls and bears are betting heavily on opposite outcomes. Plus, these aren’t random altcoins—Solana, Hyperliquid, and Tron each have their own explosive catalysts that could trigger the next move.

Here’s why these three tokens are primed for massive liquidations.

Solana’s $100 Support Battle Could Wipe Out $500M in Shorts

Solana briefly dipped below $100 in early February. That’s a psychologically critical level that hasn’t broken in two years.

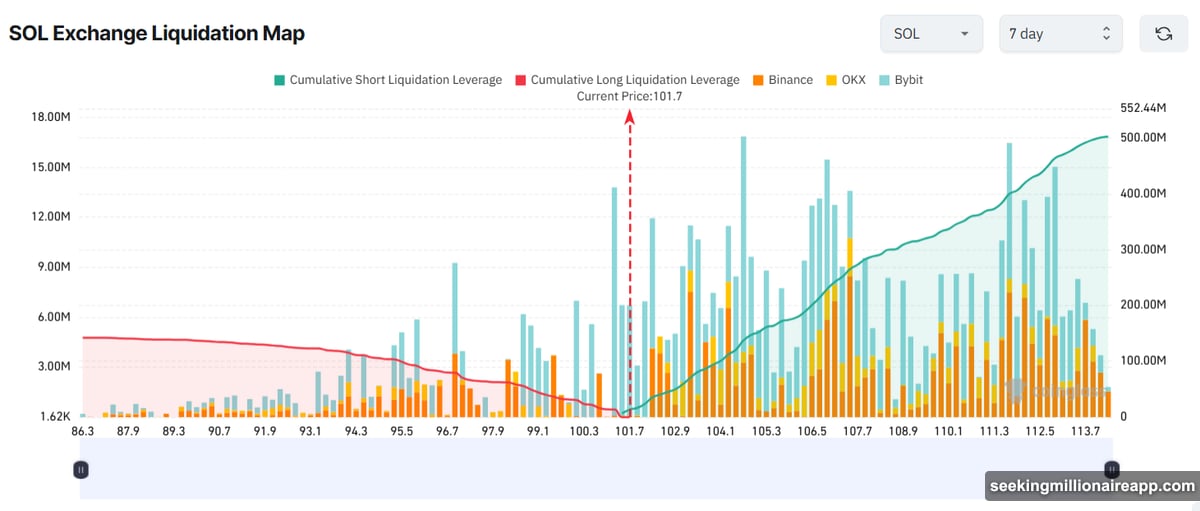

Now here’s where it gets interesting. The liquidation heatmap shows shorts dominating. Traders are piling into leveraged short positions, convinced SOL will fall further. But they’re shorting right at major support—a historically risky move.

Meanwhile, on-chain data tells a different story. Solana added over 10 million new addresses daily in January. That’s not the behavior of a dying network.

Several bullish catalysts are emerging too. Meme coin launchpads continue driving user growth. The USD1 stablecoin is expanding on Solana. And GhostSwap just brought privacy features to the ecosystem.

So you’ve got selling pressure from broader market fear colliding with Solana-specific bullish developments around $100. That creates the perfect conditions for violent price swings.

CoinGlass data reveals the stakes. If SOL bounces above $113, shorts face $500 million in liquidations. If it drops to $86 instead, longs lose $142 million.

Both sides are vulnerable. Neither can afford to be wrong.

Hyperliquid Defies Gravity While Liquidations Mount on Both Sides

Hyperliquid rallied 50% since January 21. Most altcoins are making new lows. That divergence alone makes HYPE dangerous.

The liquidation map shows unusual balance. Around $80 million in shorts get liquidated if HYPE hits $35.50. Another $80 million in longs disappear if it falls to $26.

HYPE’s rise against the broader trend already represents a fragile situation. BeInCrypto reports significant capital outflows. The market lacks liquidity to sustain this recovery.

Yet HYPE has legitimate catalysts. The team slashed monthly allocations by 90%. Demand for metal pair trading on Hyperliquid continues supporting the token.

Bulls and bears are neutralizing each other. The past four days formed consecutive spinning top candlestick patterns. That formation typically signals a large price swing is imminent.

Someone’s getting liquidated soon. The only question is which side.

TRX Faces Scandal Pressure but Corporate Buying Suggests Otherwise

Justin Sun’s former girlfriend recently accused him of market manipulation during TRON’s early days. She claims Sun instructed employees to register multiple Binance accounts for coordinated trading.

That kind of news typically triggers panic selling. Short traders are betting on further downside. The liquidation map shows nearly $29 million in short liquidations if TRX rebounds above $0.31.

But look at what’s actually happening. Tron Inc. just bought 173,051 more TRX tokens at $0.29 average price. Their total reserves now exceed 679.2 million TRX.

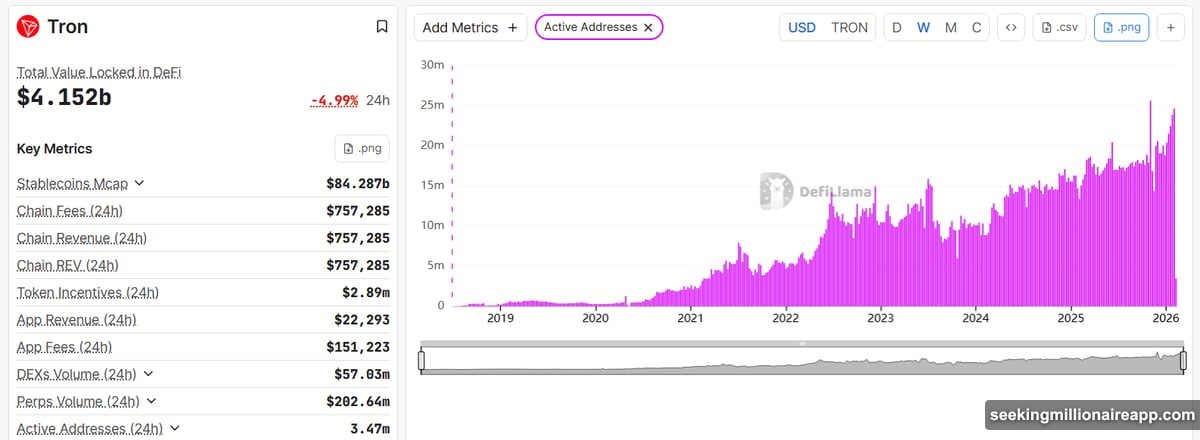

Weekly active addresses on Tron keep rising too. They’re currently at 24.68 million. That indicates demand remains solid even during broader market decline.

So shorts are betting on scandal-driven selling while the company itself is aggressively buying. That creates a dangerous mismatch.

Short sellers might capture quick profits while negative sentiment dominates. Without a clear exit plan, however, those gains could vanish fast.

The $5 Billion Liquidation Wave Is Just Beginning

Total crypto liquidations exceeded $5 billion over the last four days. That’s the largest wave since October 10th.

As liquidation losses mount, retail investors run out of capital. They can’t sustain buying pressure anymore. That pushes the market toward prolonged stagnation.

Each of these altcoins has its own story. Solana fights at critical support with bullish on-chain data. Hyperliquid defies market gravity with balanced liquidation risks. TRX faces scandal pressure while corporate buying accelerates.

But they all share one trait: extreme vulnerability to violent price swings.

Both bulls and bears are heavily leveraged. Both sides are convinced they’re right. And both sides could get liquidated this week depending on which catalyst triggers first.

The volatility isn’t finished. It’s just getting started.