Zcash holders are heading for the exits. Fast.

The privacy coin just shed nearly 70% of its trading volume in three weeks. Worse, technical indicators confirm the breakdown isn’t done yet. With price now targeting $200, the question isn’t whether Zcash will fall further. It’s how fast.

Let’s dig into what’s driving this decline and why the market structure points to more pain ahead.

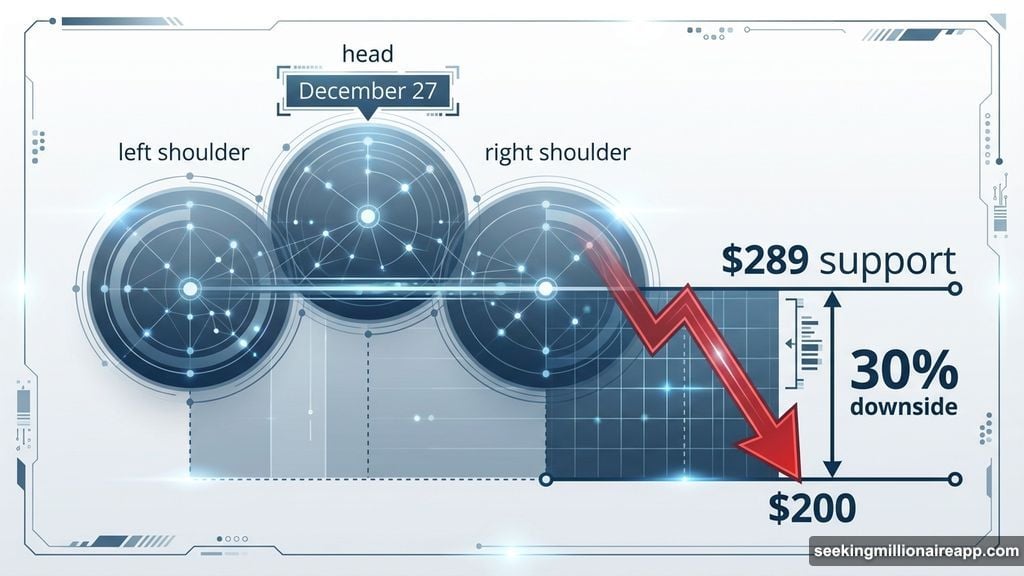

Classic Breakdown Pattern Triggers Decline

Zcash completed a textbook head-and-shoulders formation in late January. This bearish pattern signals trend reversals when buyers lose control.

The breakdown happened January 31. Since then, price has respected the structure perfectly. That’s not good news for anyone still holding.

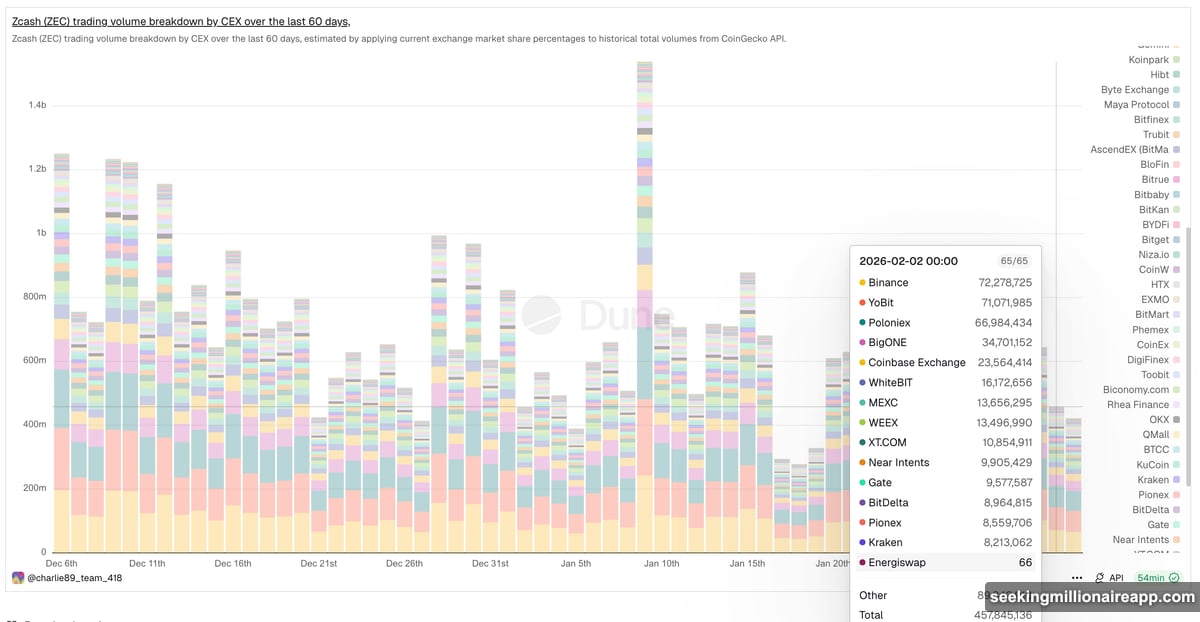

Meanwhile, trading activity evaporated. Dune Analytics shows peak volume hit $1.5 billion on January 9. By February 2, that number crashed to $450 million. The math is brutal: volume dropped roughly 70% in just 21 days.

Less trading means weaker liquidity. Fewer participants create less price support during selloffs. So declines accelerate faster than rallies can recover.

Money Flows Confirm Sellers Control Price

Capital flow indicators paint an even darker picture. The Chaikin Money Flow tracks whether money enters or exits an asset using price and volume data.

CMF peaked around December 27 when Zcash formed the “head” of its pattern. Since then, it failed to break above its downward trendline. In early February, CMF finally dropped below zero.

That shift matters. Negative CMF means outflows exceed inflows. More money is leaving Zcash than entering it. Plus, exchange data backs this up.

Exchange reserves surged over 64% in the past 24 hours. Rising reserves typically signal holders moving coins to exchanges for sale. Large holders reduced exposure by more than 35% in recent sessions.

One bright spot exists. “Smart money” wallets increased Zcash holdings by roughly 9% over 24 hours. But that accumulation remains tiny compared with broader outflows. Selective buying can’t offset widespread selling pressure.

Technical Target Points to $200 Drop

Price structure reflects this imbalance clearly. Zcash broke below $289 support. The next meaningful floor sits near $262.

Below that, the primary technical target from the head-and-shoulders pattern lands around $200. From current levels near $284, this implies potential downside approaching 30%. So far, price shows zero signs of stabilizing.

If smart money accumulation triggers a short-term bounce, Zcash must first reclaim $289 cleanly. A move above this level could open a path toward $317. That aligns with Fibonacci resistance and prior consolidation zones.

However, even such a rebound would likely stay corrective rather than structural. In confirmed downtrends, rallies often serve mainly to flush out short positions before declines resume. Without strong volume and capital inflows, these moves tend to fade quickly.

Broader Structure Still Favors Bears

For the bearish structure to weaken meaningfully, Zcash would need to reclaim the $407 area near the right shoulder of the pattern. Until that happens, the head-and-shoulders formation remains valid and controlling price action.

The volume collapse tells the real story here. When trading activity drops 70% in three weeks, markets lose the fuel needed for reversals. Fewer participants mean less disagreement about fair value. That creates one-way moves that persist longer than expected.

Exchange reserve data confirms holders aren’t waiting around. They’re moving coins to sell before price drops further. Large holder behavior shows similar urgency with 35% exposure reduction.

Smart money accumulation offers limited comfort. Yes, sophisticated traders bought roughly 9% more tokens recently. But their timing could prove premature. Catching falling knives works only if the knife stops falling.

What Holders Should Watch Now

Three factors could change this bearish outlook. First, trading volume needs to stabilize above $700 million daily. That would signal renewed interest from active participants.

Second, CMF must return to positive territory. Capital inflows need to exceed outflows consistently for several days. Otherwise, selling pressure continues dominating price action.

Third, exchange reserves should decline rather than increase. Coins leaving exchanges suggest holders plan to wait out the decline rather than sell immediately.

None of these conditions exist today. Volume remains weak. CMF stays negative. Exchange reserves keep climbing. The technical picture aligns with fundamental flows pointing toward further downside.

Zcash still shows year-on-year gains near 700%. Today, that rally feels distant. The current structure suggests the $200 target isn’t just possible. It’s becoming increasingly probable unless volume and capital flows reverse decisively.

For now, sellers control this market. Smart money bought the dip. But the dip isn’t done dipping.