BitMine’s bold Ethereum accumulation strategy isn’t winning over shareholders. The stock crashed 25% in just five days, extending its monthly loss past 33%. Now trading around $22.35, BMNR faces a brutal reality: investors are fleeing faster than management can explain away losses.

Chairman Tom Lee tried to calm the storm. He called the massive unrealized losses on BitMine’s Ethereum holdings “a feature, not a bug” of crypto treasury strategy. But market data tells a different story. Buyers didn’t stick around after his explanation. In fact, they accelerated their exit.

$6.4 Billion Underwater and Sinking

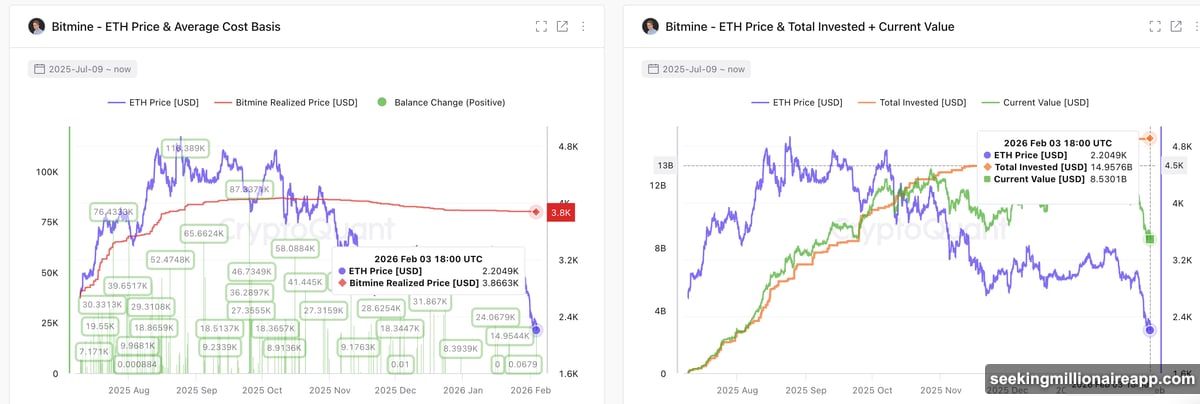

Here’s the problem BitMine can’t spin away. The company poured $14.95 billion into Ethereum. Today, those holdings are worth just $8.53 billion. That’s over $6.4 billion in paper losses—nearly half the investment value gone.

The math gets worse when you check acquisition costs. BitMine paid an average of $3,800 per ETH. Meanwhile, Ethereum trades near $2,200. That 42% gap between cost and market value creates a dangerous situation for shareholders.

Critics quickly pointed out the implications. These accumulated ETH tokens represent future selling pressure. If BitMine ever needs to liquidate or take profits, that supply hits the market. Plus, the deeper underwater they go, the harder it becomes to justify the strategy to investors who care about actual returns.

One market observer summed it up bluntly: “Tom Lee was the final exit liquidity for OG ETH whales to get out of their worthless token.” Harsh, but it reflects growing skepticism about crypto treasury plays.

The “Feature Not Bug” Theory Falls Flat

Tom Lee defended BitMine’s approach with a long-term perspective. He argued that crypto cycles naturally include temporary losses. The company designed its strategy to accumulate through downturns, betting on outperformance over complete market cycles.

That sounds reasonable in theory. Many successful crypto investors preach buying the dip and holding through volatility. But there’s a critical difference: public company shareholders expect different risk management than crypto natives.

Lee emphasized that BitMine aims to track Ethereum’s price while accumulating shares over time. Drawdowns, he insisted, come with the territory. The company isn’t trying to avoid losses—it’s trying to maximize upside when the cycle turns.

But here’s what happened next: nothing. The stock didn’t bounce after his explanation. Instead, selling accelerated. Clearly, investors weren’t buying the “feature not bug” framing. They wanted out, regardless of the long-term vision.

Volume Data Reveals Who Left First

Market indicators show exactly how the exodus unfolded. On-Balance Volume (OBV) tracks cumulative buying and selling pressure by analyzing volume on up days versus down days. It tells you whether traders are accumulating or distributing.

From early December through late January, OBV formed higher lows. That signaled steady accumulation—buyers were coming in consistently. Then between January 28 and 29, OBV broke below its rising trend line. The shift was sudden and clear: retail investors and short-term traders started dumping shares.

But retail wasn’t alone. Chaikin Money Flow (CMF) measures institutional-style capital flows using price and volume together. Readings above zero suggest accumulation. Below zero means money is leaving.

Starting January 30, CMF plunged and stayed negative. This confirmed that large buyers—likely institutions and sophisticated investors—were reducing exposure as the stock approached key support levels. Big money followed retail out the door.

Both indicators aligned with chart structure. BMNR had been forming a head-and-shoulders pattern through December and January. When price failed near the neckline and then gapped down on February 2, OBV and CMF confirmed the breakdown. Retail volume weakened first, large capital exited next, and prices collapsed last.

The sequence matters. Tom Lee’s treasury defense didn’t stop the flow-driven sell-off. If anything, it highlighted how disconnected management’s narrative had become from actual investor behavior.

Technical Breakdown Points to More Pain

After breaking the head-and-shoulders neckline and the rising trend line, BMNR resumed its broader downtrend. The pattern projects a potential 30% decline from the breakdown point. Several key levels now define what happens next.

On the downside, initial support sits near $19.26 if BMNR can’t reclaim $22.52 on the daily timeframe. Below $19.26, the next major level stands near $16.71. That aligns with the full bearish projection. If selling pressure accelerates beyond there, extended downside could reach toward $9.87—pushing the stock into single-digit territory.

Recovery faces steep resistance. The first barrier lies near $22.52. BMNR must reclaim this level just to slow the decline. Above that, resistance appears near $25.07 and $28.66. Clearing those zones would signal early stabilization but not a trend reversal.

A broader trend shift would require a move above $34.46, followed by confirmation near $42. That seems unlikely given current conditions. Both OBV and CMF remain weak, showing that buyers haven’t returned in force.

The Real Risk Nobody’s Discussing

Here’s what bothers me most about BitMine’s situation. They’re not wrong that crypto cycles involve drawdowns. Long-term believers often win by accumulating through bear markets. But public company treasuries aren’t crypto wallets.

Shareholders expect liquidity, risk management, and transparent exit strategies. BitMine offers none of those things right now. Instead, they’re locked into a massive Ethereum position with no clear plan for what happens if ETH doesn’t recover as expected.

Plus, the opportunity cost is staggering. That $14.95 billion could have funded growth initiatives, acquisitions, or dividends. Instead, it’s sitting underwater with no timeline for recovery. Every day Ethereum stays below their cost basis, shareholders are justified in questioning management’s judgment.

The “feature not bug” framing also ignores a crucial point: duration risk. Sure, crypto cycles turn eventually. But when? Six months? Two years? Five? Public shareholders can’t wait indefinitely while management executes a crypto accumulation thesis that may take years to play out.

Until capital flows turn positive and key resistance is reclaimed, technical pressure will likely dominate BMNR’s price behavior. The stock needs buyers, not explanations. And right now, buyers are nowhere to be found.