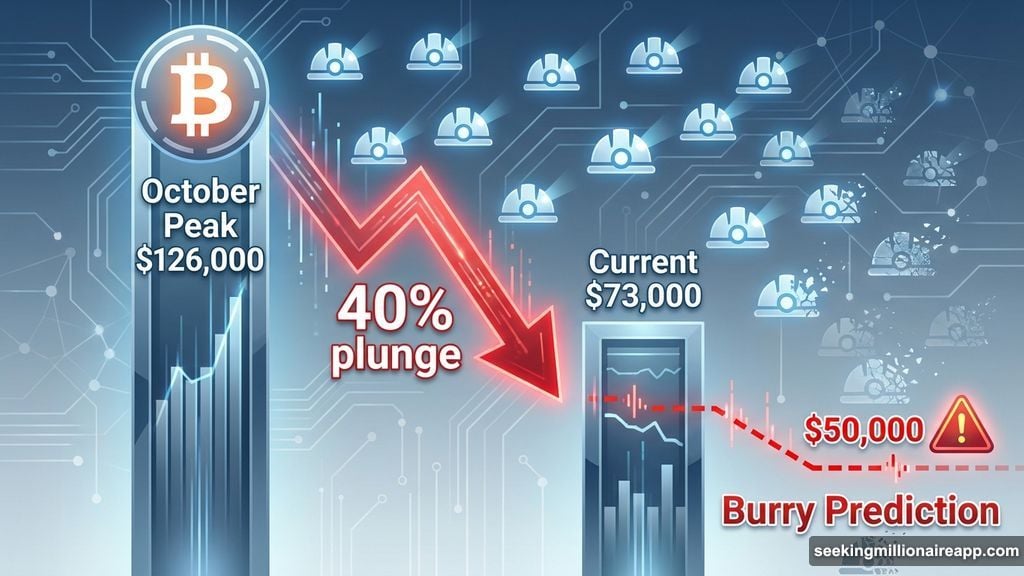

Bitcoin’s brutal 40% plunge from its October peak has traders asking one question: Is this a full-blown crypto winter?

Michael Burry thinks so. The investor who predicted the 2008 financial crisis just warned that Bitcoin’s collapse could trigger forced selling across multiple asset classes. Meanwhile, Tiger Research argues this downturn looks nothing like previous crypto winters. So who’s right?

Burry Predicts Mining Bankruptcies at $50K

The “Big Short” investor doesn’t mince words. In his latest Substack post, Burry estimated that institutions liquidated up to $1 billion in precious metals at the end of January to cover crypto losses.

“There is no organic use case reason for Bitcoin to slow or stop its descent,” Burry wrote. He warns that if BTC falls to $50,000, mining firms face bankruptcy. Plus, the market for tokenized metals futures could “collapse into a black hole with no buyer.”

Bitcoin briefly touched $73,000 on Tuesday. That’s a 40% drop from its October peak above $126,000. So Burry’s $50K prediction represents another 31% downside from current levels.

The core of his argument? Bitcoin failed as a digital safe haven. Instead of replacing gold, it became just another speculative asset driven by ETF flows and leverage. Now that leverage is unwinding fast.

Strategy Sits on $17 Billion in Losses

Burry’s contagion warning isn’t just theory. Strategy, Michael Saylor’s Bitcoin accumulation firm, now holds massive unrealized losses after BTC fell below its average purchase price of $76,000.

The damage is staggering. Strategy recorded $17.44 billion in unrealized losses in Q4 alone. Moreover, the company’s market cap crashed from $128 billion in July to $40 billion today—a 61% decline.

Here’s where it gets dangerous. Strategy’s mNAV ratio dropped from over 2.0 a year ago to just 1.1 now. That’s approaching the critical threshold that could force token sales.

In fact, Strategy raised $1.44 billion through a stock sale to ensure it can meet future obligations. The company even admitted it might sell holdings if mNAV drops below one. That marks a radical shift from Saylor’s famous never-sell stance.

So if Strategy starts dumping Bitcoin, the cascade effect could be brutal. Any sale would signal panic and crash both the stock and BTC itself.

BitMine Faces Even Steeper Losses

Strategy’s problems look mild compared to BitMine Immersion Technologies. The Ethereum accumulation firm backed by Peter Thiel holds 4.3 million ETH purchased at an average price of $3,826.

Today, ETH trades around $2,300. That represents over $6 billion in unrealized losses. Plus, the company has no good options.

Analysts note that crypto-treasury firms are trapped by their own narrative. Selling even a small amount would send a devastating signal. The resulting crash would hurt far more than the sale would help.

This creates a prisoner’s dilemma. Neither Strategy nor BitMine wants to be the first to blink. But if one starts selling, others might panic and follow.

Technical Breakdown Points to Extended Downtrend

Japanese analyst Hiroyuki Kato of CXR Engineering warns the crypto market entered a long-term downtrend. Bitcoin broke below its November low, triggering a shift from buy-the-dip to short-selling strategies.

Ethereum’s breach of the critical $2,600 support level accelerated its decline. In fact, altcoins across the board dropped 20-40% since the January FOMC meeting.

Kato points to the weekly chart showing a head-and-shoulders pattern approaching its neckline. A breach would make a near-term recovery structurally difficult.

“The high volatility in crypto and precious metals ahead of broader equity markets could be a canary in the coal mine,” Kato wrote. He suggests risk-off positioning until conditions stabilize.

So the technical setup looks grim. Multiple support levels broke, momentum shifted bearish, and the chart patterns suggest more downside ahead.

Tiger Research: This Isn’t a Crypto Winter

Despite the bearish signals, Tiger Research argues this downturn differs fundamentally from previous crypto winters.

Past winters erupted from internal industry failures. The 2014 Mt. Gox hack destroyed trust. The 2018 ICO bust revealed widespread fraud. The 2022 Terra-FTX collapse wiped out major institutions.

“We didn’t create the spring, so there is no winter either,” the report states. Both the 2024 rally and current decline were driven by external factors: ETF approvals, tariff policies, and interest rate expectations.

More significantly, the market split into three layers post-regulation. A regulated zone with capped volatility. An unregulated zone for high-risk speculation. And shared infrastructure like stablecoins that serve both.

The trickle-down effect disappeared. When Bitcoin rises, ETF capital stays in Bitcoin. It doesn’t flow into altcoins anymore.

“A crypto season where everything rises together is unlikely to come again,” Tiger Research concluded. “The next bull run will come. But it will not come for everyone.”

Two Conditions for the Next Bull Run

For that bull run to materialize, Tiger Research identifies two requirements. First, a killer use case must emerge from the unregulated zone. Second, macroeconomic conditions need to turn supportive.

Until then, the market remains in an unprecedented state. Neither winter nor spring, but something entirely new.

So both Burry and Tiger Research might be right. This might not be a traditional crypto winter with industry-wide failures. But it could still involve massive price declines as overleveraged firms unwind positions.

The difference matters less to traders watching their portfolios bleed. Whether you call it a winter or just a brutal correction, the pain feels the same.

Bitcoin needs to hold $73,000 or risk accelerating toward Burry’s $50,000 target. Strategy and BitMine need to avoid forced selling that could trigger a cascade. And the broader market needs stabilization before any recovery begins.

Right now, none of those conditions look likely. So buckle up. The next few months could get rough.