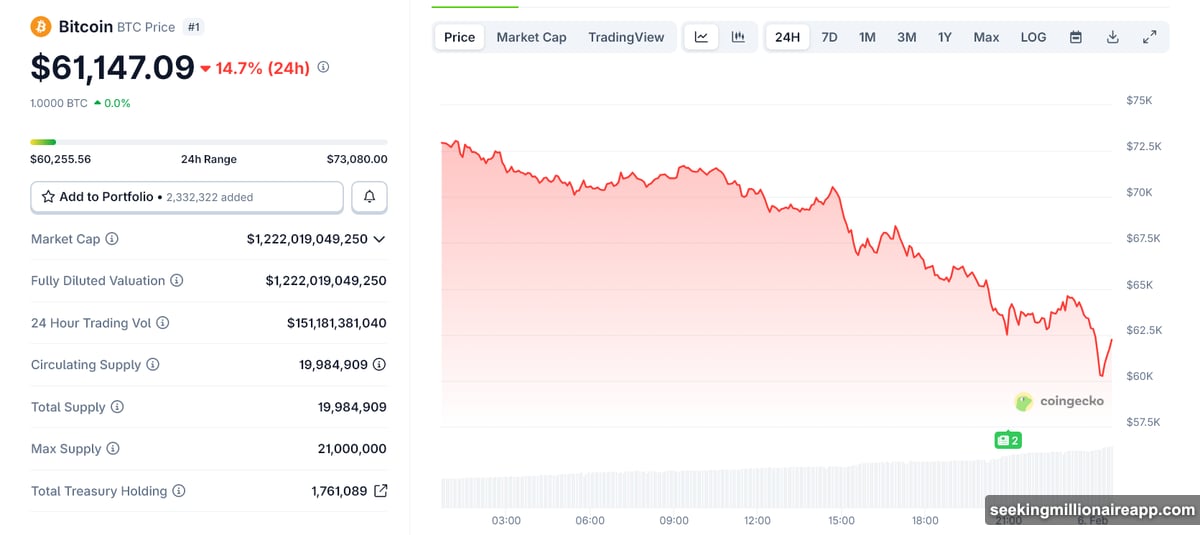

MicroStrategy just lost its superpower. Bitcoin’s drop below $60,000 didn’t just hurt the company’s balance sheet. It killed the premium that made its entire strategy work.

The numbers tell a brutal story. Strategy holds 713,500 Bitcoin at an average cost of $76,000 per coin. That’s a 21% loss on paper. But the real damage runs deeper than unrealized losses.

For the first time in years, the stock trades below the value of its Bitcoin holdings. That changes everything.

The Premium Vanished Overnight

MicroStrategy’s market net asset value collapsed to 0.87x. Translation? The stock is worth less than the Bitcoin sitting on its balance sheet.

This matters because Strategy built its empire on selling shares at a premium. The company raised $18.6 billion over two years by convincing investors to pay extra for Bitcoin exposure wrapped in equity. That premium funded more Bitcoin purchases without diluting existing shareholders.

Now the premium is gone. Issuing new shares at current prices would dilute holders instead of enriching them. So the growth engine just stalled.

Plus, this isn’t a minor technical issue. It’s a complete breakdown of the business model. Without the ability to raise capital efficiently, MicroStrategy can’t execute its core strategy of accumulating more Bitcoin.

Michael Saylor’s Math Stops Working

Strategy’s playbook looked brilliant during bull markets. Buy Bitcoin with cheap capital. Watch the stock price rise faster than Bitcoin itself. Use the premium to buy more Bitcoin. Repeat.

But that flywheel only spins one direction. It requires Bitcoin to trend up and investors to believe the premium is justified.

Right now, neither condition holds. Bitcoin fell from $109,000 to $60,000 in weeks. The 45% crash erased any narrative about inevitable appreciation. Meanwhile, investors who paid premium prices for Strategy shares now own something trading at a discount to underlying assets.

The trust broke. Rebuilding it takes time, sustained Bitcoin strength, and probably some luck. None of those arrive on demand.

Short-Term Survival Isn’t the Problem

Let’s be clear about what this isn’t. MicroStrategy doesn’t face immediate solvency risk.

The company structured its debt with long maturities. No margin calls trigger at $60,000 Bitcoin. No forced liquidations loom. Strategy raised billions when conditions were favorable, giving it breathing room now.

Moreover, unrealized losses don’t create cash flow problems by themselves. MicroStrategy can hold Bitcoin indefinitely without selling. The company’s software business still generates revenue, though nobody pays much attention to it anymore.

So Strategy survives this week, this month, probably this quarter. Survival buys time. But it doesn’t fix the broken model.

The Real Danger Lives in Extended Weakness

Catastrophic risk emerges if Bitcoin stays depressed for months. Several dominoes would fall in sequence.

First, the mNAV discount persists or widens. Investors lose faith that Strategy will ever trade at a premium again. The stock becomes just a worse way to own Bitcoin compared to spot ETFs.

Second, debt refinancing gets expensive. When maturities eventually arrive, Strategy faces higher rates or worse terms. Lenders price in the risk that Bitcoin could stay weak.

Third, dilution becomes unavoidable. If Strategy needs capital and can’t issue equity efficiently, it either takes on more expensive debt or issues shares at terrible prices. Either choice damages existing shareholders.

Finally, sentiment spirals. As confidence erodes, the discount widens further. That makes capital raising even harder. The vicious cycle feeds itself.

None of this happens overnight. But each week of Bitcoin weakness makes the next step more likely.

Strategy Moved From Offense to Defense

MicroStrategy spent two years in expansion mode. Aggressive capital raises. Bold Bitcoin accumulation. Confident public messaging from Saylor about long-term conviction.

That phase ended. Now the company sits in defensive mode, hoping Bitcoin recovers before the balance sheet pressure intensifies.

The margin for error disappeared. Strategy can’t afford another 20% drop in Bitcoin without triggering more serious discussions about risk management. It can’t issue equity without hurting shareholders. It can’t easily refinance debt at attractive terms.

Every strategic option got worse this week. The company went from having multiple paths forward to hoping for one specific outcome: Bitcoin rebounds soon and stays up.

Saylor Bet Everything on One Direction

Here’s what bothers me most. MicroStrategy didn’t just buy Bitcoin. It leveraged Bitcoin with debt and equity capital, creating a structure that amplifies both gains and losses.

That works brilliantly when Bitcoin rises. It creates spectacular wealth and validates the thesis. But leverage cuts both ways.

Saylor built a company that can’t easily adapt if the Bitcoin thesis takes years instead of months to play out. The model demands continuous upward momentum. Without it, Strategy faces mounting pressure with limited tools to respond.

This isn’t a criticism of holding Bitcoin long-term. It’s a question about leverage, timing, and risk management. Strategy positioned itself as the ultimate Bitcoin maximalist at the corporate level. That conviction might still prove correct. But the path from here to vindication got much harder.

Bitcoin could recover tomorrow. It could hit new all-time highs this year. But if it doesn’t, MicroStrategy faces the most challenging period since adopting its Bitcoin strategy.

The company survived the crash to $60,000. Whether it thrives again depends entirely on what Bitcoin does next.