Leverage just died a brutal death. Over $2.6 billion vanished in 24 hours as Bitcoin plunged below key support levels.

But here’s the twist. Several analysts believe this washout might actually signal the beginning of a recovery. Not tomorrow. Not next week. But capitulation events like this often mark turning points.

Let’s break down what just happened and why some seasoned traders are getting quietly optimistic.

Forced Liquidations Hit Historic Levels

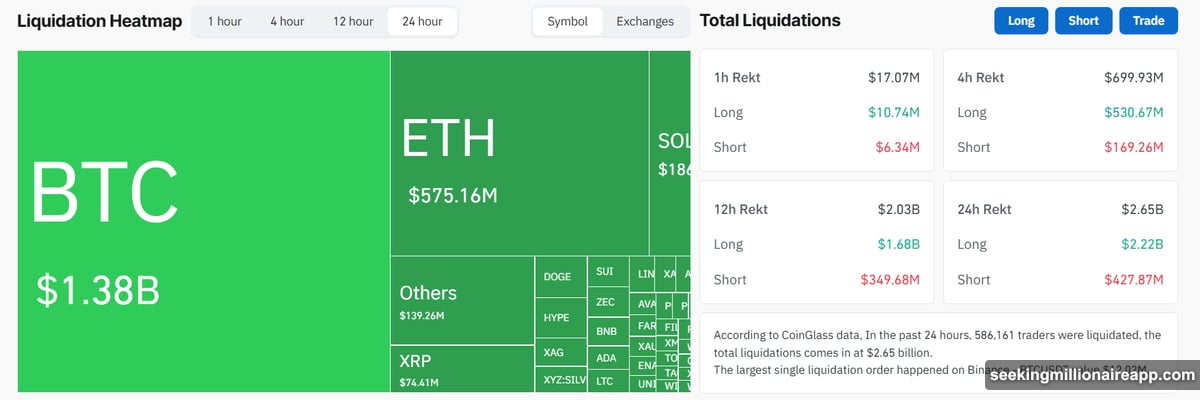

CoinGlass data shows $2.65 billion in liquidations across crypto markets in just 24 hours. Long positions got absolutely crushed, accounting for over $2.2 billion of that total.

Moreover, 586,053 traders got liquidated. That’s more than half a million positions wiped out in a single day. The carnage reached levels not seen since the FTX collapse in 2022.

In fact, this liquidation event now ranks among the Top 10 largest on record. The January 31 event saw $2.56 billion liquidated. So the rankings are shifting as we speak.

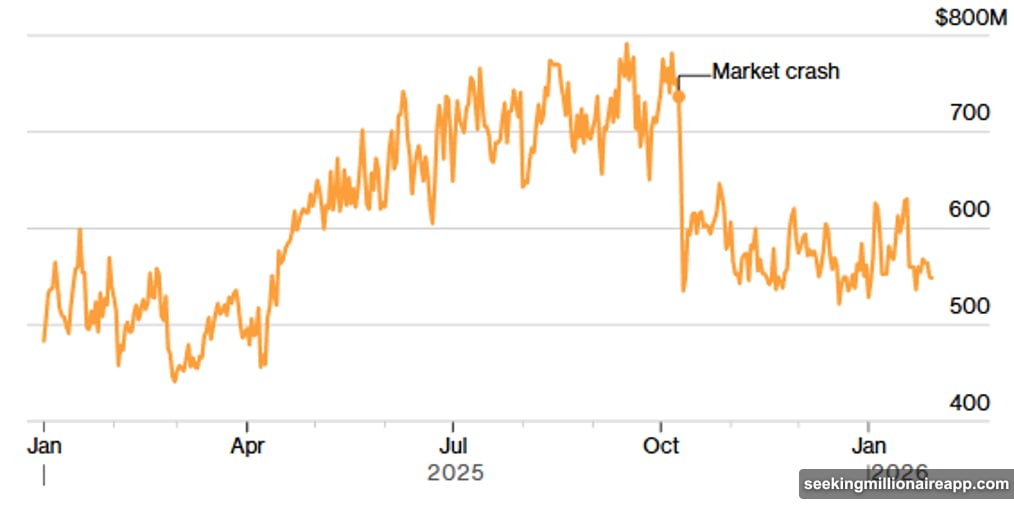

These aren’t random flash crashes. The Kobeissi Letter explained that crypto markets have been bleeding since October. The sector erased $2.2 trillion in market cap—a 50% decline. Plus, Bitcoin wiped out all gains made after Trump’s election victory.

Market Depth Collapsed to 2022 Levels

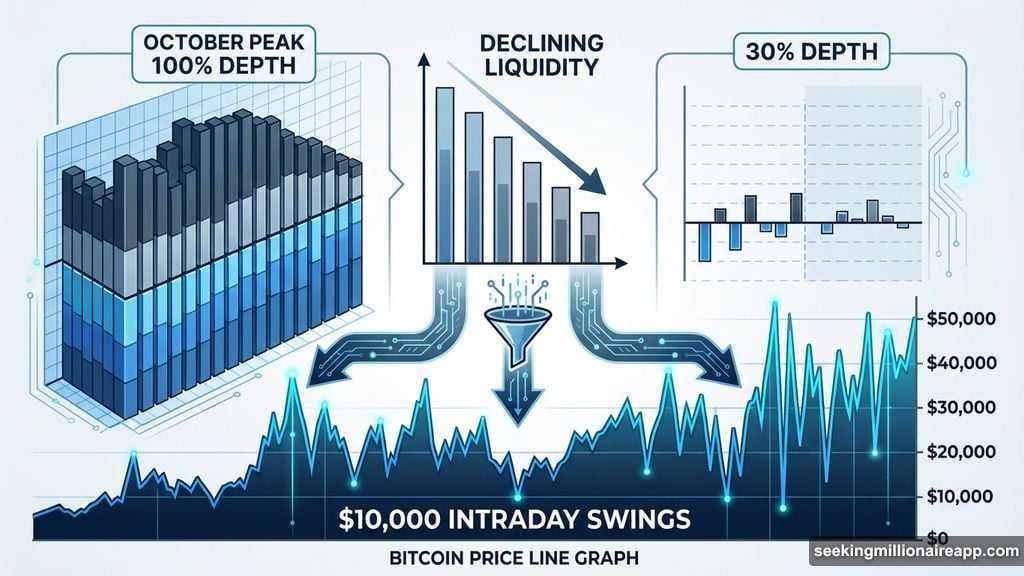

Bitcoin’s intraday swings reached $10,000 recently. Why such violent moves? Market depth completely evaporated.

Current Bitcoin market depth sits at just 30% of its October peak. That means there’s far less liquidity available to absorb large orders. So even modest selling pressure triggers massive price drops.

This mirrors conditions after the FTX collapse. Back then, thin order books caused similar wild swings. Traders who lived through that period recognize the pattern immediately.

The weak liquidity creates a vicious cycle. Liquidations damage sentiment. Poor sentiment triggers more liquidations. Then the cycle repeats, pushing prices lower with each iteration.

Bankruptcy Risk Rising for Crypto Treasuries

Panic selling pushed several crypto company treasuries toward dangerous territory. MicroStrategy’s massive Bitcoin holdings dropped below their cost basis as BTC fell to $60,000.

That creates serious balance-sheet pressure. Companies that borrowed heavily to buy Bitcoin now face margin calls and potential forced selling. So the downward spiral feeds itself.

Veteran analyst Peter Brandt offered a technical perspective using the “Bitcoin Power Law” model. He suggested BTC could find support around $42,000 based on historical patterns.

Brandt argued that if Bitcoin enters this “banana peel” zone—similar to previous bear cycles—the pain probably won’t extend much further. But getting there means more downside from current levels.

Capitulation Signals Point to Opportunity

Despite the bloodbath, some analysts see opportunity forming. Glassnode reported that Bitcoin’s capitulation index recorded its second-largest spike in two years.

This metric tracks supply distribution and measures market stress to identify potential local bottoms. Sharp spikes typically coincide with forced selling and peak volatility.

What happens next? Weak hands exit. Leveraged traders get flushed out. The market resets to healthier conditions. Then higher-conviction investors step in to accumulate spot positions.

Economist Daniel Lacalle noted that “Bitcoin deleveraging may create a strong opportunity soon.” Large-scale liquidations reduce overall market leverage. This shift away from speculation toward accumulation often precedes recovery phases.

Plus, these stress events historically mark major turning points. The 2022 post-FTX bottom formed after similar capitulation. The March 2020 COVID crash saw comparable liquidation levels before Bitcoin rallied 1000%.

Root Causes Run Deeper Than One Bad Day

The Kobeissi Letter identified three structural problems driving this downturn:

Weak liquidity makes markets fragile. Low order book depth amplifies volatility. Small sells create cascading price drops.

Negative sentiment keeps buyers on the sidelines. Fear dominates. Optimism disappeared. Traders expect lower prices, so they wait.

Cascading liquidations create feedback loops. Each wave of forced selling triggers the next. The cycle continues until leverage gets completely flushed from the system.

These factors have been building since October. The recent drop isn’t a surprise crash—it’s the culmination of months of deteriorating market structure.

When Does Recovery Actually Start?

Nobody knows the exact bottom. Not Brandt. Not Glassnode. Not anyone.

But capitulation events like this one reduce systemic risk. Leverage gets wiped out. Weak hands exit. Market structure improves. These conditions historically precede sustained rallies.

However, recoveries take time. The post-FTX bottom took months to establish. Prices chopped sideways while sentiment slowly improved. Then the rally came.

So expecting an immediate V-shaped recovery seems unrealistic. Markets need time to repair after this much damage. Traders need to rebuild confidence. Liquidity needs to return.

Still, veteran investors recognize that major opportunities form during maximum pain. When everyone’s capitulating and liquidations spike to historic levels, that’s often when smart money starts accumulating.

Watch for signs of stabilization. If Bitcoin holds above $42,000 and liquidation volume drops significantly, that might signal the worst is over. But until then, expect more volatility and continued uncertainty.