Ethereum just hit its lowest price since May 2025. The drop is brutal and fast.

ETH fell 29% in one week, breaking below the critical $2,000 support level. Now it’s trading around $1,920, and on-chain data reveals something worse than just a price correction. Investors are actively panic-selling at massive losses.

So what’s driving this collapse? Plus, could a reversal be brewing beneath the surface?

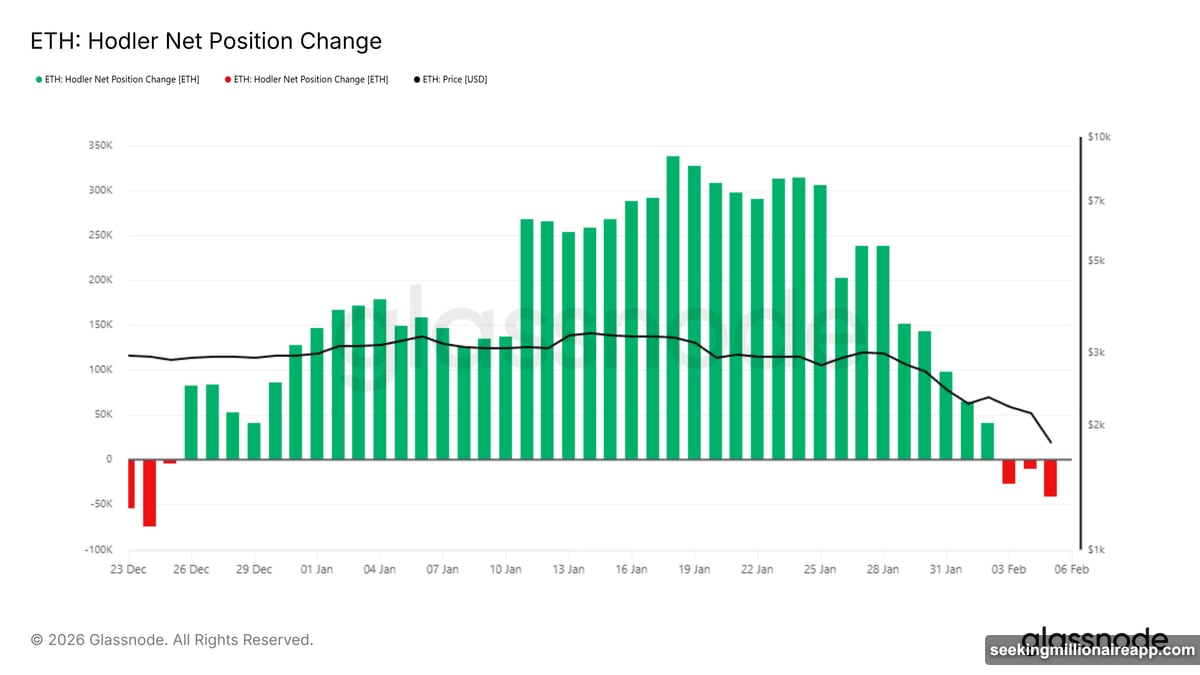

Long-Term Holders Break Their Resolve

Long-term Ethereum holders finally cracked. These are the conviction investors who typically weather market storms without flinching.

But not this time. The HODLer Net Position Change indicator flipped red, showing net outflows from long-term wallets. That’s significant. These holders form the backbone of Ethereum’s price stability.

When they start selling, it signals deep concern spreading through the entire market. Their distribution adds macro-level pressure that amplifies downward momentum. In fact, this behavior suggests the pain might intensify before any meaningful recovery takes hold.

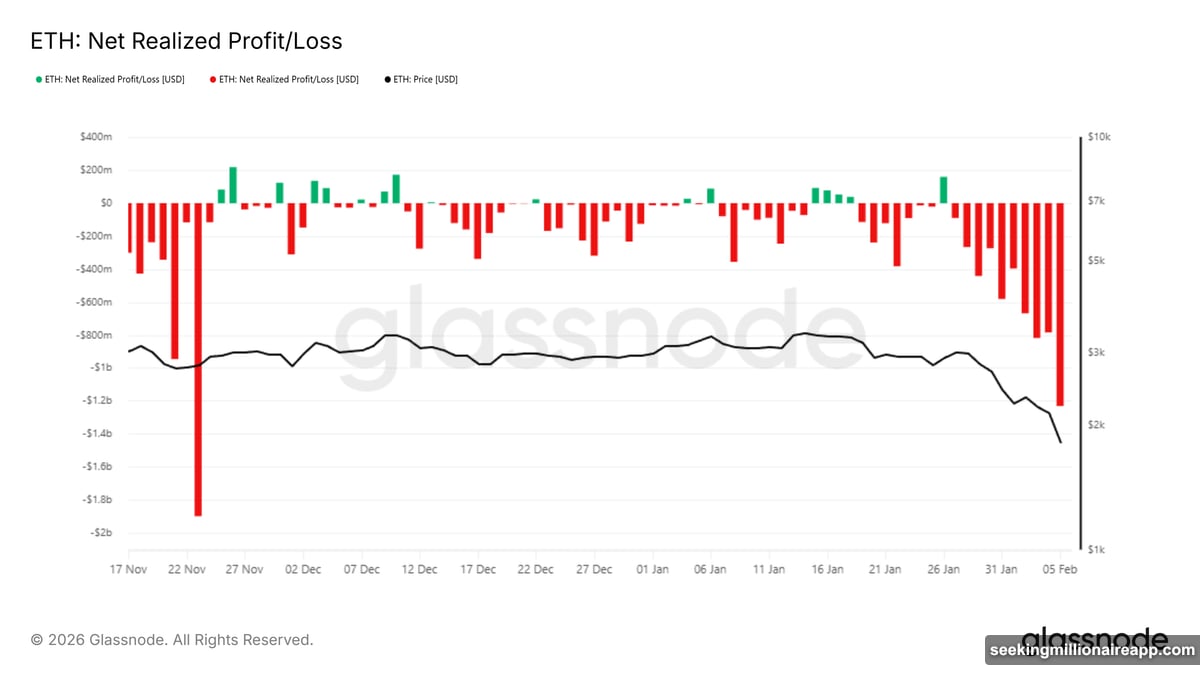

Realized Losses Hit $1.2 Billion in 24 Hours

The selling isn’t just heavy. It’s panicked and underwater.

On-chain data from the Realized Profit/Loss indicator shows investors dumping ETH despite being in the red. Realized losses surged past $1.2 billion within a single day. That’s capitulation territory.

Here’s why this matters. When holders sell at a loss, it creates additional downward pressure on price. Each sale reinforces negative momentum and signals that confidence remains fragile across the network.

Moreover, elevated realized losses typically extend declines rather than end them. The selling won’t stop until investors exhaust their panic or price finds a level where buyers finally step in with conviction.

Money Flow Index Shows Extreme Oversold Conditions

But not everything looks bearish. Some indicators hint at a possible reversal.

The Money Flow Index dropped well below 20.0, indicating selling pressure has likely saturated. Historically, readings this extreme have preceded short-term relief rallies. Markets can’t fall forever, especially when oversold conditions reach extremes.

Plus, Ethereum is currently holding above the $1,796 support level. If this floor holds, oversold conditions could fuel a bounce. However, if $1,796 breaks, ETH could slide toward $1,671 or lower.

That would push Ethereum even deeper into its nine-month low, increasing the risk of further liquidation-driven selling. So the next few days are critical for determining whether ETH stabilizes or collapses further.

What Recovery Would Look Like

A rebound scenario remains possible if selling pressure eases soon. Ethereum could reclaim the $2,000 level, supported by those extreme oversold readings.

If investors refrain from additional panic selling, ETH might gain momentum. Holding supply off exchanges would help. That would signal holders are no longer desperate to exit positions.

Under this scenario, Ethereum could push beyond $2,000 and advance toward $2,500. Securing that move would invalidate the bearish thesis and restore market confidence. But that’s a big “if” given current on-chain signals.

The Risk of Deeper Decline

Meanwhile, the bearish case remains strong. ETH is trading near a nine-month low with weakened buyer support across multiple timeframes.

Given the current on-chain and sentiment indicators, Ethereum remains vulnerable to additional downside in the near term. Long-term holders are selling. Realized losses are spiking. Confidence is fragile.

If the $1,796 support fails, price could accelerate lower. That level represents the next major defense zone. Breaking it would open the door to $1,671 or worse.

So Ethereum is at a critical juncture. The next major move depends on whether selling pressure exhausts itself or intensifies further.

Waiting for Clarity

Ethereum’s 29% crash reveals widespread panic across the market. Long-term holders are selling at losses. On-chain data confirms $1.2 billion in realized losses within 24 hours. Plus, price is testing critical support levels.

Yet oversold conditions suggest a relief rally could materialize if selling pressure subsides. The Money Flow Index sits at extremes rarely seen outside market bottoms. That’s a glimmer of hope.

But hope isn’t strategy. The current structure remains bearish until Ethereum reclaims $2,000 decisively. Until then, risk remains elevated and further downside is possible.

Watch the $1,796 support level closely. Its defense or failure will determine whether Ethereum stabilizes or collapses further into uncharted lows.