Solana just bounced 12% after a brutal drop. But here’s the problem—the buyers who usually rescue SOL during crashes aren’t showing up this time.

The broader crypto market added nearly $200 billion in value this week. That helped Solana stabilize around $88 after briefly touching $67. Aggressive dip buying prevented a total collapse. Yet on-chain data reveals a troubling reality: long-term holders are backing away.

So is this recovery real? Or just another dead cat bounce before more pain?

Long-Term Holders Are Sitting This One Out

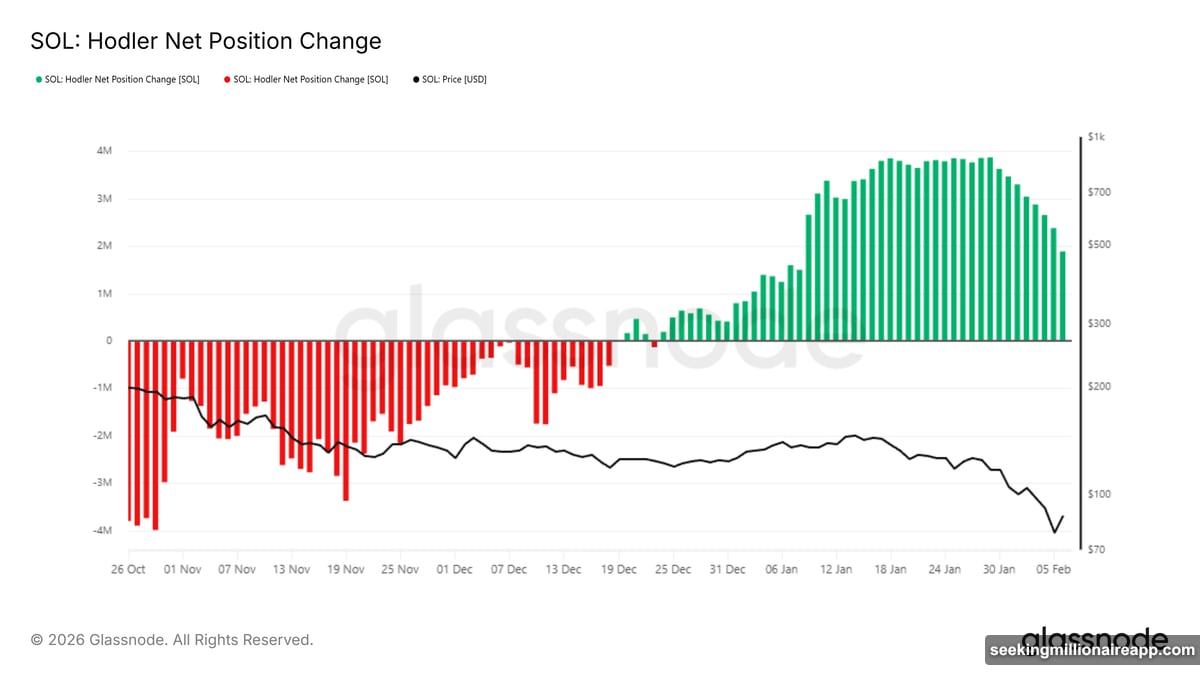

The HODLer Net Position Change dropped sharply this week. That’s a key metric tracking accumulation from investors who typically hold through volatility.

What does this mean? The people who usually support Solana during downturns are no longer buying aggressively. They’re either selling or staying on the sidelines. That’s a major red flag for any sustained recovery.

Here’s why it matters. Long-term holders provide price stability. When they accumulate, they absorb selling pressure and create a floor. But when they step back, short-term traders dominate. That leads to wild swings without durable support levels.

SOL dropped over 13% earlier this week before bouncing. Yet that selloff didn’t trigger the usual accumulation response. Instead, conviction appears to have weakened as prices fell. So without renewed long-term holder interest, any rally risks fading quickly.

Selling Pressure Might Be Running Out of Steam

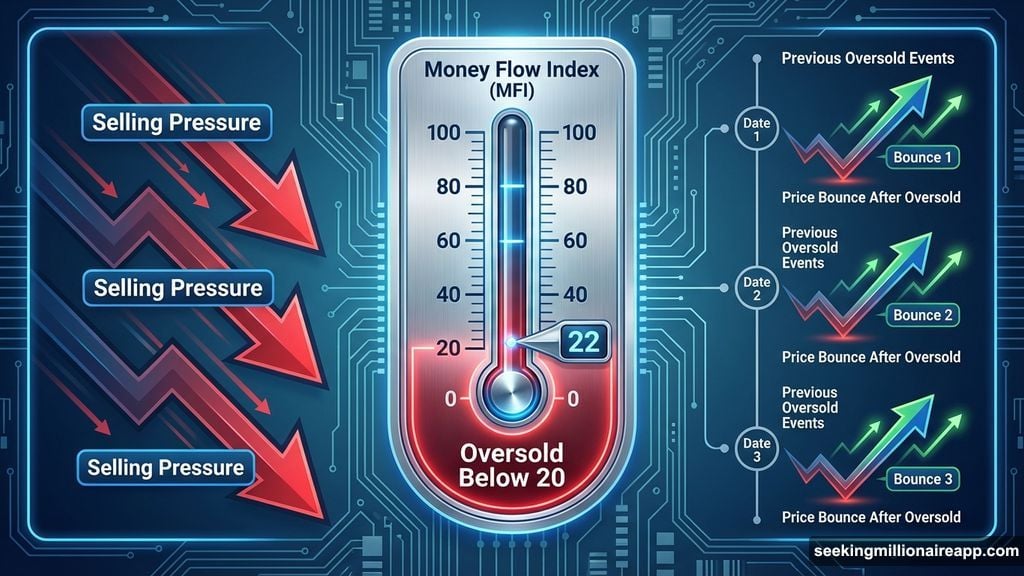

There’s one bullish signal worth watching. The Money Flow Index is approaching oversold territory below 20.0.

What does that indicate? Selling saturation. When this indicator drops into oversold zones, it typically signals that most sellers have already exited. That often precedes stabilization or short-term bounces.

Historically, Solana entered oversold conditions only three times in the past two and a half years. Each instance coincided with price stabilization or reversal. So if the MFI slips further, it could help SOL pause its decline and attract fresh buying interest.

But momentum indicators don’t guarantee recoveries. They just suggest selling exhaustion. For Solana to actually rally, demand needs to return. That means either long-term holders resuming accumulation or new capital flowing in from traders betting on a bounce.

Right now, neither is happening convincingly.

Three Scenarios for What Comes Next

Solana is trading near $88 after climbing 12% today. Strong dip buying prevented a close near the intraday low of $67. That shows demand exists at lower levels, at least for now.

First scenario: Recovery above $100. If SOL pushes past $90 and reclaims $100 as support, momentum could shift bullish. That would open the path toward $110 as confidence returns. But this requires sustained buying from long-term holders, which isn’t happening yet.

Second scenario: Range-bound action near $90. Without fresh accumulation, SOL might consolidate between $85 and $95. This would keep the price stable but fail to build conviction for a breakout. Traders would dominate, leading to choppy conditions without clear direction.

Third scenario: Further decline toward $78. If long-term holder selling continues and support at $88 breaks, SOL could retreat to $78. That would invalidate the bullish thesis and extend the correction. A move to this level would confirm that the bounce was temporary.

The Real Problem: Weak Conviction

Here’s what bothers me about this bounce. Solana recovered 12% in a single day, which sounds impressive. But the underlying support structure is crumbling.

Long-term holders aren’t buying. Momentum indicators suggest selling exhaustion, but that doesn’t mean buyers are rushing in. Instead, it just means sellers are taking a break. There’s a big difference between exhaustion and genuine demand.

Plus, the broader crypto market added $200 billion this week. That should have triggered stronger accumulation across major altcoins. Yet Solana’s on-chain signals remain weak. That disconnect suggests SOL’s bounce is more about short-term technical factors than fundamental strength.

So unless long-term holders return, this recovery risks stalling. The price might stabilize near $90 for a while. But without durable support, any negative catalyst could send SOL back toward recent lows. That’s not the setup for a sustained rally.

Watch the HODLer Net Position Change closely. If accumulation resumes, Solana has a shot at reclaiming $100. But if it stays weak, expect more volatility and limited upside. The next few days will reveal whether this bounce has legs or if it’s just another trap.