Beijing dropped a hammer on crypto this week. Not a warning. Not a consultation. A total ban on stablecoins and real-world asset tokenization for anyone touching Chinese users.

Eight government agencies signed off on February 6. The message? If you’re issuing stablecoins or tokenizing assets outside approved channels, you’re breaking the law. Plus, this isn’t about Bitcoin mining anymore. It’s about controlling every corner of digital finance before it escapes government reach.

The Offshore Loophole Just Closed

Here’s what changed. Previously, Chinese firms could launch crypto products through offshore branches. They’d set up shop in Singapore or Hong Kong. Then they’d quietly serve mainland customers from abroad.

Not anymore. The new rules explicitly ban domestic companies and their foreign subsidiaries from issuing digital currencies without state approval. So that clever workaround? Dead.

Foreign companies got hit too. Any platform offering stablecoin services to Chinese residents now faces penalties. The directive doesn’t care where you’re incorporated. If Chinese citizens can access your product, you’re violating the ban.

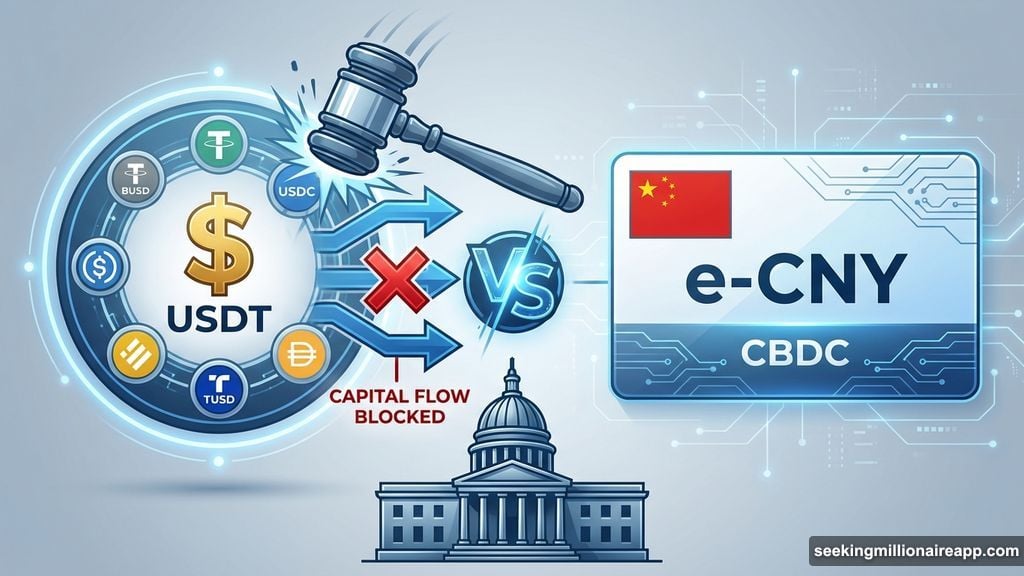

This matters because China’s crypto community has been using offshore platforms for years. Stablecoins like USDT became the bridge between fiat and crypto markets. Now Beijing wants to burn that bridge completely.

Stablecoins Threaten the Digital Yuan

The regulators spelled out their reasoning. Stablecoins carry “attributes of sovereign money.” Translation: private companies shouldn’t create dollar-pegged currencies that compete with state-issued money.

China already launched the e-CNY, its central bank digital currency. But adoption remains sluggish. Meanwhile, stablecoins process billions in daily volume. People trust them more than experimental government coins.

So Beijing took the obvious step. Ban the competition. The directive specifically prohibits Renminbi-pegged stablecoins issued abroad. That eliminates any private alternative to the e-CNY.

Moreover, authorities claim stablecoins bypass anti-money-laundering protocols. They’re not entirely wrong. Stablecoins do make it easier to move money across borders. For a government obsessed with capital controls, that’s an existential threat.

Real-World Assets Get the Axe

The ban doesn’t stop at stablecoins. Real-world asset tokenization got targeted too. The RWA sector hit $24 billion in total value recently. Investors tokenize everything from real estate to securities.

But China just reclassified all of that as illegal. The notice calls unauthorized tokenization “illegal public security offerings” and “unauthorized futures business.” Those are criminal charges, not regulatory slaps.

Here’s the specific language: “Real-world asset tokenization activities within China, as well as providing related intermediary and information technology services… should be prohibited.”

That covers a lot. Tokenizing property? Illegal. Fractionalized ownership of securities? Illegal. Even providing tech services for these activities? Still illegal.

The only exception? Government-approved financial infrastructure. But that means jumping through endless compliance hoops. And getting domestic clearance before doing anything abroad.

Why RWAs Scared Beijing

Real-world asset tokenization threatens China’s financial control in multiple ways. First, it enables capital flight. Wealthy Chinese can tokenize domestic assets and trade them internationally. That circumvents strict currency controls.

Second, tokenization creates parallel financial markets. People can buy fractional ownership in properties or companies without touching traditional banks. Beijing loses visibility into these transactions.

Third, RWAs compete with state-run asset exchanges. China wants all financial activity funneled through regulated platforms. Tokenization allows peer-to-peer transfers that bypass those chokepoints.

So the crackdown makes strategic sense. If the government can’t monitor or tax these transactions, better to ban them entirely.

Enforcement Just Got Serious

Previous crypto bans lacked teeth. Companies found workarounds. Users accessed foreign exchanges through VPNs. The black market thrived.

This time feels different. The directive establishes a “collaborative framework” linking local and national regulators. That means coordinated enforcement across provinces and borders.

The government plans to eliminate regulatory arbitrage. Chinese firms previously used neighboring jurisdictions as testing grounds. They’d launch products in Singapore or the Cayman Islands, then quietly serve mainland customers.

Now any firm pursuing tokenization abroad must meet “heightened compliance standards” and obtain domestic clearance. That’s bureaucracy designed to kill innovation. Few companies will bother jumping through those hoops.

The Digital Yuan Finally Gets Protection

Let’s be honest about what’s happening here. China wants digital finance to exist exclusively within state-controlled systems. The e-CNY hasn’t gained traction because people don’t trust it. They prefer stablecoins backed by actual reserves.

So instead of improving the digital yuan, Beijing banned the alternatives. Classic protectionism. But it might backfire.

Chinese crypto users won’t suddenly embrace the e-CNY just because stablecoins are illegal. They’ll find new ways to access foreign platforms. VPN usage will spike. Peer-to-peer trading will move deeper underground.

Meanwhile, China’s blockchain developers will leave for friendlier jurisdictions. Singapore, Dubai, and Hong Kong are already rolling out the welcome mat. The brain drain accelerates.

What This Means for Global Crypto

China’s actions ripple beyond its borders. The stablecoin market just lost potential access to 1.4 billion people. That’s significant even if most couldn’t access these platforms anyway.

More importantly, other authoritarian governments are watching. If China successfully enforces this ban, expect similar crackdowns in Russia, Turkey, and other nations obsessed with capital controls.

On the flip side, this strengthens the case for decentralized stablecoins. USDC and USDT remain vulnerable because they’re issued by centralized companies. But algorithmic stablecoins or fully decentralized alternatives could resist government pressure better.

The RWA sector faces bigger challenges. Tokenizing real-world assets requires legal bridges to traditional finance. Those bridges rely on regulatory cooperation. If major economies start banning tokenization, the entire model collapses.

The Narrow Path Forward

The directive does leave one small opening. Activities on “government-approved financial infrastructure” remain legal. But what does that mean in practice?

Probably not much. State-approved blockchain platforms operate under strict oversight. They’re permissioned networks where the government controls validator nodes. That defeats the entire purpose of blockchain technology.

Plus, any firm operating in this space must obtain “domestic clearance” before expanding abroad. Good luck getting approval for anything innovative or competitive with state interests.

So the “narrow path” is really just a token gesture. Beijing wants to look reasonable while effectively shutting down the entire crypto ecosystem.

China Chose Control Over Innovation

This ban reflects a fundamental choice. Beijing values financial control over technological innovation. They see crypto as a threat to monetary sovereignty, not as a tool for financial inclusion or efficiency.

You can debate whether that’s the right choice. But the direction is clear. China won’t be a player in the next generation of digital finance unless it happens entirely within state-controlled infrastructure.

For the global crypto industry, that’s both a loss and an opportunity. A loss because China’s vast market and technical talent are now largely off-limits. An opportunity because other nations can position themselves as crypto-friendly alternatives and attract the capital and brainpower fleeing China.

The question isn’t whether Beijing can enforce this ban. It’s whether the rest of the world follows China’s lead or takes the opposite path.