Bitcoin just bounced off $60,000 like it hit a trampoline. But that recovery? It’s not what it seems.

The numbers tell a different story. Hidden metrics reveal this bounce is probably temporary. Plus, the market shows classic bear patterns that haven’t finished playing out yet.

So where does Bitcoin go from here? Let’s break down what the data actually shows.

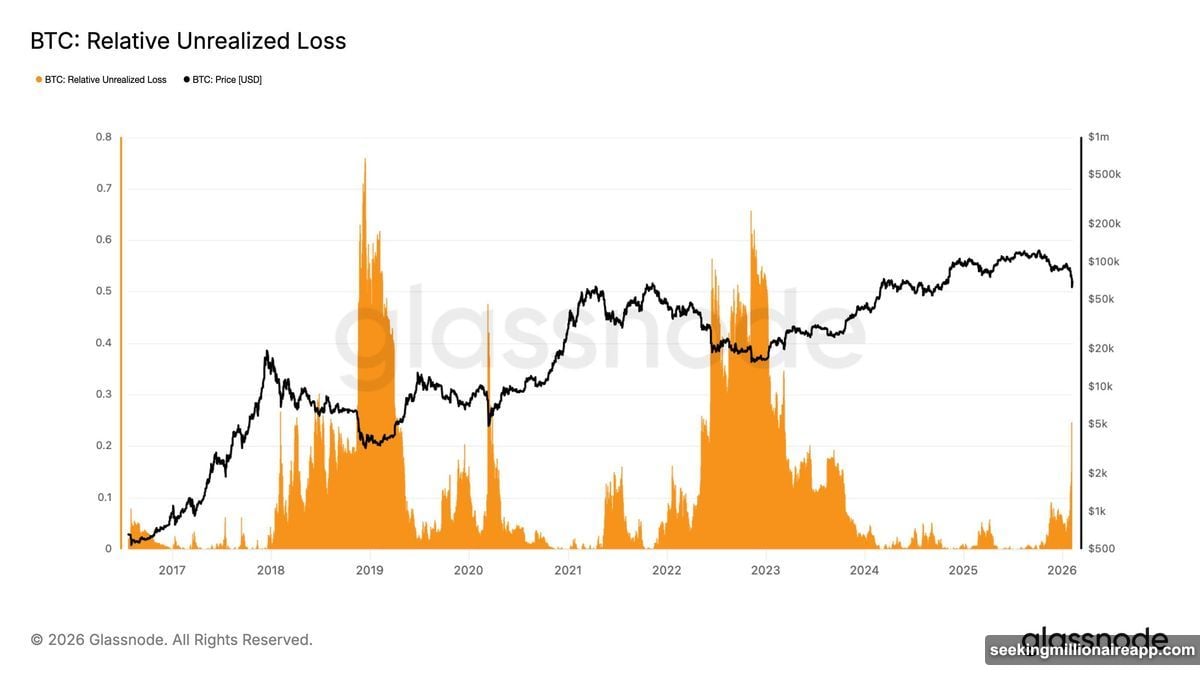

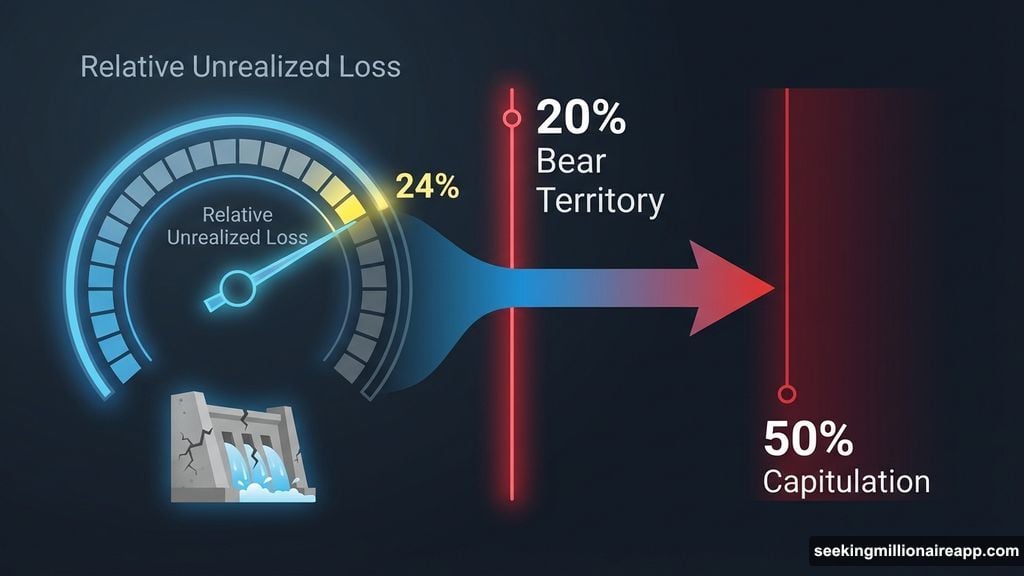

Loss Levels Hit Bear Territory

Bitcoin’s Relative Unrealized Loss just spiked to 24%. That’s a big deal.

This metric measures how many coins are underwater compared to total market value. Anything above 20% signals bear market conditions. Bitcoin sailed past that threshold during the recent crash.

However, it hasn’t hit extreme panic levels yet. True capitulation happens above 50%, where sellers give up completely. Right now, we’re at 24%. That means selling pressure is intense but not exhausted.

Think of it like a dam with cracks spreading. Water’s leaking through, but the structure hasn’t collapsed. More pressure could push Bitcoin lower before this phase ends.

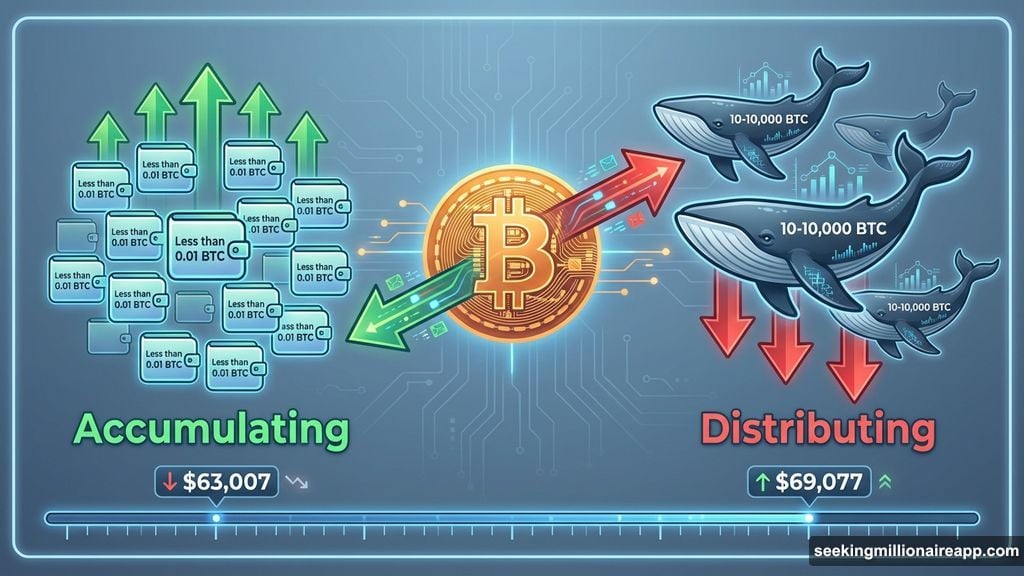

Small Fish Buy While Big Whales Sell

Here’s where things get interesting. Wallets holding less than 0.01 BTC keep accumulating. These tiny retail investors are buying the dip aggressively.

Meanwhile, larger wallets between 10 and 10,000 BTC are quietly distributing. They’re selling into this bounce, taking profits while retail provides exit liquidity.

Social media tells another story. Platforms overflow with bearish sentiment. Yet these same fearful traders are actually buying. The disconnect is striking.

Normally, true bottoms require retail capitulation. Small holders need to stop accumulating and start panic selling. Until that happens, rebounds face natural resistance from larger holders taking advantage of temporary strength.

Fresh Wallets Flood the Network

Despite the crash, new Bitcoin addresses surged 37% this past week. That’s thousands of first-time users entering the ecosystem.

New participants typically show up during volatility. They see lower prices and jump in, hoping to catch the bottom early. This influx demonstrates continued belief in Bitcoin’s long-term value.

Yet new users alone can’t stop a bear market. Their capital helps cushion drops but rarely reverses major trends. If broader market conditions deteriorate, even strong network growth struggles to prevent further declines.

Support Zones Face Critical Tests

Bitcoin trades near $69,077 right now after defending $63,007 during the crash. Buyers stepped in aggressively at that level, preventing a slide to $60,000.

That defense matters. It shows demand exists at lower prices. But it doesn’t guarantee recovery.

The broader setup suggests Bitcoin could break down again soon. Losing $63,007 support would trigger another leg down. The next major level sits at $55,500, where historical support clusters.

For bulls, reclaiming $71,672 becomes critical. Bitcoin needs to flip that resistance into support and hold it. Only then does the immediate bearish structure weaken.

The Bounce Looks Fragile

This recovery attempt shows cracks everywhere you look. Large holders distribute while small holders accumulate. Social sentiment screams bearish while wallets quietly add exposure. New users flood in as prices crash.

These contradictions suggest the market hasn’t found equilibrium yet. Real bottoms typically show clearer capitulation. Retail stops buying. Sentiment turns truly desperate. Large holders start accumulating instead of selling.

We’re not there yet. Instead, we’re watching a messy consolidation inside a broader downtrend. Short-term bounces happen in bear markets. They feel like reversals until they aren’t.

Bitcoin could chop around current levels for weeks. Or it could break $63,007 and cascade toward $55,500. The data leans bearish until proven otherwise.

Watch What Happens at $63,000

Right now, everything hinges on that $63,007 level. Bitcoin defended it once. Can it hold if tested again?

Smart money is distributing into strength. New buyers provide temporary support. But if macro conditions worsen, even aggressive dip buying may not prevent deeper losses.

The bear market isn’t over. It’s just taking a breather. And those pauses? They’re exactly when traders get caught believing recovery arrived too soon.

Stay cautious. Watch support levels closely. And remember that bear markets always look better right before they get worse.