Bitcoin just had its worst day since FTX collapsed. And no, it wasn’t retail panic selling or some quantum computing scare.

Arthur Hayes, BitMEX’s co-founder, thinks institutional dealer hedging is the real culprit. Meanwhile, Pantera Capital’s Franklin Bi points to a distressed Asian entity unwinding leveraged positions. Together, these theories reveal something bigger: Bitcoin’s volatility isn’t about retail sentiment anymore. It’s about complex institutional trading strategies that most people don’t even know exist.

The ETF Note Problem Nobody Saw Coming

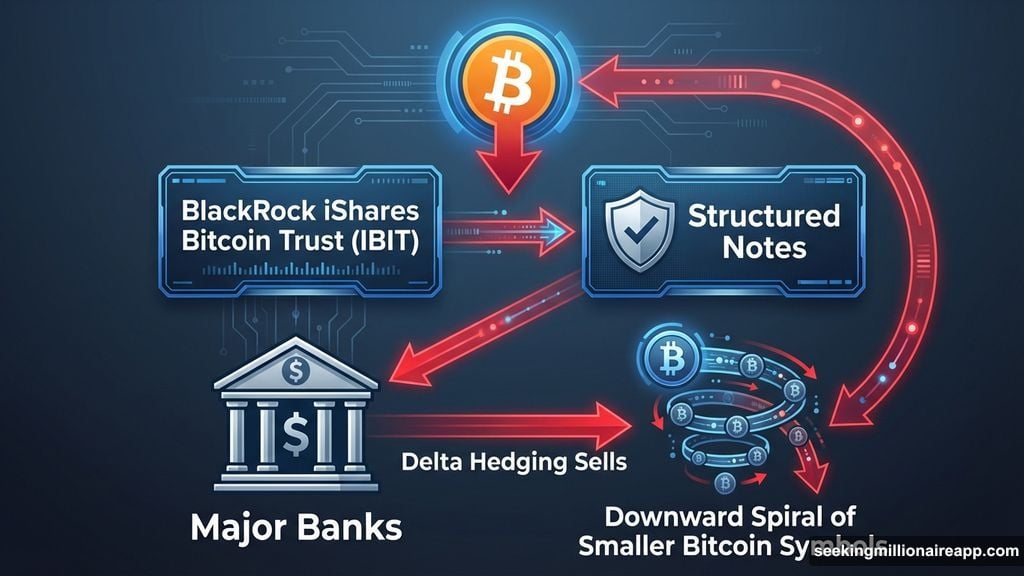

Hayes zeroed in on structured financial products tied to BlackRock’s iShares Bitcoin Trust (IBIT). These notes let big institutions get Bitcoin exposure without actually buying Bitcoin directly.

Sounds simple enough. But there’s a catch.

Major banks issue these structured notes with built-in safety features. Think principal-protection levels that trigger when prices drop too far. When Bitcoin dips below these predetermined thresholds, dealers must sell the underlying asset to stay risk-neutral.

Finance pros call this delta hedging. In traditional equity markets, it’s standard practice. But in crypto? It creates a vicious feedback loop where selling triggers more selling.

Here’s why that matters. As Bitcoin’s price falls, dealers dump more Bitcoin to manage risk. That selling pushes prices lower. Which triggers more hedging. Which causes more selling. And so on.

Hayes put it bluntly: these derivatives don’t cause market moves, but they absolutely amplify them in both directions. So when Bitcoin drops, the cascade gets much steeper much faster than it would from organic selling alone.

The Hidden Asian Player Theory

Franklin Bi from Pantera Capital has a different take. He thinks a large, distressed non-crypto entity drove the crash.

This player wasn’t your typical crypto fund. According to Bi, it was likely an Asia-based institution that flew under the radar precisely because it had no deep ties to crypto-native counterparties. Market watchers simply didn’t see it coming.

Bi’s theory gets more specific. The entity was probably running leveraged market-making strategies on Binance, funded by the Japanese yen carry trade. That’s when traders borrow cheap yen at low interest rates to invest in higher-yielding assets elsewhere.

When that trade unwinds—whether from sudden margin calls or shifting currency dynamics—the entity must liquidate positions fast. And in Bitcoin’s case, that means massive sell pressure hitting the market all at once.

Plus, this wasn’t gradual deleveraging. It was forced, urgent selling that compounded Bitcoin’s downward spiral during an already volatile period.

Why Hayes Isn’t Calling It a Conspiracy

Hayes was quick to clarify one thing: there’s no “secret plot” to crash the crypto market.

Instead, he argues these mechanisms are simply how modern financial markets operate. Structured derivatives exist to provide exposure while managing risk. Delta hedging is a standard practice across asset classes.

The problem? Bitcoin’s relatively smaller market size compared to traditional assets means these hedging activities have outsized effects. What might barely register in the $50 trillion equity market creates violent swings in the $1 trillion crypto market.

Hayes even expressed gratitude for the absence of bailouts. Why? Because without government intervention, overleveraged positions unwind naturally. The market clears out “tourists” who took on too much risk, and then resumes its upward trajectory.

So while the mechanics might seem sinister, Hayes sees them as neutral forces that simply amplify whatever direction the market is already moving. The real issue is that Bitcoin’s infrastructure now includes institutional players using tools that weren’t built with crypto’s volatility in mind.

The Bigger Picture: Institutions Changed Everything

These two theories—Hayes’ dealer hedging and Bi’s distressed entity—point to a fundamental shift in Bitcoin’s market structure.

Retail sentiment used to dominate. Reddit threads, Twitter hype, and FOMO drove price action. Now? Complex institutional strategies, margin calls, and risk-management protocols play a much bigger role.

That’s not necessarily bad. Institutional participation brings liquidity, legitimacy, and long-term stability. But it also imports traditional finance’s complexity—and its vulnerabilities.

For instance, the yen carry trade has nothing to do with Bitcoin fundamentally. Yet when it unwinds, Bitcoin crashes. Similarly, dealer hedging tied to ETF notes creates sell pressure completely divorced from Bitcoin’s actual utility or adoption.

So Bitcoin’s price now reflects not just demand from believers and speculators, but also the mechanical adjustments of risk desks halfway around the world. And most retail investors have no idea these forces even exist.

What This Means for Bitcoin Traders

If you’re trading Bitcoin in 2026, you need to think beyond technical analysis and on-chain metrics. Institutional flows matter now. A lot.

Watch for signs of structured product issuance tied to Bitcoin ETFs. Hayes mentioned he’s compiling a list of these notes to identify trigger points that could cause rapid price moves. That kind of intel could help traders anticipate when cascading hedging might kick in.

Also, pay attention to currency markets. If the yen carry trade shows signs of stress, Bitcoin could face selling pressure even if crypto fundamentals look strong. These macro linkages didn’t exist a few years ago. Now they’re critical.

Finally, understand that volatility cuts both ways. Hayes pointed out that these amplification mechanisms work on the upside too. When Bitcoin rallies, dealer hedging can accelerate gains just as violently as it deepens crashes.

So the new Bitcoin isn’t just about hodling through dips. It’s about understanding the invisible institutional machinery that now drives price action—and positioning accordingly.

Bitcoin’s volatility isn’t going away. But the forces behind it have evolved far beyond retail panic and whale manipulation. Institutional trading strategies, risk management protocols, and global currency dynamics now shape Bitcoin’s price in ways most traders never see. Hayes and Bi just pulled back the curtain. Now it’s up to you to trade accordingly.