The crypto market just added $30 billion in 24 hours. Bitcoin crossed $70,000 again. And traders finally exhaled after a brutal week.

But this bounce isn’t guaranteed to stick. Markets stabilized over the weekend, yet capital inflows remain weak. So the real question isn’t why prices rose. It’s whether they’ll keep rising or collapse back down.

Let’s break down what moved markets and what comes next.

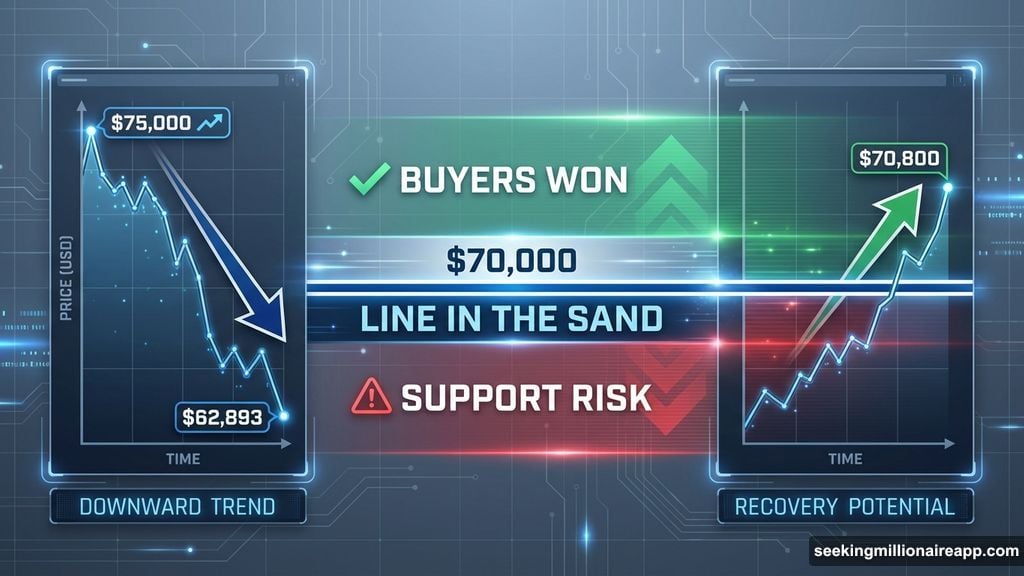

Bitcoin Finally Held $70,000

Bitcoin is trading near $70,800 right now. That matters because $70,000 became the line in the sand for bulls.

Price spent the past week whipsawing around this level. Sellers kept pushing it lower. Buyers kept defending support. This weekend, buyers won temporarily.

However, holding $70,000 once doesn’t guarantee anything. Bitcoin needs sustained demand to push higher. The immediate target sits at $75,000. But reaching that level requires more than weekend stability.

Momentum remains fragile. Capital hasn’t flooded back into crypto yet. Without stronger buying pressure, Bitcoin risks sliding back below $70,000. If that happens, price could fall toward $62,893. That would erase this entire bounce and invalidate the recovery attempt.

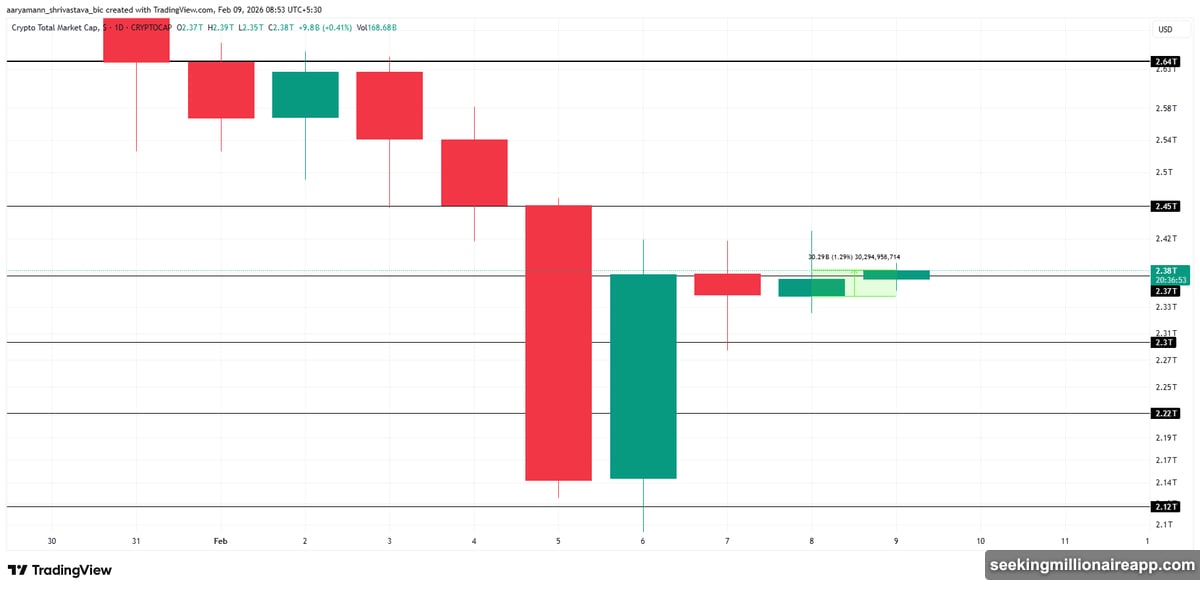

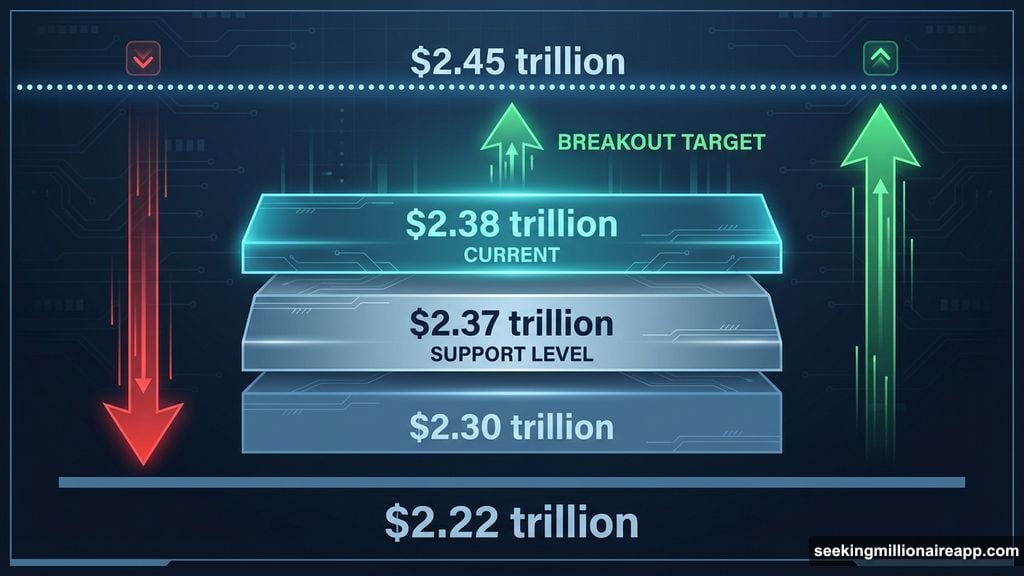

Total Crypto Market Cap Stabilized Above Key Support

The total crypto market cap hit $2.38 trillion. That’s up from $2.35 trillion just 24 hours earlier.

Markets are now consolidating above the $2.37 trillion support level. This suggests buyers and sellers reached temporary equilibrium after last week’s chaos. Volatility dropped significantly over the weekend.

Sustained low volatility is critical for further gains. If stability continues, the market could attempt breaking above $2.45 trillion. That would signal renewed confidence and support broader recovery across digital assets.

But downside risk hasn’t disappeared. If selling pressure returns, the total market cap could drop back toward $2.30 trillion. Worse conditions might push it down to $2.22 trillion. That would erase recent gains and delay any meaningful recovery for weeks.

STABLE Stabilized After 43% Crash

STABLE is trading near $0.0186 right now. The altcoin crashed 43% over the past week before finally finding support at $0.0165.

Price is sitting just below the $0.0189 resistance level. Breaking above that barrier would improve momentum significantly. The next upside target stands at $0.0225 if buyers can push through resistance.

Yet buying pressure remains weak across altcoins. Most traders are still licking their wounds from last week’s losses. Without stronger demand, STABLE could slip back below the $0.0165 support.

If that happens, price would likely fall toward $0.0140. That would invalidate the bullish recovery thesis and extend the current downtrend even further.

DeFi Drama and Vitalik’s Framework

Vitalik Buterin criticized most of today’s DeFi as superficial this weekend. He argued that many yield strategies prioritize speculation over real decentralization.

His comments sparked debate across crypto Twitter. Buterin outlined a framework for “real” DeFi. He highlighted overcollateralized stablecoins and risk-minimizing algorithmic designs as genuinely decentralized use cases.

Meanwhile, analyst c-node echoed similar concerns about superficial DeFi projects. Both emphasized that true decentralization requires more than high APYs and flashy marketing.

This debate matters because it shapes how serious investors evaluate DeFi projects going forward. Expect more scrutiny on whether protocols actually deliver decentralization or just gamify speculation.

BitMine Bought 20,000 ETH on the Dip

BitMine acquired roughly 20,000 ETH for $41.98 million this weekend. The firm took advantage of recent market volatility to expand its Ethereum treasury.

This purchase brings BitMine closer to holding 5% of ETH’s circulating supply. Current holdings exceed 4.29 million ETH. That’s a massive bet on Ethereum’s long-term value.

Strategic accumulation during market downturns suggests institutional confidence hasn’t evaporated. However, one firm buying doesn’t create a trend. Broader institutional participation remains muted for now.

What Happens Next Depends on Volatility

Markets stabilized over the weekend. But stability doesn’t guarantee recovery.

Bitcoin needs to break above $75,000 with conviction. The total crypto market cap needs to push past $2.45 trillion. Altcoins like STABLE need sustained buying pressure to confirm upside momentum.

None of that is guaranteed. If volatility returns and selling pressure increases, recent gains will evaporate quickly. Support levels at $70,000 for Bitcoin and $2.37 trillion for the total market cap will be tested again.

So watch volatility closely. Low volatility favors bulls. High volatility favors chaos. Right now, we’re in a brief calm period. Enjoy it while it lasts. Because crypto markets rarely stay calm for long.