The crypto market tanked more than 20% this year. Now traders face a tough question: is this the bottom, or does the bear market have more room to fall?

Santiment just shared five concrete signals that help answer that question. These aren’t gut feelings or vague technical indicators. Instead, they combine sentiment analysis with on-chain data to spot when fear peaks and reversals become likely.

Let’s break down what actually works when timing crypto dips.

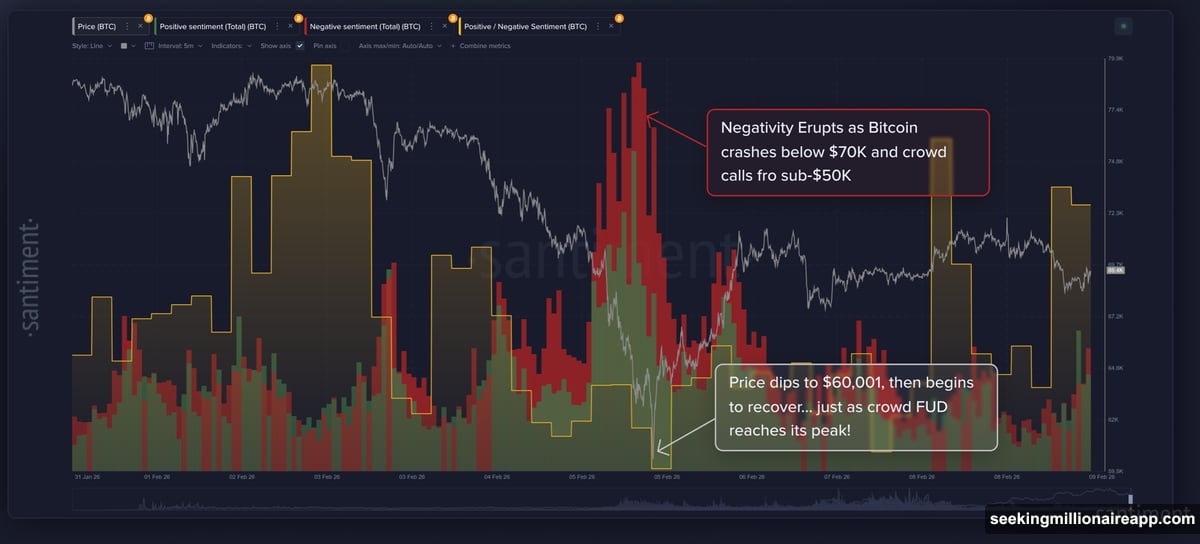

Extreme Fear Shows Up Before Rebounds

Social sentiment acts like a market thermometer. When negative commentary spikes hard across crypto Twitter, Reddit, and forums, prices often sit near local bottoms.

Santiment tracks the balance between pessimistic and optimistic language tied to specific coins. Sharp increases in fear, uncertainty, and doubt consistently precede market bounces.

Bitcoin proved this pattern recently. After bottoming at $60,001 last Thursday, it rebounded 19% in under 24 hours. The surge came right after FUD dominated social feeds.

Here’s why this matters. Retail traders panic during steep drops. They flood social media with doom predictions. But by the time everyone expects further crashes, the worst selling pressure often already passed.

So extreme negativity becomes a contrarian buy signal. When predictions of crypto’s death multiply, that’s usually the exact moment to consider buying.

Watch for Language Shifts From “Dip” to “Crash”

Mentions of “buying the dip” increase during every selloff. But Santiment warns this metric alone doesn’t work reliably.

Markets frequently rebound before retail traders fully capitulate. In fact, prices often bottom while retail investors still search for better entry points.

The real signal comes from language escalation. When discussions shift from calling it a “dip” to labeling it a “crash,” fear-driven capitulation intensifies.

This catastrophic language suggests retail confidence broke completely. Traders who bought earlier dips now regret those decisions. New buyers hesitate because they fear catching a falling knife.

That moment of peak despair often marks opportunity. Not certainty, but probability shifts in your favor when language turns apocalyptic.

Bearish Keywords Cluster at Bottoms

Santiment also tracks trending bearish keywords like “selling,” “down,” or narratives claiming assets are “going to $0.”

These phrases emerge when retail traders lose hope entirely. They stop looking for rebounds and start accepting permanent losses.

For example, mentions of “selling” spike when holders decide to exit positions regardless of price. Similarly, doomsday predictions about worthless coins flood forums during capitulation phases.

However, this metric works best combined with other signals. Bearish keyword clusters confirm that sentiment reached extremes, but they don’t guarantee immediate reversals.

Markets can stay irrational longer than traders expect. Plus, some bear markets genuinely continue falling even after sentiment bottoms.

The MVRV Ratio Spots Underwater Buyers

On-chain metrics add objectivity to sentiment analysis. Santiment highlights the 30-day Market Value to Realized Value ratio as particularly useful.

MVRV measures whether recently active wallets are, on average, in profit or loss. When MVRV enters the “strongly undervalued” zone, recent buyers are deeply underwater.

This condition often precedes rebounds. Why? Because late buyers who entered at higher prices now sit on painful losses. Many eventually capitulate and sell.

Once that final wave of selling exhausts itself, supply pressure eases. New buyers can enter without immediately facing overhead resistance from underwater holders trying to break even.

Santiment notes that traders should avoid heavy investment when MVRV sits in the “strongly overvalued” zone. Conversely, buying below the “strongly undervalued” threshold historically provided good upside.

Still, MVRV doesn’t work in isolation. It confirms other signals rather than serving as a standalone timing tool.

Context Determines What Counts as a Dip

Defining a “dip” depends entirely on your trading timeframe. A 1.7% move might matter for hourly swing traders. But most investors operate on weekly cycles.

Santiment emphasizes using objective data instead of intuition or “anecdotal things.” This approach offers clearer insight into when fear-driven selloffs near exhaustion.

However, buying decisions ultimately come down to individual risk tolerance and strategy. These signals help identify periods of heightened fear and potential opportunity. But they don’t guarantee rebounds will follow.

Many analysts suggest the broader bear market still has room to run. Prices could remain under pressure for months. So decisions to buy or hold should account for opportunity costs and personal circumstances.

The Real Risk Nobody Mentions

Here’s what bugs me about dip-buying strategies. They work great in hindsight. Every chart shows obvious entry points after the fact.

But in real-time, during actual fear cycles, these signals feel unreliable. Your portfolio bleeds red. Social media screams about crashes. And you’re supposed to buy more?

That’s psychologically brutal. Even with solid signals flashing green, most traders hesitate or second-guess themselves. Fear overrides logic when money’s actually on the line.

Plus, bear markets can invalidate every technical signal. What looks like capitulation might just be the beginning of deeper losses. No indicator guarantees protection against prolonged downturns.

So use these signals as guides, not guarantees. Combine multiple indicators before committing capital. And never invest more than you can afford to lose during uncertain market conditions.

The crypto market will eventually recover. But timing that recovery remains incredibly difficult, even with the best data available.