Crypto markets lost $19 billion overnight. But here’s the weird part—nobody’s panicking.

Bitcoin hovers around $69,500 with zero momentum. Altcoins like Midnight (NIGHT) took brutal hits. Yet the total market cap holds above critical support levels. So what’s really happening here?

The market isn’t crashing. It’s stuck. Traders are waiting for something—a catalyst, a signal, anything—to break the stalemate.

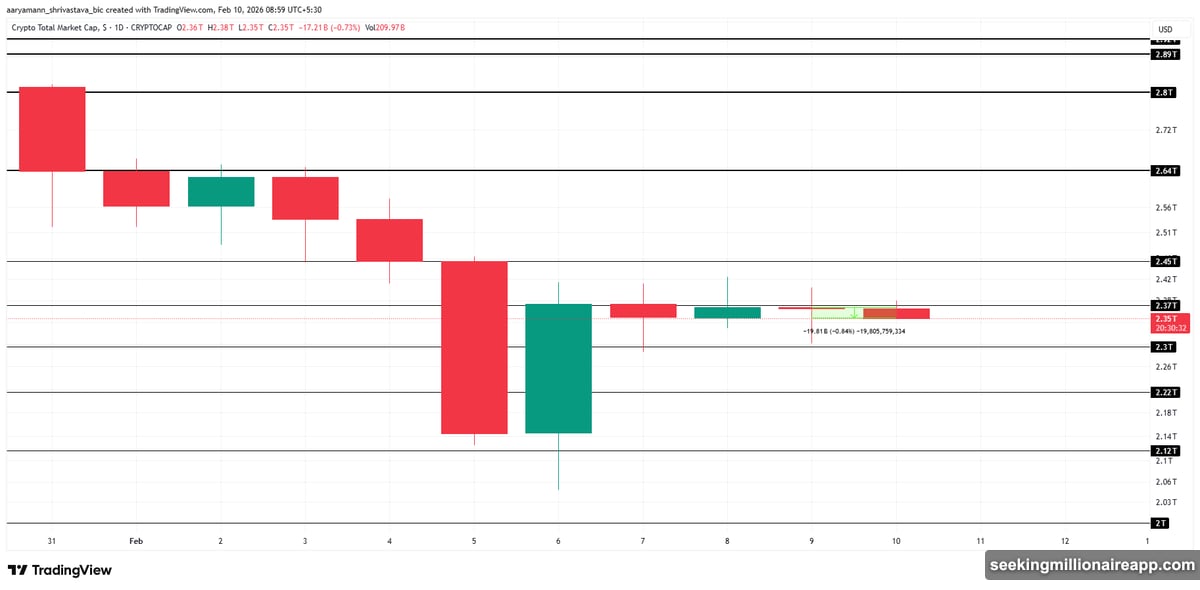

Total Market Cap Barely Holding Support

The total crypto market cap dropped to $2.35 trillion. That puts it just above the $2.30 trillion floor that’s held for weeks.

Here’s the critical level. The $2.37 trillion resistance keeps rejecting every rally attempt. Until that breaks, expect more sideways action. Investors won’t commit capital without clearer direction from macro conditions or fresh liquidity.

Support at $2.30 trillion matters more than most realize. If that level fails, the correction deepens fast. Weak sentiment or renewed selling could push the market into proper bearish territory. Right now it’s just consolidation. Below $2.30 trillion? That changes everything.

But there’s upside potential too. A decisive move above $2.37 trillion would flip momentum bullish. From there, the path to $2.45 trillion opens up. Strong inflows could even push toward $2.64 trillion. It all depends on whether buyers show up or stay on the sidelines.

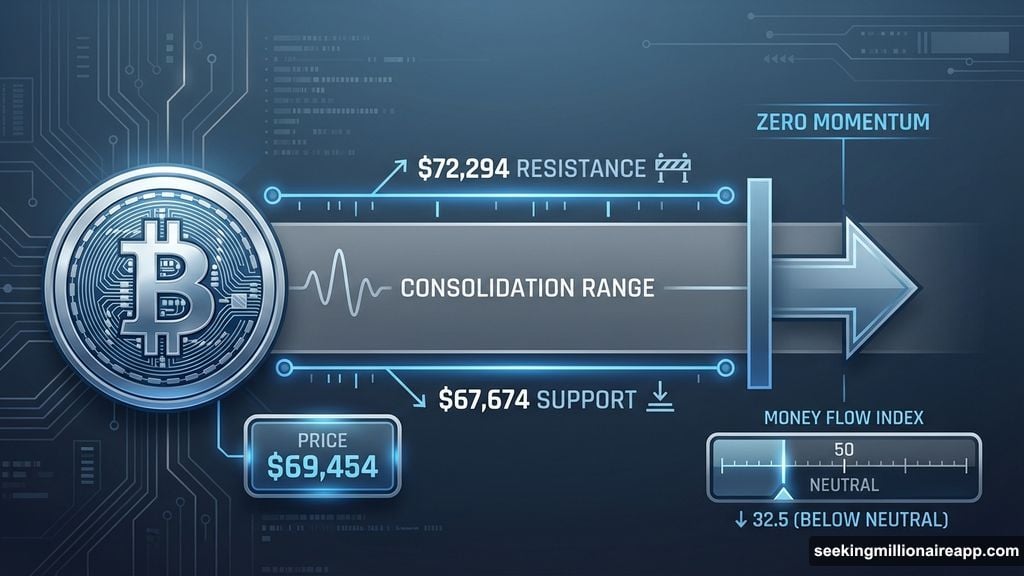

Bitcoin Can’t Break $70,000

Bitcoin traded around $69,454 for the past 24 hours. Zero progress.

The stalled price action doesn’t reflect selling pressure. Instead, it shows muted demand. Nobody’s buying aggressively. Nobody’s dumping either. Just… nothing. Traders are watching and waiting.

Momentum indicators confirm the weakness. The Money Flow Index sits below neutral. That signals subdued buying interest. Meanwhile, Bitcoin holds above the $67,674 support level. But that floor looks shaky.

If conditions worsen, a drop below $67,674 invites more downside volatility. Bitcoin could test lower levels quickly. The question is whether buyers step in or let it slide.

Recovery depends on changing market conditions. If demand strengthens, Bitcoin could challenge the $72,294 resistance. Breaking above that level would shift short-term momentum. From there, $75,000 becomes the next target. But without stronger participation, Bitcoin stays trapped in this range.

Midnight Rejected Hard After Rally Attempt

Midnight crashed 8% in 24 hours. Price now sits near $0.0486 at the time of writing.

The weekend rally failed. Sellers took control after NIGHT got rejected at the $0.0551 resistance level. That rejection confirmed bearish pressure. Now the altcoin trends lower as traders reassess risk.

If the decline continues, NIGHT could retest the $0.0457 support. That move would confirm weakening demand. Plus, it extends the current corrective phase. Altcoins often overreact to broader market weakness. Midnight is no exception.

But recovery isn’t impossible. Improved market conditions and renewed inflows could trigger a rebound. The key level to watch? $0.0551. Reclaiming that resistance would invalidate the bearish thesis. It would also open room for more upside.

Right now though, momentum favors the bears.

Why Markets Are Stuck, Not Scared

This isn’t a crash. It’s a standoff.

Bitcoin holds above support. The total market cap hasn’t collapsed. Yet nobody’s buying aggressively either. Traders are waiting for clearer signals before committing capital.

Macro conditions remain uncertain. Regulatory news stays quiet. No major catalyst has emerged to push markets in either direction. So prices consolidate in tight ranges while participants sit on their hands.

Here’s what makes this dangerous. Prolonged consolidation often precedes sharp moves. The longer markets stay trapped, the more explosive the breakout—or breakdown—becomes. Volatility is building even if it doesn’t show yet.

For now, watch those key levels. Bitcoin’s $67,674 support and the market’s $2.30 trillion floor matter most. Hold those, and consolidation continues. Break those, and things get interesting fast.

Altcoins Show Weakness First

Altcoins like Midnight typically signal broader market direction before Bitcoin moves. That 8% drop in NIGHT? It’s a warning sign.

When altcoins get rejected at resistance and lose support quickly, it suggests deteriorating market conditions. Sellers are active. Buyers aren’t defending key levels. That often precedes wider weakness.

Bitcoin’s relative stability masks underlying fragility. If altcoins continue bleeding out, Bitcoin eventually follows. The question is timing. Markets can stay range-bound longer than expected. But the pressure builds with each failed rally attempt.

Smart traders watch altcoin price action for clues. Right now, those clues point toward caution. Not panic. Just caution.

What Happens Next

Two scenarios play out from here.

Bullish case: Market cap breaks above $2.37 trillion. Bitcoin pushes past $72,294. Altcoins like Midnight reclaim resistance levels. Momentum shifts positive. Traders pile in. Prices rally toward higher targets.

Bearish case: Support levels fail. Bitcoin drops below $67,674. Total market cap slides under $2.30 trillion. Altcoins accelerate lower. Correction deepens. Volatility spikes.

The market decides which path soon. Consolidation can’t last forever. Something will break—either support or resistance. Position accordingly and watch those critical levels closely.