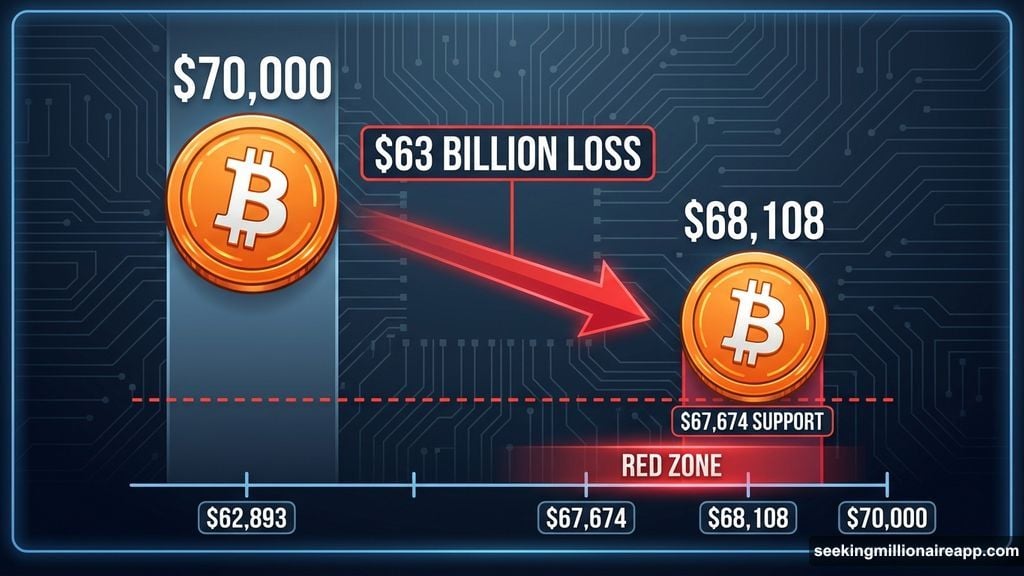

The crypto market just lost $63 billion in a single day. Bitcoin dipped below $70,000 again. And fear is spreading fast across the entire space.

This isn’t just another routine dip. Multiple factors hit at once, creating a perfect storm that’s rattling investor confidence. Plus, the broader financial markets aren’t helping matters.

Let’s break down what’s actually happening and what it means for your holdings.

Bitcoin Can’t Hold $70,000

Bitcoin traded at $68,108 at press time, clinging to the $67,674 support level. That floor matters more than most people realize. It’s the line between controlled consolidation and potential freefall.

The Money Flow Index tells a concerning story. It sits below neutral, showing sellers dominate the market right now. Buying pressure remains weak despite Bitcoin’s established position in institutional portfolios.

If $67,674 breaks, the next stop could be $62,893. That’s where technical analysts expect stronger support to kick in. But getting there would mean another 8% drop from current levels.

Still, Bitcoin showed resilience before. The $70,000 psychological barrier acts as both resistance and a potential launchpad. Breaking through with conviction could shift momentum quickly.

Fear Drives the Entire Market Lower

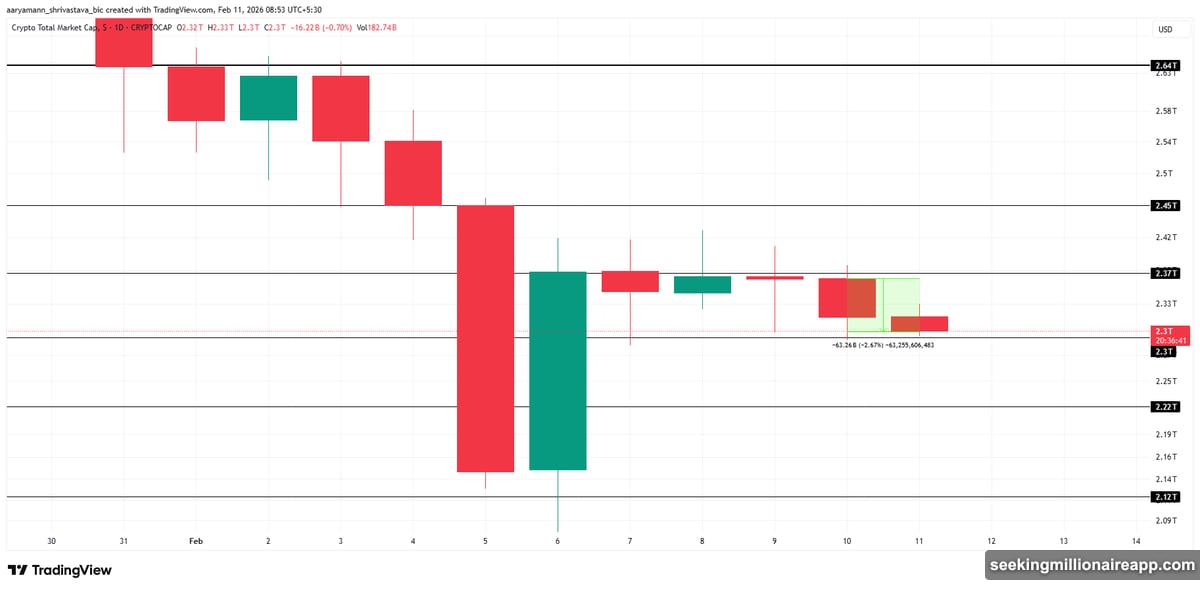

The Fear and Greed Index hit extreme fear territory. That reading reflects exactly what’s playing out in price action across cryptocurrencies.

Total crypto market capitalization dropped to $2.30 trillion. Now it’s stuck in a tight range between $2.30 trillion and $2.37 trillion. This consolidation shows investors can’t decide what comes next.

Traders are waiting for clearer signals before committing serious capital. Macroeconomic uncertainty makes that caution understandable. When traditional markets look shaky, crypto typically feels the pressure first.

Technical indicators show weakening momentum across the board. Volume remains light compared to previous rallies. And liquidity conditions keep tightening as more investors move to the sidelines.

MYX Finance Takes the Hardest Hit

Among altcoins, MYX Finance suffered the worst damage. It crashed 17% in just 24 hours, dropping to $5.17 after losing the $5.27 support level.

The Chaikin Money Flow indicator reveals the problem. After briefly turning positive last week, it’s back below the zero line. That means capital is flowing out faster than it’s coming in.

This pattern shows up repeatedly when altcoins enter distress mode. Weak projects get hit hardest during market-wide selloffs. MYX’s price action suggests traders see limited near-term upside.

If selling continues, the next support sits at $4.81. That would represent another 7% decline from current levels. Not great for anyone who bought near recent highs.

However, altcoins can reverse fast when sentiment shifts. Reclaiming $5.27 as support would signal buyers are stepping back in. From there, a move toward $5.99 becomes possible.

Legal Drama Adds to the Pressure

SafeMoon’s former CEO Braden John Karony just got sentenced to 100 months in prison for fraud. The token collapsed, and now the legal system is holding people accountable.

That news reminds everyone that crypto still carries serious regulatory and legal risks. When high-profile fraud cases make headlines, it dampens enthusiasm across the sector.

Meanwhile, Goldman Sachs disclosed over $2.36 billion in crypto holdings. Their portfolio includes $1.1 billion in Bitcoin, $1.0 billion in Ethereum, and significant positions in XRP and Solana.

So we’re seeing both sides of the crypto story. Traditional finance giants are building positions. But legal crackdowns continue targeting fraudulent projects and executives.

What Happens Next Depends on Two Things

First, Bitcoin needs to hold $67,674. If that support breaks, expect further declines across the market. Altcoins would likely suffer even worse than BTC.

Second, broader market sentiment needs to stabilize. Crypto doesn’t trade in isolation. When stock markets look uncertain, risk assets like cryptocurrency get sold first.

The current consolidation phase could last days or weeks. Markets rarely move in straight lines, even during bear trends. Short-term volatility will probably continue regardless of direction.

If sentiment improves and institutional buyers step back in, total market cap could push above $2.37 trillion. That would open the path toward $2.45 trillion and possibly $2.64 trillion with sustained momentum.

But betting on a quick recovery seems risky right now. The Fear and Greed Index doesn’t flip from extreme fear to greed overnight. These shifts take time and usually require a catalyst.

The Bigger Picture Remains Uncertain

Goldman Sachs holding billions in crypto shows institutional adoption continues. That’s important for long-term believers. Traditional finance giants don’t make $2.36 billion bets on assets they think will disappear.

Yet the SafeMoon fraud case proves serious problems still exist in crypto. Scams, rug pulls, and outright fraud damage the entire industry’s reputation. Every conviction helps, but the damage to investor confidence lingers.

So we’re caught between two competing narratives. Institutional money is flowing in. But regulatory crackdowns and fraud cases keep scaring retail investors away.

The market needs to work through this fear phase before sustainable growth returns. That means watching key support levels, monitoring volume trends, and staying aware of macroeconomic shifts that affect risk appetite.

Your strategy should match your risk tolerance. If you’re long-term bullish, this fear phase might present buying opportunities. If you’re trading short-term, the current volatility makes timing entries and exits much harder.

Either way, the $63 billion drop shows crypto markets can still move fast and punish overconfidence. Risk management matters more than ever when fear dominates sentiment.