Robinhood just posted its best year ever. Revenue hit $4.5 billion, up 50% from 2024. Net income nearly doubled to $1.9 billion. Options trading boomed. Gold subscriptions grew fast.

But here’s the problem. Crypto revenue collapsed 38% to $221 million. That dragged down Q4 results and spooked investors. Plus, the stock broke below a critical support pattern in early February. Now it’s bouncing, but technical signals suggest this rally won’t last.

Let me walk you through why HOOD might drop another 40% from here.

Strong Earnings Can’t Hide Crypto Weakness

Robinhood diversified beyond meme stocks and crypto trading. That’s good news for long-term stability. The company now generates solid revenue from options, interest income, and subscription services.

Q4 earnings per share beat expectations. Full-year revenue growth topped 50%. These numbers prove the core business model works. Management even launched Robinhood Chain, an Ethereum Layer 2 network. This platform will eventually support tokenized stocks and 24/7 trading.

Yet none of that mattered to the market. Why? Because crypto revenue missed badly.

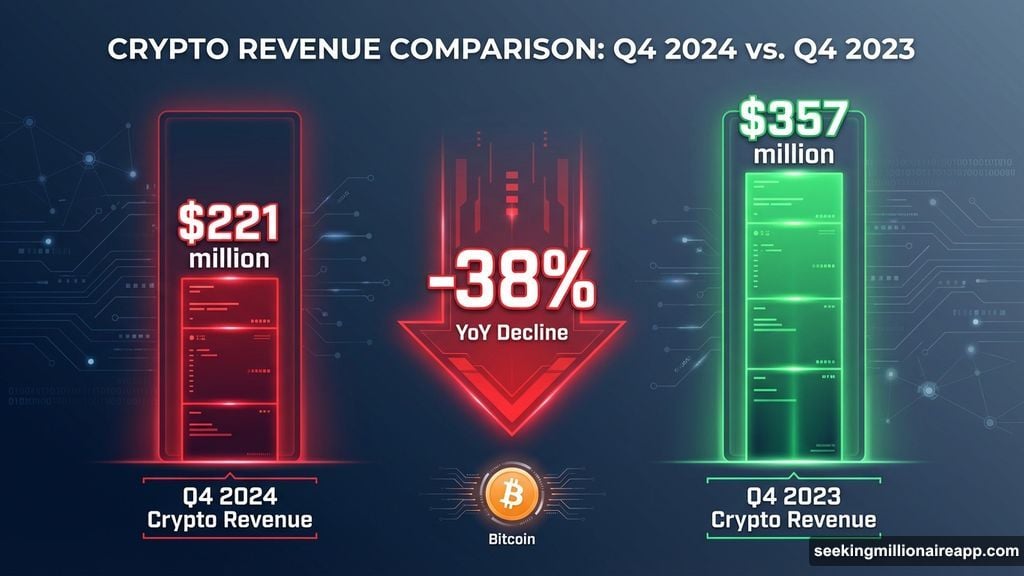

Analysts expected around $242 million in crypto sales. Robinhood delivered only $221 million. That’s a 38% year-over-year decline. Bitcoin’s pullback and lower trading volumes killed activity on the platform.

Moreover, total Q4 revenue came in at $1.28 billion versus estimates of $1.35 billion. That $50 million shortfall sent the stock down 7% in after-hours trading. So even with record profits, investors focused entirely on crypto weakness.

This tells you something important. The market still views Robinhood as heavily dependent on crypto trading. Until that changes, weak Bitcoin prices will keep dragging down the stock.

Money Flow Indicators Show Big Wallets Are Leaving

Price rebounds don’t mean much without strong buying support. That’s where money flow analysis comes in.

Chaikin Money Flow (CMF) tracks institutional buying and selling. When CMF stays positive, big investors are accumulating. When it stays negative, they’re either selling or staying away.

Right now, Robinhood’s CMF remains stuck below zero. Even during the 23% rebound from $71, CMF couldn’t reclaim the zero line. In fact, it stayed below its falling trendline the entire time.

What does this mean? The rally lacks institutional backing. Retail traders might be buying the dip. But large wallets aren’t joining them. That makes any bounce fragile and prone to reversal.

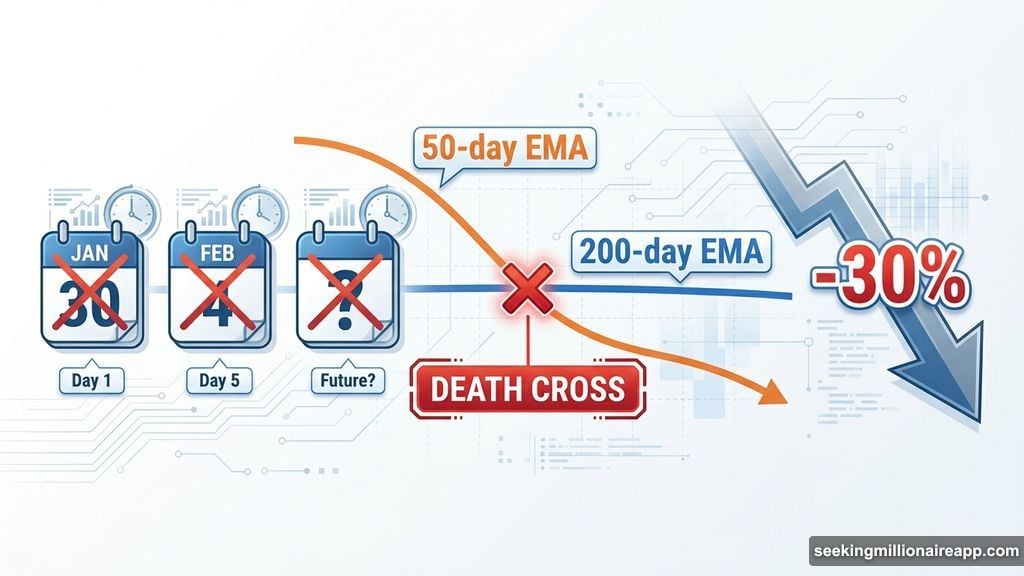

Then there’s the death cross risk. This happens when the 50-day exponential moving average (EMA) drops below the 200-day EMA. Traders watch this signal closely because it often precedes extended downtrends.

Robinhood already saw two bearish crossovers on January 30 and February 4. After the January signal, the stock fell nearly 30%. Now the 50-day EMA is moving toward the 200-day again. If this third crossover confirms, selling pressure could intensify fast.

There’s one small bright spot. On-Balance Volume (OBV) formed higher lows between September and February. Meanwhile, HOOD made lower lows. This divergence suggests some retail investors kept accumulating during the decline.

But here’s the catch. Retail buying alone rarely reverses major trends. Without institutional support, these small-scale purchases won’t stop a sustained drop.

Technical Structure Points to $55 Target

Chart patterns confirm the bearish outlook. Robinhood has traded inside a falling channel since October. This means lower highs and lower lows between parallel trendlines.

Recently, a new parallel channel formed based on updated price action. This structure points to potential downside exceeding 40% if support breaks.

The critical level right now is $71. That’s where HOOD found support during the February 5 low. As long as the stock holds above $71, the rebound has a chance to survive.

However, a clean break below $71 changes everything. The next major support zone sits near $55. That represents a 40% drop from current levels around $87.

On the upside, resistance stacks up quickly. First, HOOD needs to reclaim $87, which it’s testing now. Beyond that, $98 acts as the next barrier. Above $98, major resistance waits at $107 and $119.

So bulls need to clear four levels just to improve the short-term structure. Bears only need to break one.

That’s why the risk-reward heavily favors the downside here.

Crypto Dependence Remains the Core Problem

Here’s what frustrates me about this situation. Robinhood built a solid, diversified business. Revenue streams improved. Profitability hit record levels. Management launched innovative products like Robinhood Chain.

Yet the stock can’t escape its crypto dependency. Even though crypto represents a shrinking share of total revenue, it still drives market perception. When Bitcoin drops, HOOD drops harder.

This creates a vicious cycle. Crypto traders leave during bear markets. Revenue falls. The stock drops. That scares away institutional investors. Money flow turns negative. The stock drops more.

Meanwhile, Robinhood’s strong fundamentals get ignored. The market doesn’t care about subscription growth or options volume when crypto revenue misses estimates.

So until crypto activity recovers, HOOD will struggle. The 23% bounce might feel encouraging. But without strong institutional buying and crypto stabilization, another 40% drop looks more likely than a sustained rally.

Watch $71 closely. If that level breaks, the path to $55 opens fast.