The government shut down Wednesday. Crypto legislation? On hold. New Solana ETFs? Stuck. Everything in Washington just hit pause.

This isn’t the first shutdown. But for an industry counting on Congress to finally pass clear rules, the timing stinks. Let’s break down what stops working and when things might restart.

ETFs Hit the Brakes Hard

The Securities and Exchange Commission almost approved new crypto ETFs last week. Solana and Litecoin funds were ready to launch. Then the shutdown hit.

The SEC published some final paperwork Monday. But they couldn’t finish everything before federal workers got sent home. So issuers sit waiting with products they can’t launch.

These funds represent real money. Investment firms spent months preparing. Marketing campaigns were ready. Launch dates got circled on calendars. Now? Everything’s frozen until Congress reaches a deal.

Meanwhile, the IRS managed to squeeze out interim guidance before shutdown. Small wins matter in these situations.

Legislation Timeline Gets Fuzzy

Market structure bills were already moving slowly through Congress. The shutdown makes things worse.

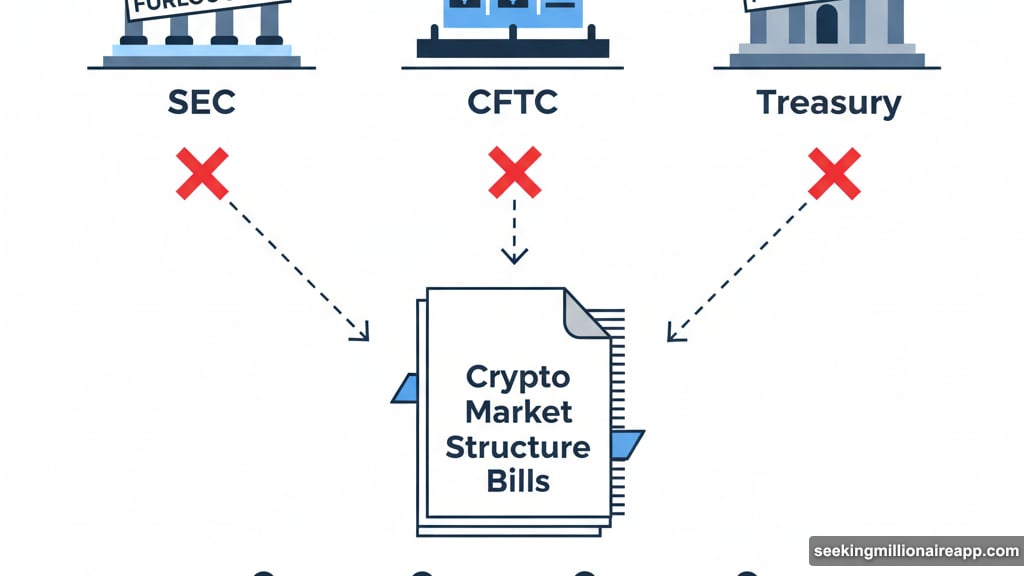

Here’s the immediate problem. Lawmakers write bills by consulting with regulators. Those regulators are currently furloughed. So staffers drafting crypto legislation can’t ask questions or get feedback from the SEC, CFTC, or Treasury.

One Washington insider told CoinDesk that a two-week shutdown probably won’t derail things much. Lawmakers weren’t planning votes until late October anyway. The bill text still needs work regardless of shutdown status.

But anything longer than two weeks? That’s where uncertainty grows. Ron Hammond from Wintermute explained that extended shutdowns breed partisan bitterness. That makes the bipartisan cooperation needed for crypto bills harder to achieve.

December still looks possible for moving legislation forward. However, the longer workers stay furloughed, the more that timeline slips.

History Offers Some Clues

The longest government shutdown ever ran from December 2018 through January 2019. That one lasted 35 days during Trump’s first term.

Democrats controlled the House then. Republicans ran the Senate. Sound familiar? Different party balance than today, but similar divided government dynamics.

This current shutdown just started. It could end quickly or drag on for weeks. Nobody knows yet which direction it heads.

Hammond’s team is watching for Senate committee markups by Thanksgiving. That’s the hearing where lawmakers debate and potentially advance bills. Missing that window would push everything into 2026.

The 2026 midterm elections ramp up fast. Once campaign season hits full swing, controversial legislation gets even harder to pass. So the window for crypto bills is narrowing.

What Actually Stops During Shutdown

Federal employees split into two groups during shutdowns. Essential workers keep working without pay. Everyone else gets furloughed.

The SEC? Mostly furloughed. That means no new ETF approvals. No enforcement actions. No responses to industry questions. The agency basically goes dark.

Similar story at other financial regulators. The CFTC, Treasury, and banking regulators all scale back operations dramatically.

Congress itself still functions. Lawmakers still report to work. But their ability to consult experts and finalize complex legislation suffers when the regulatory agencies aren’t available.

Public hearings typically get cancelled. Committee work slows down. Partisan negotiations that were already difficult become even more strained.

Crypto Policy Was Finally Moving

The frustrating part? Crypto policy had real momentum before this happened.

Hammond described recent weeks as incredibly busy for crypto developments. Multiple agencies published guidance. Lawmakers made progress on market structure bills. New ETF applications moved through review processes.

Then everything stopped at once. Not because of opposition to crypto. Not because of technical problems. Simply because Congress couldn’t agree on overall government funding.

Industries unrelated to crypto face similar delays. But crypto companies had particular reason to hope for progress this fall. The shutdown puts those hopes on ice.

When Things Might Restart

Short shutdown? The crypto world resumes work pretty quickly. ETF approvals move forward within days. Legislative conversations pick up where they left off.

Extended shutdown? That’s where the real damage happens. Weeks without regulatory feedback means bill drafts stall. Delayed ETF launches create market uncertainty. Companies planning product rollouts have to push back timelines.

The shutdown also affects tax guidance, enforcement priorities, and routine agency communications. All those small delays add up.

Wintermute still sees market structure legislation as more likely than not to pass before 2026 elections. But that calculation assumes the shutdown ends relatively soon.

If we’re still in shutdown mode by November, those odds start dropping. December votes become unlikely. Early 2026 gets crowded with other priorities.

The crypto industry has waited years for clear rules. A few more weeks shouldn’t matter much. But in an election year with narrow windows for legislative action, every delay counts.

Federal workers will get backpay when the government reopens. The crypto industry? They just get delays with no compensation.

Post Title:

Meta Description: