Dogecoin just stopped bleeding. After Saturday’s ugly dip to $0.248, DOGE bounced hard and reclaimed $0.26 by early Sunday.

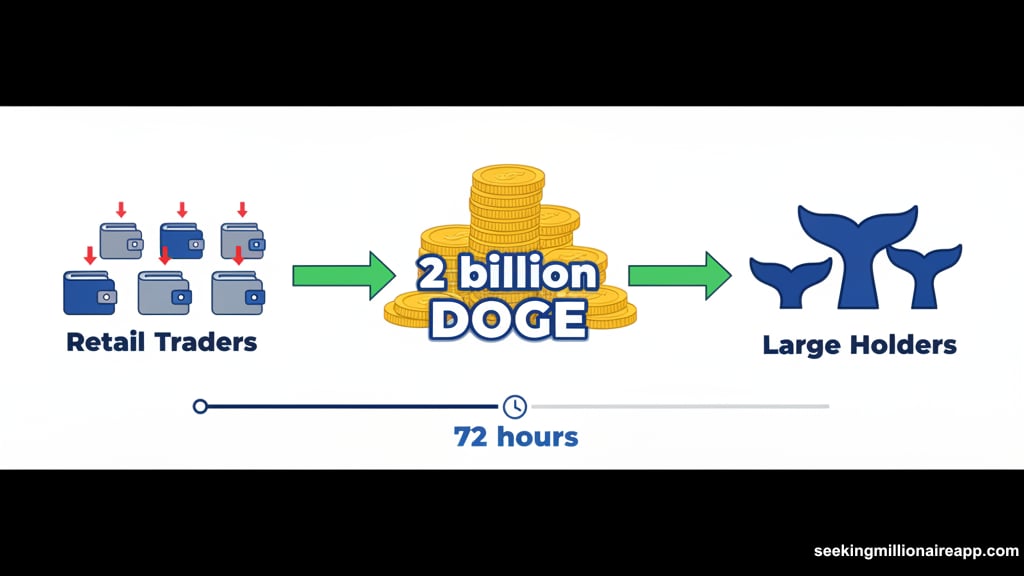

The recovery wasn’t random. Big wallets scooped up 2 billion DOGE over the past 72 hours. That’s the kind of accumulation that often precedes breakouts. Plus, trading volume spiked to 485.6 million during the bounce, confirming real institutional money stepped in.

Now the question becomes simple. Can DOGE hold above $0.26 and push toward $0.30?

Whales Bought the Dip Hard

Large holders accumulated 2 billion DOGE in just three days. That’s not retail panic buying. That’s strategic positioning.

These accumulation patterns have preceded previous rallies. When whales buy during fear, they’re betting on recovery. So far, their timing looks solid.

Meanwhile, trading volume tells the same story. The 485.6 million DOGE traded during Saturday’s capitulation shows institutions participated in the selloff cleanup. They didn’t just buy the dip. They bought it aggressively.

This creates an interesting dynamic. Retail traders who sold in panic handed their tokens to stronger hands. Those stronger hands typically don’t flip for quick profits.

Technical Picture Shows Ascending Channel

DOGE formed an ascending channel from the $0.248 bottom. That’s textbook bullish structure after a flush-out.

Support sits firmly at $0.247–$0.249. The token tested this level twice during Saturday’s decline and bounced both times. Strong support zones create reliable launching points.

Resistance appears at $0.265 short-term. But the bigger target sits at $0.30–$0.33. If DOGE breaks through current resistance, that’s where momentum likely carries price next.

Beyond $0.33, some analysts eye $0.40 as the ultimate breakout target. That seems ambitious. But DOGE has surprised skeptics before with vertical moves when conditions align.

ETF Narrative Builds Quietly

SEC filings for DOGE ETFs continue moving through regulatory review. Most traders ignore this noise until approval seems imminent. That’s probably a mistake.

Institutional products create sustainable demand. Bitcoin and Ethereum proved this when their spot ETFs launched. DOGE could follow the same pattern.

The difference? DOGE’s market cap sits far below BTC and ETH. So ETF-driven inflows could move price more dramatically. Even modest institutional adoption creates disproportionate impact on smaller-cap tokens.

Nobody knows when or if DOGE ETFs get approved. But the optionality exists. And that optionality carries value.

Broader Crypto Market Context Matters

Last week saw $1.7 billion in liquidations across crypto markets. That kind of forced selling creates temporary price distortions. But it also clears leverage and resets market structure.

Now crypto markets are stabilizing. Bitcoin held key support levels. Ethereum showed strength. And traders are rotating back into high-beta tokens like DOGE.

This rotation makes sense after liquidation events. Once fear subsides, risk appetite returns. DOGE benefits disproportionately from that shift because of its volatility profile and retail popularity.

The token remains attractive to traders seeking leverage to Bitcoin’s moves. When BTC consolidates or climbs steadily, DOGE often outperforms on a percentage basis.

What Needs to Happen Next

DOGE must prove it can sustain closes above $0.26. One bounce doesn’t confirm a trend reversal. Consistent support at this level does.

Traders should watch for volume patterns. If buying volume exceeds selling volume on retests of $0.26, that confirms the level holds. If volume drops during bounces, the rally likely fizzles.

The $0.30 level represents psychological resistance and a technical barrier. DOGE hasn’t traded above $0.30 consistently in months. Breaking through requires momentum, volume, and probably a broader crypto rally.

Beyond technical factors, whale behavior matters most. If large holders continue accumulating, price likely grinds higher. If they start distributing, rallies fail quickly.

My Take on DOGE’s Setup

This bounce looks legitimate. The accumulation data, volume profile, and technical structure all align. That doesn’t guarantee success. But it shifts probabilities toward higher prices.

The risk-reward at current levels favors buyers. Support sits 2-3% below. Resistance sits 15-20% above. That’s a decent setup for position traders willing to manage risk.

However, DOGE remains a high-volatility asset prone to sudden reversals. Position sizing matters more than timing. Even good setups fail sometimes. Don’t bet money you can’t afford to lose on speculative tokens.

If DOGE breaks $0.30, the move could get wild fast. Momentum traders will pile in. Retail FOMO kicks in above round numbers. And the token’s history of explosive rallies creates self-fulfilling prophecy potential.

But if $0.26 fails, expect another test of $0.24 or lower. Crypto doesn’t reward blind optimism. Trade the chart, watch the volume, and respect the levels.