Galaxy Digital dropped a bomb on the retail investing world Monday. Their new GalaxyOne platform promises yields up to 8% while letting you trade crypto, stocks, and ETFs from one place.

The stock jumped 8% in premarket trading. And for good reason. This launch puts Galaxy in direct competition with Robinhood and Coinbase, two giants that dominated the digital-first investing space.

But Galaxy brings something different. They’re leveraging a massive institutional lending business to power yields that blow past traditional savings accounts.

What GalaxyOne Actually Offers

The platform blends three core services into one mobile and web experience. First, high-yield cash accounts with FDIC insurance. Second, crypto trading across major tokens like Bitcoin, Ethereum, and Solana. Third, access to U.S. stocks and ETFs.

The yield structure caught my attention immediately. Regular users earn 4% annually on cash deposits. Accredited investors can reach 8% through Galaxy Premium Yield.

Those rates come from Galaxy’s institutional lending operations. The company manages over $1.1 billion in loan books. So they’re not offering promotional rates they can’t sustain. Instead, they’re passing through earnings from actual business operations.

Plus, the app handles automated reinvestment. You can set earnings to flow back into crypto or cash. That simplifies compounding without constant manual transfers.

How This Changes the Competitive Landscape

Robinhood and Coinbase dominated retail crypto and stock trading for years. Both platforms expanded services recently. They added crypto staking, margin trading, and retirement accounts.

Now Galaxy enters with a different angle. They combine institutional infrastructure with consumer-facing products. Most retail investors don’t realize how powerful that combination can be.

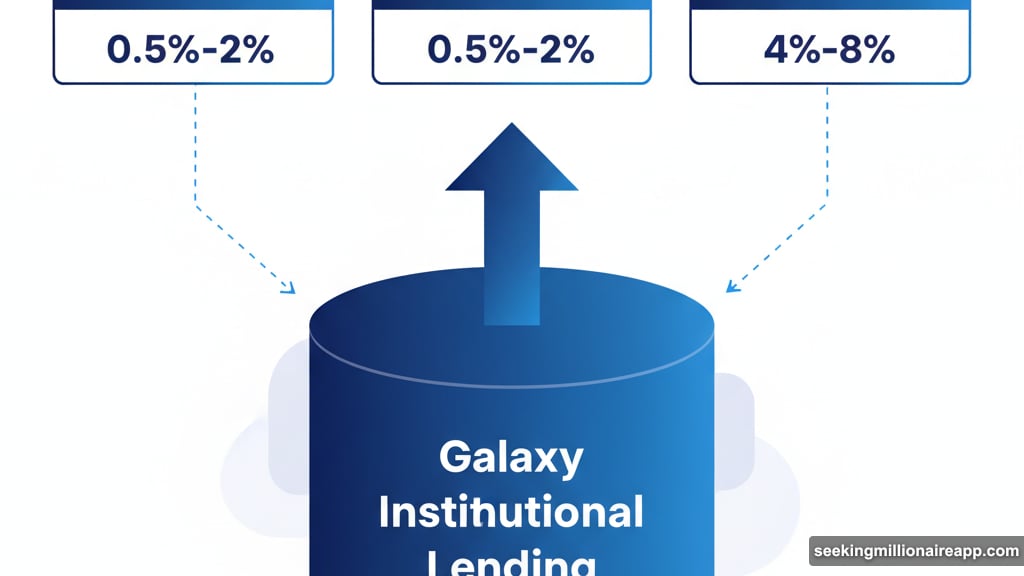

Consider the yield products. Traditional brokerages offer sweep accounts earning 0.5% or less. Robinhood and Coinbase improved those rates. But Galaxy’s 4%-8% range represents a significant jump.

The key difference? Galaxy runs an institutional lending business that generates real returns. Robinhood and Coinbase primarily make money from trading fees and payment for order flow. So their yield products rely more on external partnerships than internal operations.

Galaxy also benefits from timing. The company went public on Nasdaq in May. Shares doubled since listing. That provides capital and credibility for consumer expansion.

The Institutional Advantage Nobody’s Talking About

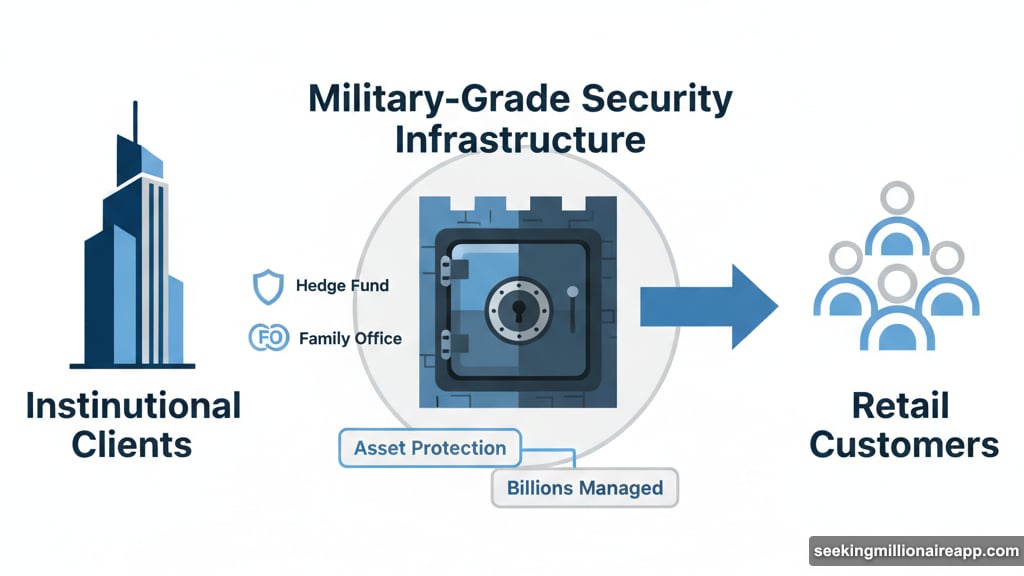

Most people think of Galaxy as an institutional player. They manage crypto assets for hedge funds, family offices, and corporations. That background shapes GalaxyOne in subtle but important ways.

Security infrastructure matters. Institutional clients demand military-grade asset protection. Galaxy built those systems for managing billions. Now retail customers benefit from the same security standards.

Liquidity access works differently too. Galaxy maintains relationships with major market makers and trading venues. That means better execution prices and deeper liquidity pools than newer platforms can access.

Risk management becomes crucial when offering yield products. Galaxy’s lending team prices risk professionally. They don’t chase high yields by taking excessive counterparty exposure. Instead, they manage a conservative loan book that generates steady returns.

Missing Features That Should Arrive Soon

Galaxy announced plans for additional products. Business accounts will launch for companies wanting crypto exposure alongside traditional banking. Crypto staking will let users earn rewards on proof-of-stake tokens. Expanded lending products will provide more ways to earn on idle assets.

The roadmap makes sense. Galaxy acquired Fierce, a fintech platform, last year. GalaxyOne builds on that infrastructure. So they’re not starting from scratch like many crypto startups.

However, some gaps exist today. No options trading yet, no fractional shares for stocks, no international markets beyond U.S. exchanges. Those features might come later, but early adopters should know the current limitations.

Why Yields This High Actually Make Sense

Eight percent returns sound too good to be true. But the math checks out when you understand the source.

Galaxy lends to institutional borrowers at rates higher than 8%. They keep a spread for risk and operations. Then they pass through 8% to premium customers. Regular customers get 4%, with Galaxy keeping a larger spread.

Institutional borrowers pay these rates because crypto lending markets remain inefficient. Traditional banks won’t touch most crypto loans. So specialized lenders like Galaxy fill that void and earn premium rates.

The risk? If institutional borrowers default, Galaxy takes losses. But the company manages this actively. They require overcollateralization. They monitor positions constantly. They’ve operated this business successfully for years.

Still, retail investors should understand the risk profile. These yields come from lending, not magic. Lending involves credit risk. FDIC insurance covers the cash deposit accounts, but not the yield products backed by Galaxy’s loan book.

Market Reaction Tells the Real Story

Galaxy stock jumped 8% on the announcement. That suggests investors believe this strategy will work. But context matters.

Both Robinhood and Coinbase traded 2% higher Monday morning too. The entire fintech sector caught a bid from broader market strength. So isolating Galaxy’s move from general market enthusiasm proves difficult.

Long-term, watch user acquisition metrics. Does Galaxy attract meaningful deposits? Do users actually trade actively, or just park cash for yield? Those numbers will determine success.

Also watch competitive responses. Robinhood and Coinbase won’t sit idle. They’ll likely improve yield offerings or add features to match Galaxy’s proposition. That competitive dynamic could benefit consumers through better rates and services across platforms.

Who This Platform Actually Serves

GalaxyOne targets investors who want unified access to multiple asset classes. If you currently juggle separate apps for crypto, stocks, and cash management, this consolidates everything.

The yield products appeal to anyone holding idle cash. Most checking accounts pay nothing. Even high-yield savings accounts rarely exceed 2-3%. So 4% represents meaningful improvement without taking excessive risk.

Accredited investors get the premium tier. That requires $1 million in assets or $200,000 in annual income. Those investors can access the 8% yield product. For them, GalaxyOne becomes a compelling alternative to money market funds or short-term bonds.

Active traders might find the platform less compelling initially. Robinhood offers options and margin. Coinbase provides deeper crypto markets. Galaxy hasn’t matched those features yet. But the roadmap suggests they’re working toward more sophisticated trading tools.

Galaxy’s consumer push represents a significant strategic shift. They’ve built a strong institutional business. Now they’re leveraging that infrastructure to compete in retail markets. The combination of high yields, unified access, and institutional-grade security makes a compelling pitch.

Whether it succeeds depends on execution. Building consumer platforms requires different skills than serving institutions. User experience matters more. Customer support must scale efficiently. Marketing needs to reach mainstream investors, not just crypto natives.

The early stock reaction suggests optimism. But the real test comes over the next 6-12 months as usage data emerges. If Galaxy can attract and retain significant assets, Robinhood and Coinbase face a serious new competitor. If adoption stalls, this becomes an interesting experiment that didn’t quite work.

Either way, more competition benefits consumers. Better yields, more features, and improved services typically follow when platforms battle for market share. So regardless of Galaxy’s individual success, the launch pushes the entire industry forward.