Banks in developing countries just got a warning. Up to $1 trillion could vanish from their vaults by 2028.

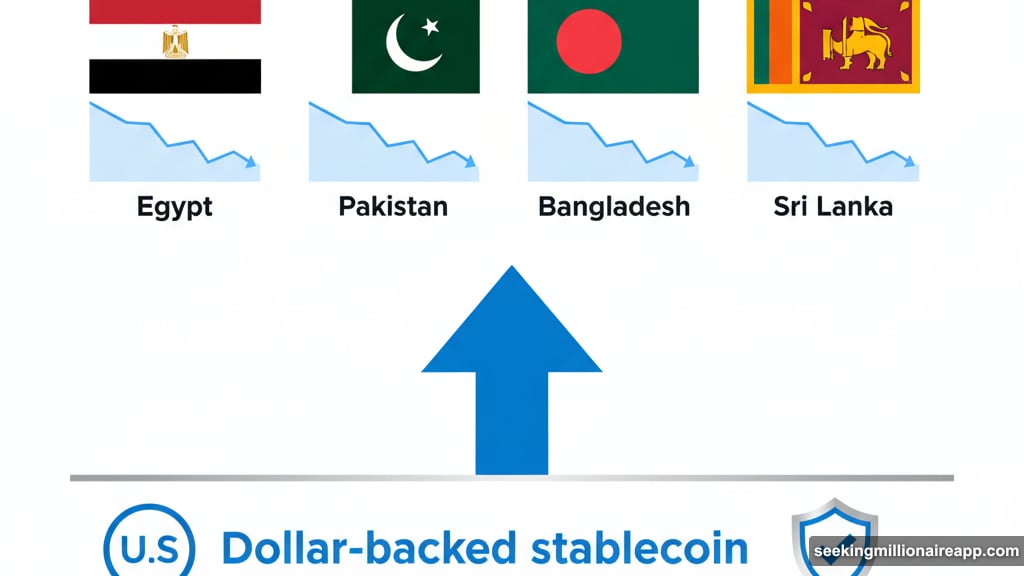

The culprit? Stablecoins. Standard Chartered’s latest report shows how dollar-backed digital currencies are becoming the escape hatch for savers stuck with weak local currencies and high inflation. Plus, this isn’t just theory anymore. It’s already happening in Egypt, Pakistan, Bangladesh, and Sri Lanka.

Why Savers Are Bailing on Local Banks

Traditional banks in emerging markets face a tough reality. Their deposit base is bleeding out.

Stablecoins offer something local banks can’t match: stability. When your national currency loses 20% of its value in a year, a digital token pegged to the U.S. dollar suddenly looks brilliant. Moreover, stablecoins provide instant liquidity without the bureaucratic hassles of traditional banking.

Standard Chartered analysts Geoff Kendrick and Madhur Jha pointed to a broader trend. Core banking functions have been shifting to non-bank sectors since the 2008 financial crisis. Stablecoins just accelerated what was already in motion.

The Numbers Tell a Stark Story

Standard Chartered projects the global stablecoin market will hit $2 trillion by 2028. That’s massive growth from current levels.

Here’s the kicker. Two-thirds of that demand will come from emerging markets. These aren’t tech enthusiasts experimenting with crypto. They’re ordinary people trying to protect their savings from inflation and currency devaluation.

Even without offering interest yields—now banned under the U.S. GENIUS Act—stablecoins attract users who prioritize capital preservation over returns. So the value proposition is simple: keep your money’s value intact while your neighbor’s savings erode in a local bank account.

How Stablecoins Actually Work for Savers

Stablecoins are cryptocurrencies tied to stable assets like the U.S. dollar or gold. They serve multiple purposes in crypto markets, including payment infrastructure and international money transfers.

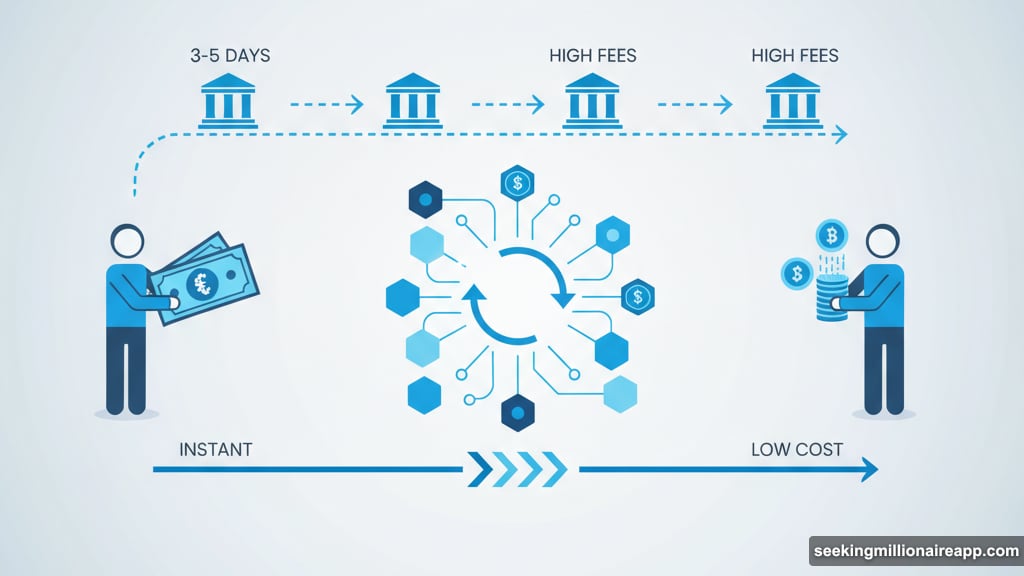

For someone in a developing economy, the appeal is straightforward. Convert local currency to a dollar-backed stablecoin. Now your savings track the dollar instead of a depreciating local currency. Plus, you can send money internationally faster and cheaper than traditional remittance services.

The technology removes friction from financial transactions. No waiting days for wire transfers. No excessive fees eating into your principal. Just peer-to-peer value transfer on blockchain networks.

Banks and Regulators Scramble to Respond

Emerging market authorities aren’t blind to this threat. Many are launching digital currency pilots and upgrading payment systems.

But here’s the problem. Technology moves faster than regulation. By the time governments implement digital alternatives, stablecoins have already captured significant market share.

Standard Chartered warns that slow-moving regulators could turn “stablecoin summer” into a long winter for local banks. That’s not hyperbole. If $1 trillion exits the banking system, the implications for credit availability and economic stability are severe.

The Double-Edged Sword

Stablecoins present both threat and opportunity. Yes, they drain deposits from traditional banks. Yet they also promise cheaper remittances and faster payments—benefits that could modernize entire economies.

The question is whether regulators can harness these advantages while mitigating the risks. Some countries might embrace stablecoins and build regulatory frameworks around them. Others might try to ban them outright, driving usage underground.

History suggests bans rarely work with digital technologies. The smarter play involves creating competitive alternatives while allowing regulated stablecoin usage.

What This Means for Banking Systems

A trillion-dollar deposit flight would devastate emerging market banks. These institutions rely on deposits to fund loans and support economic activity. Take away that capital base, and lending capacity collapses.

Moreover, stablecoins disproportionately attract the most sophisticated savers—people with enough financial literacy to navigate crypto platforms. That leaves banks with a lower-quality deposit base and increased vulnerability to runs.

The ripple effects extend beyond individual banks. Weakened banking systems can’t support economic growth. Credit becomes scarce. Interest rates climb. Small businesses struggle to get financing.

The U.S. Dollar Dominance Angle

Here’s something nobody talks about enough. Stablecoin adoption reinforces U.S. dollar dominance in developing economies.

When people in Egypt or Pakistan choose dollar-backed stablecoins, they’re essentially dollarizing their personal finances. That makes their countries more vulnerable to U.S. monetary policy while reducing the effectiveness of local central bank actions.

So stablecoins don’t just challenge emerging market banks. They challenge the monetary sovereignty of entire nations.

Three years feels like a long time. But in banking and regulatory terms, it’s a blink. Standard Chartered’s warning should wake up policymakers who assumed crypto was just a speculative sideshow.

The technology has matured. The use cases are proven. The momentum is building. Either emerging market authorities adapt quickly with competitive digital solutions, or they watch $1 trillion walk out the door.