BitMine Immersion Technologies doesn’t mess around. The firm scooped up 179,251 ether tokens last week, pushing its total holdings past 2.83 million ETH.

That’s serious money. At current prices, BitMine’s latest shopping spree cost roughly $820 million. Plus, the company now controls over 2% of Ethereum’s entire supply.

But here’s what makes this interesting. BitMine isn’t just hoarding crypto for fun. The firm aims to corner 5% of all ether in circulation.

The Treasury Strategy Gets Aggressive

Remember when Michael Saylor’s Strategy started piling into bitcoin? BitMine is following that exact playbook, but with Ethereum instead.

The approach works like this. Publicly-traded companies raise capital specifically to buy crypto. Then they hold those digital assets on their balance sheets. So shareholders get indirect exposure to cryptocurrency without buying it directly.

BitMine’s chairman Thomas Lee, who also co-founded Fundstrat Capital, leads this charge. His firm currently ranks as the world’s largest listed ETH treasury company. Only Strategy’s massive bitcoin holdings surpass BitMine’s total crypto reserves.

Moreover, the numbers keep growing. BitMine’s complete treasure chest now includes:

- 2.83 million ETH tokens

- 192 bitcoin

- $456 million in cash

- A stake in Worldcoin-focused treasury firm Eightco Holdings

That brings total reserves to $13.4 billion. Not bad for a company that only pivoted to this strategy last June.

Staking Adds Another Revenue Layer

Here’s where BitMine’s strategy gets clever. The firm doesn’t just sit on its ether tokens doing nothing.

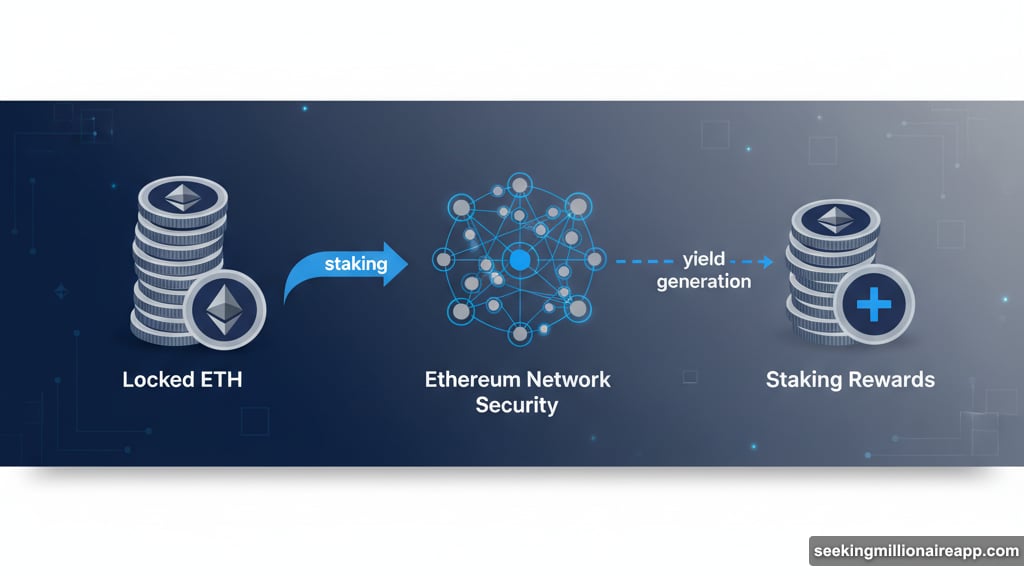

Instead, BitMine stakes its ETH holdings. Staking means locking up tokens to help secure Ethereum’s network. In return, stakers earn rewards paid in additional ether.

So BitMine generates ongoing yield from its massive crypto position. Think of it like earning interest on a savings account. Except the “interest” comes from blockchain protocol rewards rather than a bank.

This staking revenue provides cash flow. Plus, it compounds BitMine’s holdings over time as the firm reinvests those rewards.

Market Reaction Shows Confidence

Investors seem to like BitMine’s aggressive buying. The company’s stock jumped 4.3% in pre-market trading Monday, hitting just over $59 per share.

That’s the strongest price level in two weeks. Moreover, the stock move came alongside broader crypto gains over the weekend.

But here’s the real signal. Thomas Lee made his stance clear in Monday’s announcement: “We remain confident that the two supercycle investing narratives remain AI and crypto.”

Translation? BitMine plans to keep buying. The firm believes Ethereum’s current price represents a discount compared to its future value.

So expect more treasury announcements like this one. BitMine’s goal of controlling 5% of ETH supply means billions more in potential purchases ahead.

The Broader Treasury Trend Accelerates

BitMine isn’t alone in this approach. More publicly-traded firms are adopting digital asset treasury strategies.

Why the sudden rush? Several factors drive this trend:

- Institutional investors want crypto exposure without direct custody headaches

- Companies view digital assets as inflation hedges

- Staking rewards provide new revenue streams

- Shareholder demand for alternative investments grows

Yet BitMine stands out for its focus on Ethereum rather than bitcoin. Most treasury firms follow Strategy’s bitcoin-only playbook.

That bet on ETH comes with unique risks and rewards. Ethereum’s ecosystem supports DeFi, NFTs, and countless applications. So the network has more use cases than bitcoin’s primary store-of-value narrative.

However, Ethereum also faces competition from faster, cheaper blockchains. Plus, regulatory uncertainty around staking creates additional complexity.

What This Means for Ethereum

BitMine’s buying spree affects Ethereum’s market dynamics. When one entity controls 2% of supply, that concentration matters.

First, it reduces available ether for everyone else. Less supply typically means higher prices, all else equal.

Second, BitMine’s staking locks up massive amounts of ETH. Staked tokens can’t be sold immediately. So that further constrains liquid supply.

Third, the company’s continued buying creates steady demand. BitMine isn’t trading in and out. The firm accumulates and holds for the long term.

But concentration also brings risks. What happens if BitMine needs to sell? A liquidation of even 10% of its holdings could tank ETH prices.

For now, though, BitMine shows no signs of selling. The firm’s 5% supply goal means another $8-10 billion in potential purchases at current prices.

That’s a lot of buying pressure. Good news for ether holders. Less great for anyone hoping to accumulate ETH cheaply.