Jesse Pollak just did something unusual. Instead of quietly developing a token behind closed doors, Base’s creator asked the entire crypto community what they want.

The invitation sparked immediate speculation. Builders, traders, and users flooded in with proposals. Some pushed for immediate launch timing. Others demanded fair distribution models. Everyone had opinions about how Base should handle its native token.

But here’s the twist. This isn’t your typical Layer 2 token launch. Coinbase owns Base. That creates game theory nobody’s dealt with before.

What Jesse Pollak Actually Said

Pollak opened the conversation two weeks ago. He wanted input on token design, distribution, and purpose. The response overwhelmed him.

“I’ve been blown away by the input in just the first two weeks,” he shared publicly.

Suggestions came from all directions. One proposal urged rewarding on-chain builders and active users. Another called for a 2025 release to catch peak market conditions. That idea included avoiding “typical pump-and-dump optics” by prioritizing long-term contributors.

Some even proposed a mascot to give the token personality. The ideas kept coming.

However, Pollak quickly shut down launch speculation. “It’s definitely not going to happen in 2025,” he clarified. Base just started exploring options. They want to build this in the open with community input.

That transparency marks a shift. Most projects develop tokens in stealth mode. They announce finished products. Base is doing the opposite by inviting public co-creation from day one.

The Coinbase Shareholder Problem

Here’s where things get complicated. Coinbase is publicly traded. That changes everything about token economics.

AJC, enterprise research manager at Messari, explained the unprecedented challenge. “This marks the first time a publicly traded company will launch a token,” he noted.

Traditional token launches maximize value for private investors and teams. But Coinbase shareholders expect returns too. So the goal becomes maximizing shareholder value while rewarding users.

That creates tension. Shareholders won’t give up token rights without getting something back. Any airdrop must somehow increase Coinbase’s enterprise value.

Yet users want fair distribution. They built Base into a thriving ecosystem. They deserve rewards for their contributions.

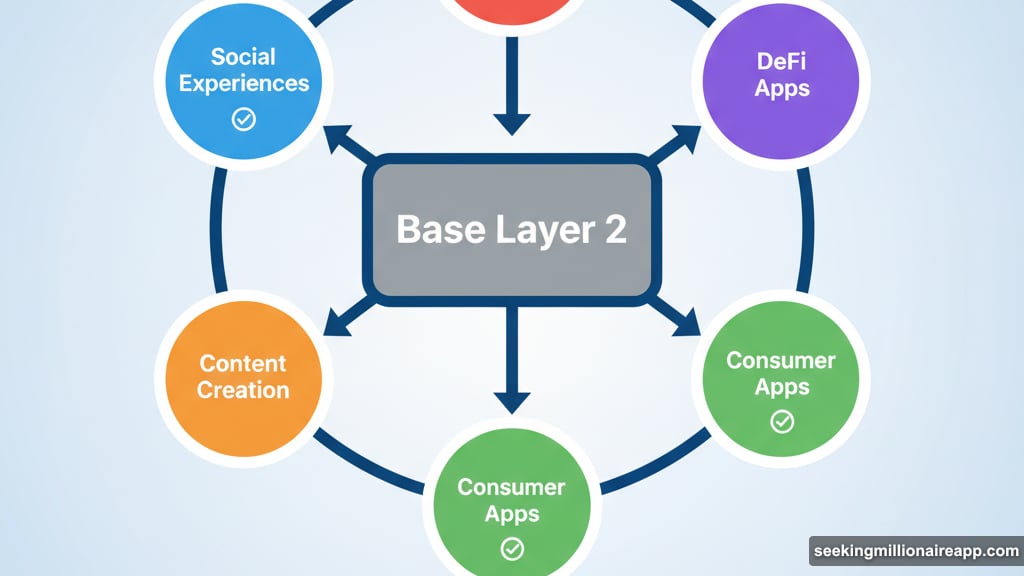

AJC suggested focusing on “durable value” activities. Reward users who build consumer apps, create content, or drive social experiences. Don’t just incentivize DeFi metrics like trading volume or total value locked.

That sounds logical. But balancing user rewards with shareholder demands creates complex trade-offs. No perfect solution exists.

Base’s Bigger Strategy: Every Token, Every User

This token discussion comes during Coinbase’s transformation. The exchange plans to enable direct trading for every token built on Base.

That means meme coins, experimental assets, everything. Traditional listing barriers disappear. Over 100 million Coinbase users gain access to thousands of on-chain projects.

The integration democratizes liquidity. Small projects get instant market access. Users discover tokens without jumping through hoops.

A Base token fits into this vision. It could power discovery mechanisms, reward ecosystem participation, or govern network decisions. The possibilities extend beyond simple speculation.

But timing matters. Launch too early and the token becomes another pump-and-dump scheme. Wait too long and momentum fades.

Pollak chose transparency over speed. He’s exploring openly, learning from community feedback, building consensus before committing.

What Makes This Token Launch Different

Most crypto projects announce finished products. They reveal tokenomics, distribution schedules, and launch dates as done deals. Community input comes too late to matter.

Base flipped that model. Pollak started the conversation before finalizing anything. He’s genuinely listening to proposals, weighing trade-offs, considering alternatives.

This approach has pros and cons. Open development builds trust. Users feel invested in outcomes. The final design reflects actual community needs.

Yet public discussions create noise. Everyone wants different things. Some demand immediate airdrops. Others prioritize long-term sustainability. Reaching consensus becomes harder with more voices.

Plus, transparency invites speculation. Every comment gets analyzed for clues. Price predictions emerge despite no token existing yet. That creates distractions.

Still, the experiment matters. If Base succeeds at community co-creation, other projects might follow. Token design could become more democratic, less dictated by founding teams.

Balancing Retail and Institutional Interests

Base faces a unique challenge. It must serve retail users and Coinbase shareholders simultaneously.

Retail users want generous airdrops. They built the ecosystem through activity and loyalty. Fair distribution feels essential.

Shareholders want value accretion. They expect the token to boost Coinbase’s market cap. Giving away too much dilutes enterprise value.

Finding middle ground requires creativity. Maybe the token generates fees that flow to Coinbase. Perhaps it unlocks premium features that drive exchange usage. Possibly it creates new revenue streams nobody’s thought of yet.

One proposal suggested rewarding long-term contributors over short-term speculators. That aligns incentives. Users who stick around benefit most. Quick flippers get less.

Another idea involved staged releases. Early adopters receive allocations first. Later distributions reward ongoing participation. That maintains interest over time.

The key is designing mechanics that satisfy both groups. Users need to feel valued. Shareholders need to see returns. Neither can dominate completely.

What Happens Next

Pollak made one thing clear. Base won’t rush this decision. They’re exploring carefully, building consensus, avoiding mistakes.

That patience might frustrate speculators. Everyone wants dates and details. But premature launches often backfire. Better to take time and get it right.

Meanwhile, the community keeps proposing ideas. Some suggestions make sense. Others seem impractical. All contribute to the conversation.

Base will eventually synthesize this feedback into concrete plans. They’ll announce tokenomics, distribution schedules, and launch timing when ready.

For now, the discussion itself matters. It sets precedent for how crypto projects engage communities. It challenges assumptions about token design. It explores new models for balancing competing interests.

Whether Base succeeds or stumbles, the experiment pushes boundaries. Publicly traded companies launching tokens face unique constraints. Navigating those constraints transparently creates valuable lessons for everyone.

The Base token might trigger a meme coin rush. It could revolutionize on-chain token discovery. Or it might face challenges nobody anticipated. Time will tell.

But one thing’s certain. This isn’t your typical crypto launch. Base is trying something different. That alone makes it worth watching closely.