International money transfers used to take days and cost a fortune. Now they happen in seconds for pennies.

Stablecoins are doing to SWIFT what email did to fax machines. The shift isn’t coming. It’s already here. Plus, most people still don’t realize how fast the old system is becoming obsolete.

The Two-World Problem Nobody Talks About

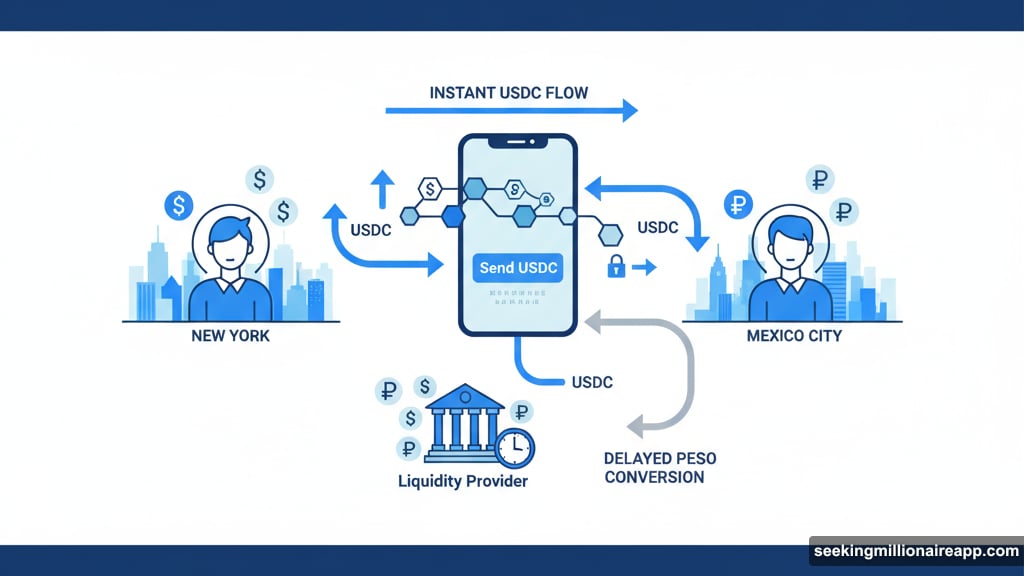

Here’s the friction point. Stablecoins move instantly across blockchains. But your local currency sits in banks that close at 5 PM.

This creates a bizarre split. Digital money operates 24/7. Traditional money runs on banker’s hours. So when someone sends USDC from New York to Mexico City, somebody still needs to convert it to pesos through the banking system.

That delay costs real money. Liquidity providers—the companies bridging crypto and cash—end up holding pesos overnight. They can’t recycle that capital until banks reopen. Meanwhile, their money just sits there earning nothing.

The user gets instant settlement. But the provider absorbs all the inefficiency costs.

How Big Is This Actually Getting?

The numbers tell a wild story. USDT hit a $175 billion market cap. USDC sits at $75 billion. Combined, they move billions of dollars across borders every single day.

Yet stablecoins still account for less than 1% of global money flows. That sounds tiny. But consider where adoption is happening first.

Remittances lead the charge. Workers sending money home skip Western Union entirely now. They send USDC instead and save 90% on fees. Business-to-business payments follow close behind. Plus, e-commerce merchants are jumping in fast because settlement happens instantly instead of waiting days for SWIFT transfers.

These aren’t hypothetical use cases anymore. They’re happening at scale right now.

Four Ways People Actually Use Stablecoins

The market identified four clear winners. First, hedging in high-inflation economies. Argentinians park savings in USDC instead of watching pesos lose value daily.

Second, cross-border payments and remittances. This remains the biggest growth opportunity. Moving dollars internationally through stablecoins beats traditional rails on every metric that matters.

Third, DeFi and programmable finance. Smart contracts can now handle complex payment logic automatically. No middlemen required.

Fourth, trading and liquidity. Crypto traders need stable assets to park capital between trades. Stablecoins filled that gap perfectly.

The Speed and Cost Advantage Is Brutal

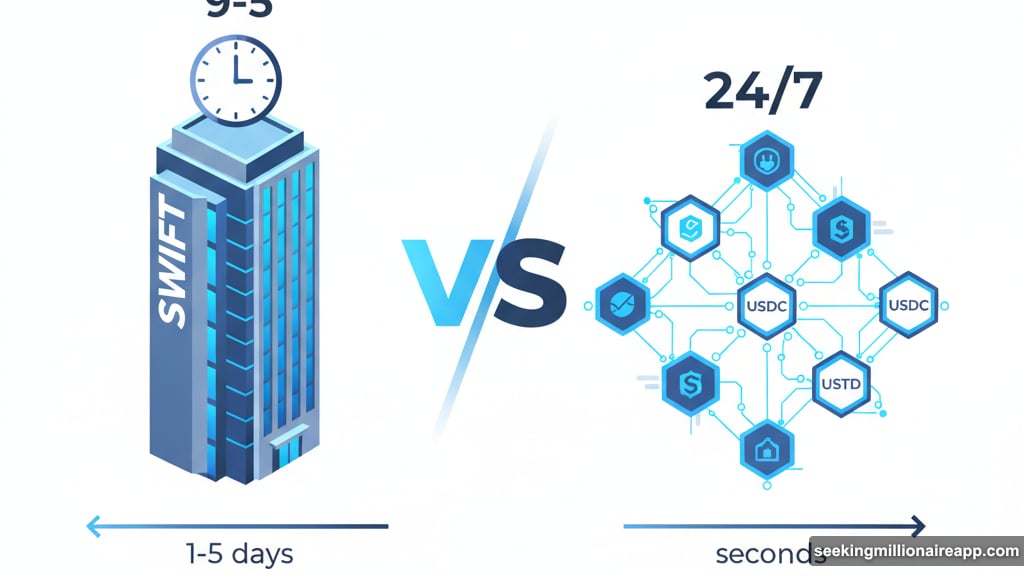

Let’s compare real numbers from 2025. Traditional SWIFT transfers take 1-5 days. Stablecoins settle in seconds. SWIFT costs $15-50 per transaction. Stablecoins cost $0.10-5.00.

SWIFT operates Monday through Friday during business hours. Stablecoins work every second of every day. Plus, SWIFT requires multiple intermediary banks. Stablecoins need zero intermediaries.

The cost difference alone kills SWIFT for small and medium-sized flows. But the speed advantage makes stablecoins unstoppable for time-sensitive payments.

Think about a freelancer in the Philippines getting paid by a U.S. company. SWIFT means waiting a week and losing 10% to fees and exchange rates. Stablecoins mean payment arrives in minutes with fees under a dollar.

That’s not a marginal improvement. It’s a completely different experience.

FX On-Chain Solves the Last Bottleneck

The real breakthrough comes from FX-on-chain protocols. They collapse the two-state problem into one digital state.

Instead of converting USDC to fiat through banks, you swap USDC directly for peso-stablecoins or real-stablecoins. Those local-currency stablecoins then redeem instantly for cash.

But here’s the clever part. Global flows naturally balance. Remittances send USD into countries. Businesses and institutions send local currency out. On-chain pools match these flows in real-time.

That means liquidity providers stop warehousing overnight risk. Capital circulates continuously instead. The system finally works like actual foreign exchange markets—except with instant settlement and full transparency.

One provider told me they previously locked up 30% of capital overnight waiting for banks. After switching to FX-on-chain, they recycle that capital 24/7. Their effective capacity tripled without raising more money.

Real People, Real Use Cases

Take exporters in Nigeria. They sell goods abroad and receive payment in dollars. Previously, converting those dollars to naira took days through correspondent banks. Each delay cost money because exchange rates kept moving.

Now they receive USDC. Convert to naira-stables on-chain in seconds. Redeem for local cash instantly. The whole process happens before exchange rates can shift significantly.

Or consider households in Argentina. Inflation runs over 100% annually. Keeping savings in pesos guarantees losing purchasing power. So families convert to USDC immediately after getting paid. They hold dollars digitally until they need to spend.

These aren’t crypto enthusiasts. They’re regular people using stablecoins because traditional banking fails them. The technology fades into the background. All they know is their money moves faster and costs less.

What Comes Next

Three fronts will determine how fast stablecoins grow. First, FX-on-chain needs to expand. More local-currency stablecoins mean better coverage globally.

Second, regulation must define guardrails without killing innovation. Some governments already see the value. Others are still debating whether to embrace or restrict stablecoins.

Third, non-USD stables need to proliferate. Euro-stables, yen-stables, and local-currency stables will enable true multi-currency settlement. That unlocks the next wave of adoption.

The past decade was about Bitcoin as digital gold. This decade will be about stablecoins as digital dollars—and eventually, digital fiat for everyone, everywhere.

Why This Matters More Than You Think

SWIFT isn’t disappearing tomorrow. Large institutional flows still depend on it. But for everyone else, stablecoins are becoming the obvious choice.

Faster settlement. Lower costs. Always available. Transparent liquidity. These advantages compound over time.

What started as a bridge between crypto and traditional finance is becoming the rails of global commerce itself. That’s not hype. It’s already happening at scale in remittances, B2B payments, and e-commerce.

The question isn’t whether stablecoins will disrupt cross-border payments. They already are. The question is how fast traditional systems adapt—or get left behind.

My bet? Much faster than most people expect. Because once you’ve sent money instantly for pennies, you never want to go back to waiting days and paying dollars.