Ethereum just shed 12% of its value in 24 hours. Most investors panicked. But crypto whales did the opposite.

While retail traders rushed to sell, institutional players quietly scooped up massive ETH positions. In fact, recent on-chain data reveals purchases worth over $180 million during the dip. This tells a very different story than the fear dominating crypto Twitter.

Let’s examine what these smart money moves actually mean for Ethereum’s near-term prospects.

Mining Giant Pulls $126 Million in ETH Off Exchanges

Two fresh wallets linked to BitMine, a major mining operation, withdrew 33,323 ETH from exchanges this week. That’s $126.4 million moved into cold storage.

The timing matters here. These withdrawals happened through FalconX and Kraken right as prices crashed. Mining firms don’t pull assets off exchanges unless they plan to hold long-term. Moving coins to private wallets signals conviction, not day trading.

Plus, BitMine has serious skin in the game. They understand Ethereum’s infrastructure better than most investors. So when they accumulate during a crash, it suggests they see the current volatility as temporary noise rather than a fundamental problem.

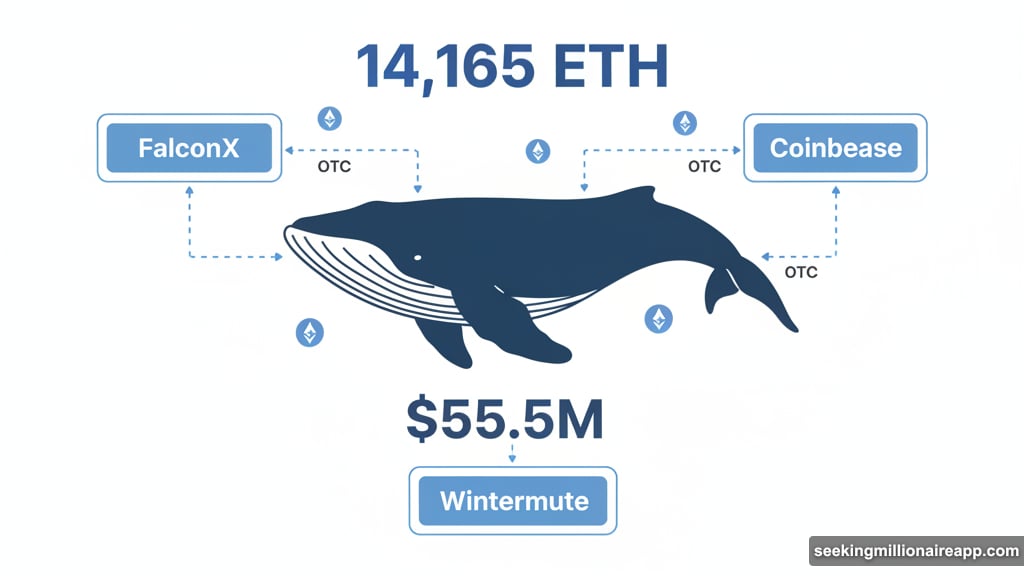

Mystery Whale Drops $55 Million Through OTC Deals

Meanwhile, an “OTC whale” grabbed 14,165 ETH through three separate platforms. That’s another $55.5 million in strategic purchases.

The whale used FalconX, Coinbase, and Wintermute for these transactions. But here’s what makes this interesting. Over-the-counter deals happen quietly, away from public order books. This whale deliberately avoided causing price spikes or triggering market reactions.

OTC purchases at this scale rarely happen on impulse. Wealthy investors use this method when they expect major upside but want to avoid tipping off the market. So this move suggests serious expectations of recovery.

Lookonchain, the on-chain analytics platform that spotted these trades, noted this represents classic “buy the dip” behavior from sophisticated players. They’re leveraging depressed prices to increase holdings before the next leg up.

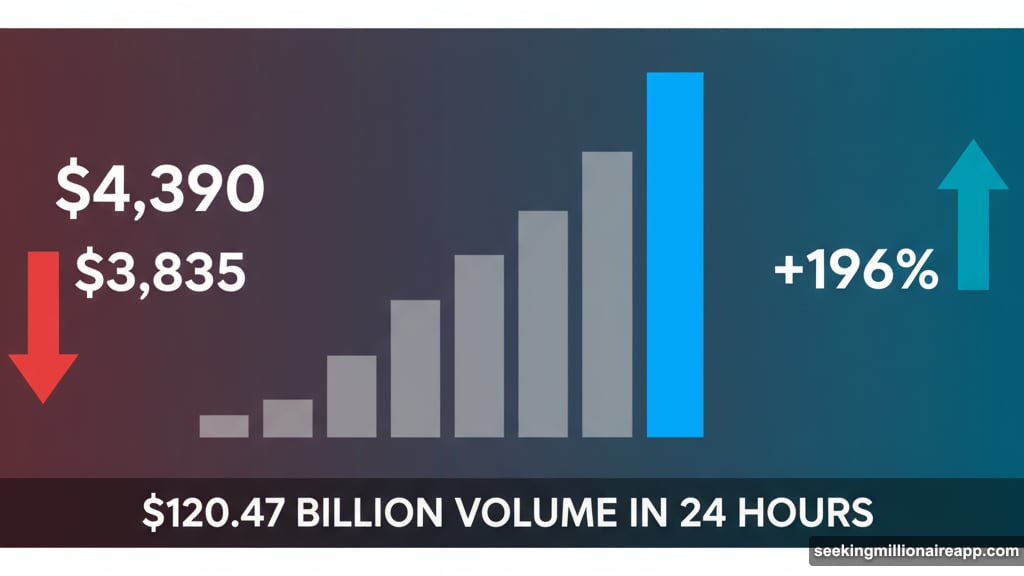

Trading Volume Exploded 196% During the Crash

Ethereum currently trades at $3,835, down from $4,390 just days ago. That’s a painful $555 drop in a market where many were calling for $5,000.

Yet something strange happened during the crash. Trading volume surged 196% to $120.47 billion in 24 hours. Massive volume during price drops typically signals accumulation, not panic selling. When volume spikes this hard, it means money is changing hands from weak holders to strong ones.

This pattern often precedes faster recoveries. High volume establishes new support levels and clears out leveraged positions. So the current consolidation could set the stage for the next rally.

Ethereum Still Beats Bitcoin Year-to-Date

Despite this week’s carnage, Ethereum remains up 30% in 2025. That actually beats Bitcoin’s 25% gain over the same period.

Why the edge? Ethereum’s proof-of-stake consensus mechanism provides built-in yield opportunities that Bitcoin can’t match. Stakers earn rewards while holding ETH, creating natural buying pressure and reducing sell pressure.

Plus, Ethereum’s ecosystem continues expanding with layer-2 solutions and real-world asset tokenization. These fundamental developments don’t disappear because of a temporary price correction.

Robert Kiyosaki Called This Weeks Ago

The “Rich Dad, Poor Dad” author recently urged followers to focus on Ethereum as a wealth-building asset. He specifically recommended ETH for long-term investors willing to weather volatility.

Kiyosaki’s timing looks prescient now. He positioned Ethereum as undervalued before this dip, suggesting prices would climb higher over time. The current whale accumulation suggests institutional players share his view.

Interestingly, Kiyosaki often compares crypto to precious metals in terms of long-term store of value. He sees both silver and Ethereum as assets that will appreciate as traditional currency systems face pressure.

What This Accumulation Really Means

Large holders don’t throw $180 million at a crashing asset unless they expect significant recovery. These moves suggest institutional confidence in Ethereum’s fundamentals remains intact.

The OTC purchases and exchange withdrawals tell us sophisticated investors view current prices as opportunity, not disaster. They’re positioning for the next cycle while retail investors flee in fear.

However, short-term volatility will likely continue. Markets need time to digest this correction and establish new support levels. Plus, broader crypto market conditions remain uncertain with regulatory questions and macroeconomic pressures.

Still, when mining operations and OTC whales accumulate this aggressively during a crash, it pays to notice. These players have resources and information most retail investors lack. Their actions suggest they see value others are missing.

Watch how Ethereum handles the $3,800 level over the next week. If it holds and volume remains elevated, we could see a sharp bounce as shorts cover and sidelined capital re-enters. But if support breaks, the next stop might be closer to $3,500.

Either way, the smart money already made their move. They bought the fear while everyone else sold the panic.