Crypto got crushed Wednesday while stocks and gold partied. Bitcoin held above $112,000, barely. But altcoins? They collapsed.

The damage runs deeper than most realize. FET plunged 6.2% in a single day and lost 43% this week. That’s not a correction. That’s capitulation.

Meanwhile, traditional markets climbed higher. The disconnect tells you everything about where traders see risk right now. And crypto just became the riskiest bet on the board.

Altcoin Carnage Spreads Beyond FET

FET’s bloodbath started when Ocean Protocol dumped the ASI Alliance and apparently offloaded tokens on Binance. But the selling pressure didn’t stop there.

MYX dropped 10%. CAKE fell 4%. The altcoin season index on CoinMarketCap crashed to 38 out of 100. Earlier this month it sat at 67.

That’s a brutal shift in sentiment. Plus, it happened fast. The index measures whether altcoins outperform Bitcoin. When it drops this sharply, it signals traders fleeing to safer crypto assets or exiting entirely.

Remember, altcoins typically get hit first when markets turn defensive. Bitcoin holds value better as the established asset. So when you see this pattern, expect more pain before recovery starts.

Derivatives Signal Bearish Positioning

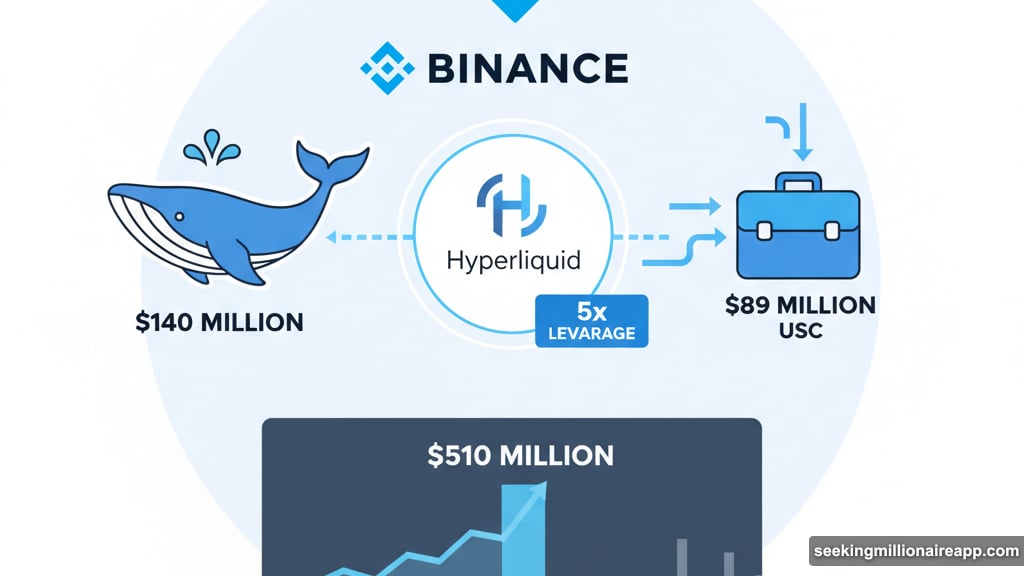

Smart money moved aggressively against crypto Wednesday. One whale opened a $140 million short position on Bitcoin through Hyperliquid using 5x leverage.

That’s not cautious hedging. That’s a conviction bet on lower prices.

Bitcoin futures open interest on Binance jumped by $510 million during Asian trading hours. A single trader transferred $89 million in USDC to the exchange, likely preparing to short futures contracts.

Meanwhile, perpetual funding rates for Bitcoin and Ether stayed flat or negative. That tells you long positions aren’t paying shorts to maintain their bets. Instead, the market structure favors bears.

Options activity on the CME hit record highs with 61.44K BTC in open interest. Yet futures volume remained subdued. Traders want protection without taking directional bets. That’s defensive behavior, not bullish confidence.

FET Crashes to Two-Year Lows

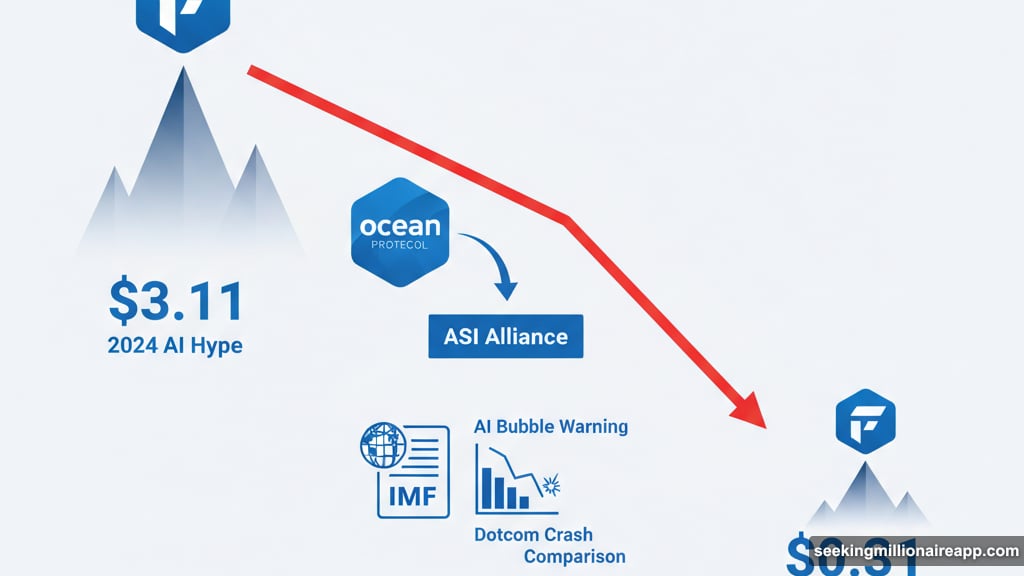

FET now trades at $0.31, its lowest price in two years. The token peaked at $3.11 in 2024 during the AI hype cycle. It’s lost 90% since then.

Ocean Protocol’s exit from the ASI Alliance triggered the immediate selloff. But the underlying weakness existed long before that announcement.

The token showed persistent selling pressure with no buyer support. Every bounce got sold. Every rally failed. That’s how bear markets work.

Here’s what stings. FET erased all gains from the recent bull market. Investors who bought during the AI excitement now sit on massive losses. And the IMF’s warning about an AI bubble bursting doesn’t help sentiment.

The IMF compared potential AI market dynamics to the dotcom crash. If they’re right, AI-linked tokens like FET face further downside as reality checks hype-driven valuations.

Bitcoin Holds Range While Alts Crumble

Bitcoin traded near $112,000, posting modest gains while staying in its established range. That’s actually impressive given the carnage in altcoins and derivatives positioning.

The range-bound behavior suggests Bitcoin found support at current levels. Buyers stepped in when price approached the lower boundary. That creates a floor, at least temporarily.

But the divergence between Bitcoin and altcoins raises concerns. Typically, Bitcoin leads market direction. Altcoins follow with amplified moves. When altcoins collapse while Bitcoin holds steady, it often precedes broader market weakness.

Stocks rallied Wednesday. Gold climbed higher. Yet crypto struggled to participate in the risk-on environment. That disconnect matters because it shows traders don’t view crypto as a safe haven or even a risk asset worth holding right now.

Options Traders Seek Downside Protection

Put skew in short-dated Bitcoin options increased overnight on Deribit. Traders bought more put options relative to calls, signaling expectations for downward price movement.

One notable flow over Paradigm’s OTC desk involved a long position in the October 18 expiry $108,000 Bitcoin put. That bet pays off if Bitcoin drops below $108,000 by Friday.

The combination of rising put demand and negative funding rates creates a bearish setup. Options traders protect against drops. Futures traders short the market. Spot buyers stay sidelined.

This positioning can become self-fulfilling. When enough traders position bearishly, their hedging and short-selling creates the very price action they feared. Markets don’t need fundamental reasons to move when derivatives pressure builds.

Mixed Signals in Open Interest Growth

Open interest increased notably for XPL, ASTER, SUI, and LINK futures. But the top 10 tokens showed mixed performance overall.

Rising open interest usually signals growing market participation. But context matters. When open interest climbs while prices fall, it often indicates short positions accumulating rather than new bullish bets.

The selective nature of open interest growth also tells a story. Traders focused on specific altcoins rather than broad-based crypto exposure. That suggests tactical positioning rather than conviction about overall market direction.

Ether futures and options remained elevated near lifetime peaks. Yet Ether’s price action looked weak relative to Bitcoin. High open interest with weak price action typically precedes volatility spikes, either up or down.

Why Traditional Markets Diverged

Stock markets rallied Wednesday. Gold hit new highs. Bitcoin barely moved. Altcoins tanked.

That divergence reveals how traders view risk hierarchies. Stocks represent growth expectations. Gold offers inflation protection and safe-haven appeal. Crypto? Right now it’s just speculative and risky.

When risk-on sentiment drives traditional markets higher but crypto lags, it suggests institutional money isn’t flowing into digital assets. Retail traders dominate crypto markets, and they’re currently defensive.

The IMF’s AI bubble warning likely contributed to FET’s collapse. But it also reflects broader concerns about speculative asset valuations. If AI stocks face a reckoning, AI-linked crypto tokens will suffer worse.

What Comes Next for Crypto Markets

Short-term outlook looks challenging. Derivatives positioning favors bears. Altcoins show technical weakness. Bitcoin holds support but lacks bullish catalysts.

The next key level for Bitcoin sits at $108,000, matching that put option strike. If price breaks below that level, expect cascading liquidations as stops trigger and shorts pile on.

For altcoins, the damage already occurred. FET’s 43% weekly drop and the altcoin season index collapse signal a shift from speculation to risk-off behavior. Recovery requires either Bitcoin breaking higher or new catalysts emerging for specific tokens.

Options expiry Friday could create volatility. Large open interest in puts means market makers need to hedge dynamically. That can amplify price moves in either direction as expiry approaches.

Funding rates staying negative provides a contrarian indicator. When everyone positions bearishly, markets sometimes squeeze higher to liquidate those shorts. But that requires buying pressure, which currently doesn’t exist.

Markets don’t turn bullish overnight. This defensive positioning could persist for weeks, especially if traditional markets roll over or if more negative crypto news emerges. Stay cautious until derivatives sentiment shifts and altcoins stabilize.