The Chicago Mercantile Exchange just opened the door for institutions to bet on XRP and Solana in a whole new way.

Options trading for both cryptocurrencies went live this week. Major players including Wintermute, Galaxy, Cumberland DRW, and SuperState executed the first trades. This marks a significant expansion of CME’s crypto offerings beyond Bitcoin and Ethereum.

Here’s what this actually means for crypto markets.

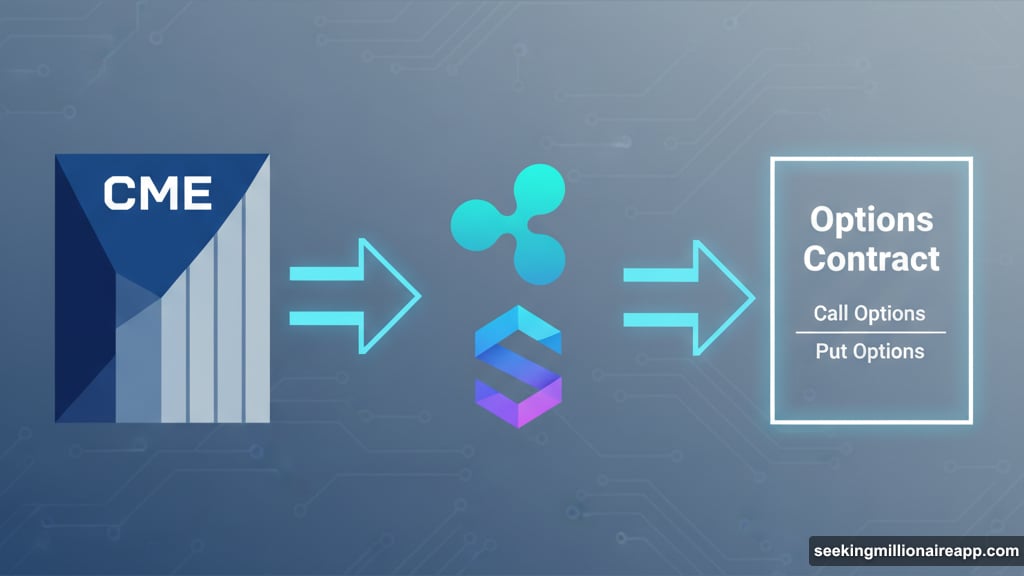

Options Trading Comes to Alt Coins

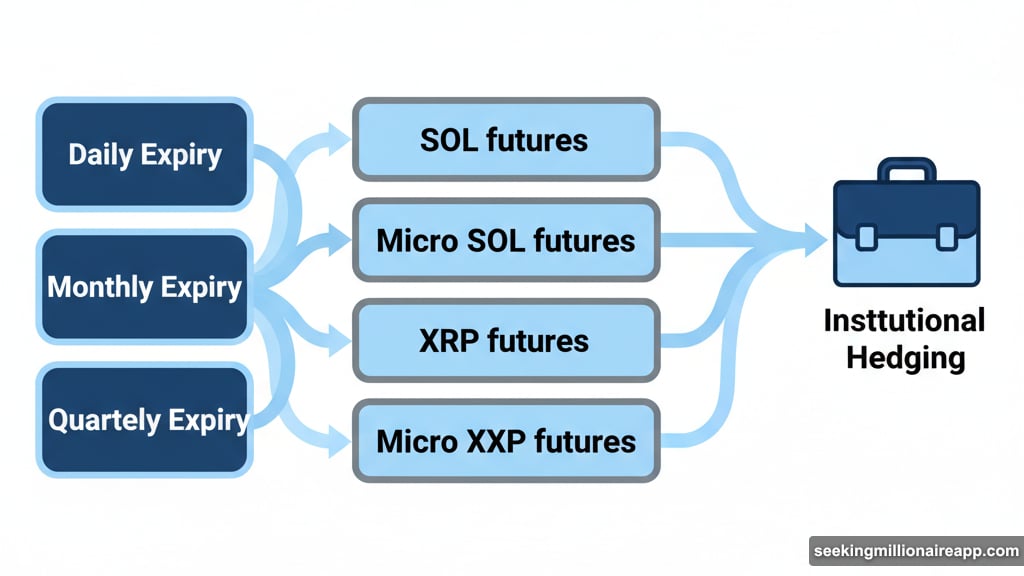

CME now offers options on SOL, Micro SOL, XRP, and Micro XRP futures. Traders can choose daily, monthly, or quarterly expiry dates.

So what are options anyway? They’re contracts that give buyers the right to purchase or sell an asset at a set price later. But here’s the key part: there’s no obligation to follow through.

Call options grant the right to buy. Put options grant the right to sell. Both let traders manage risk without committing massive capital upfront.

That flexibility matters enormously for institutions. They can now hedge XRP and Solana exposure with the same tools they use for traditional assets. Plus, CME’s regulated environment provides the legitimacy that cautious investors demand.

The First Trades Tell a Story

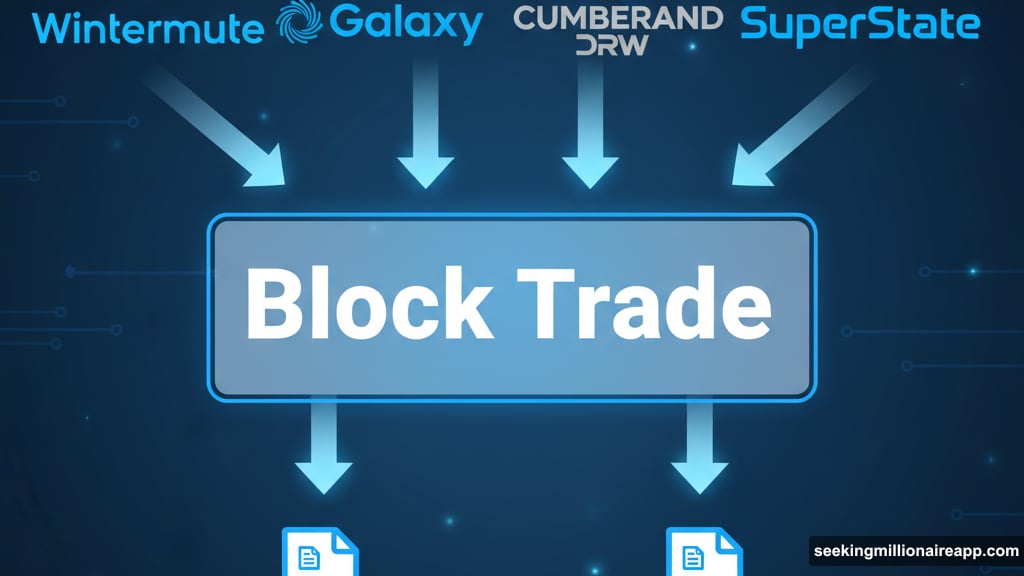

Cumberland DRW and Galaxy executed the first Solana options trade on Monday. It happened as a block trade, meaning they negotiated directly instead of using the public order book.

Block trades signal serious institutional interest. These aren’t retail investors making small bets. They’re major market makers deploying significant capital.

“Cumberland is thrilled to facilitate the first block trade for options on SOL futures,” said Roman Makarov, Head of Cumberland Options Trading at DRW. “Institutional participants are clearly seeking greater choice and depth in crypto markets.”

Meanwhile, Wintermute and SuperState handled the first XRP options trade on Sunday, October 12. Again, a block trade between sophisticated participants.

Saahith Pochiraju from SuperState noted that XRP options help manage exposure within funds like their Crypto Carry strategy. That’s institutional portfolio management language. Not speculation. Strategy.

Why This Matters Beyond Trading

Options create several downstream effects that strengthen crypto markets.

First, liquidity improves. Market makers can hedge positions more efficiently. That tighter risk management means they’re comfortable providing deeper order books. Better liquidity benefits everyone trading these assets.

Second, price discovery gets more sophisticated. Options markets reflect expectations about future volatility and price movements. Those signals help all participants make informed decisions.

Third, institutional participation increases. Many funds face regulatory restrictions on direct crypto holdings. But derivatives on regulated exchanges? That’s often permissible. So options access brings new capital into the ecosystem.

“As the crypto market continues to mature, market participants increasingly are looking to manage their exposure and pursue new opportunities across a wider range of crypto instruments,” said Giovanni Vicioso, Global Head of Cryptocurrency Products at CME Group.

He’s right. This isn’t about speculation anymore. Institutions want risk management tools. They need hedging strategies. Options provide both.

The Numbers Back Up the Demand

CME’s existing crypto futures already showed strong interest in these assets. XRP futures volume rose 7.19% to $7.84 billion in September. Solana futures jumped 57.1% to $13.5 billion during the same period.

Compare that to Bitcoin futures, which fell 4.05%, and Ethereum futures, which dropped 17.9%. Clearly, institutional appetite for alternative cryptocurrencies is growing faster than for the majors.

Plus, total open interest across all crypto derivatives hit a record $230 billion in September. That’s the amount of capital committed to outstanding contracts. Rising open interest indicates growing participation and confidence.

Options add another layer to this ecosystem. They complement futures by offering different risk-reward profiles. Some traders want directional bets via futures. Others prefer the asymmetric risk of options.

What’s Different This Time

CME previously launched crypto products that failed to gain traction. So why will these succeed?

The infrastructure matured. Trading firms now have systems designed for crypto options. Clearing mechanisms work smoothly. Risk management practices evolved through years of futures trading.

Moreover, the regulatory environment improved. Institutional investors feel more comfortable participating in regulated crypto markets. CME’s credibility removes concerns about custodial risk or exchange failures.

Finally, demand actually exists. Those first-day block trades weren’t orchestrated marketing stunts. They represented real capital deployed by sophisticated firms. That organic interest bodes well for sustained trading activity.

The Institutional Crypto Playbook

These launches fit a broader pattern. Traditional finance is absorbing crypto through regulated channels.

Spot Bitcoin ETFs brought mainstream investors into BTC. CME futures provided hedging tools. Now options on major altcoins extend that infrastructure to Solana and XRP.

Each step normalizes crypto as an asset class. Wall Street speaks the language of derivatives. Options, futures, swaps—these are familiar instruments. So packaging crypto into these formats accelerates institutional adoption.

Meanwhile, crypto-native participants gain access to sophisticated trading strategies. Market makers can run delta-neutral positions. Funds can implement covered call strategies. Volatility traders can play both sides of price movements.

Everyone wins. Traditional finance gets comfortable crypto exposure. Crypto markets get deeper liquidity and tighter spreads.

Not Everyone’s Celebrating

Some crypto purists argue that derivatives undermine the original vision. They point out that paper contracts don’t require actual asset ownership. So CME traders can speculate on XRP without ever touching actual XRP tokens.

That criticism holds some weight. Derivative markets can manipulate spot prices through coordinated positioning. Plus, the regulatory complexity potentially excludes smaller participants.

However, the alternative is worse. Without regulated derivatives, institutions largely avoid crypto. That leaves markets dominated by retail traders and vulnerable to manipulation. Proper derivatives infrastructure actually stabilizes prices over time.

Besides, options don’t replace spot markets. They complement them. Traders still need to own the underlying asset for many strategies. So demand for physical XRP and SOL should increase alongside derivatives activity.

What Happens Next

CME’s options launch is just the beginning. Other exchanges will likely follow with their own offerings. Competition drives innovation and better pricing for traders.

Moreover, success with XRP and Solana options could open doors for other cryptocurrencies. Cardano, Avalanche, Polygon—any asset with sufficient liquidity becomes a candidate for CME derivatives.

The regulatory approval process takes time. But each new product makes the next one easier. CME is building a playbook for adding crypto assets to traditional finance infrastructure.

Meanwhile, trading volumes will determine ultimate success. Those impressive first-day numbers need to translate into sustained activity. Market makers must commit capital consistently. Institutional users need to find value in these tools.

Early signs look promising. But the real test comes over months, not days.

The Bigger Picture

XRP and Solana options represent crypto’s ongoing maturation. These markets are transitioning from speculative playgrounds to legitimate asset classes.

That transformation requires infrastructure. Custody solutions, regulatory frameworks, risk management tools—all the boring stuff that makes institutions comfortable. CME’s options fit squarely into that category.

Some crypto enthusiasts lament losing the wild-west energy. But professionalization brings benefits. Better liquidity, lower volatility, and broader participation ultimately serve everyone holding these assets.

The question isn’t whether traditional finance will absorb crypto. That’s happening already. The question is how quickly and on whose terms.

CME’s latest product launch suggests crypto is negotiating from a position of strength. Major assets are earning spots alongside traditional instruments. Not as novelties. As legitimate tools for portfolio management and risk hedging.

That’s progress, whether you’re excited about institutional adoption or skeptical of it. Markets are evolving. Smart participants adapt.