Cross-border payments suck. They’re slow, expensive, and ridiculously complicated. But that’s about to change dramatically.

Investment bank William Blair just dropped a bold prediction. Stablecoins will replace the entire legacy system for international business payments. Not “might replace” or “could disrupt.” They’re saying it’s happening.

The implications reach far beyond crypto circles. Traditional correspondent banks face an existential threat. Meanwhile, a handful of companies sit perfectly positioned to capture billions in displaced revenue.

The Problem With Moving Money Today

Sending money across borders remains stuck in the 1970s. Your payment bounces through multiple correspondent banks. Each one takes a cut and adds delay.

The process typically takes 3-5 business days. Sometimes longer. And you’ll pay 3-6% in fees for the privilege. Plus, good luck tracking where your money actually is during that time.

William Blair calls this system “slow, expensive, and fragmented.” That’s diplomatic banking speak for “absolutely terrible.” The infrastructure simply wasn’t built for a globalized economy operating 24/7.

Moreover, foreign exchange risk adds another layer of complexity. Exchange rates fluctuate during transit. So the amount you send rarely matches what arrives. Businesses hate this uncertainty when managing cash flow.

Why Stablecoins Change Everything

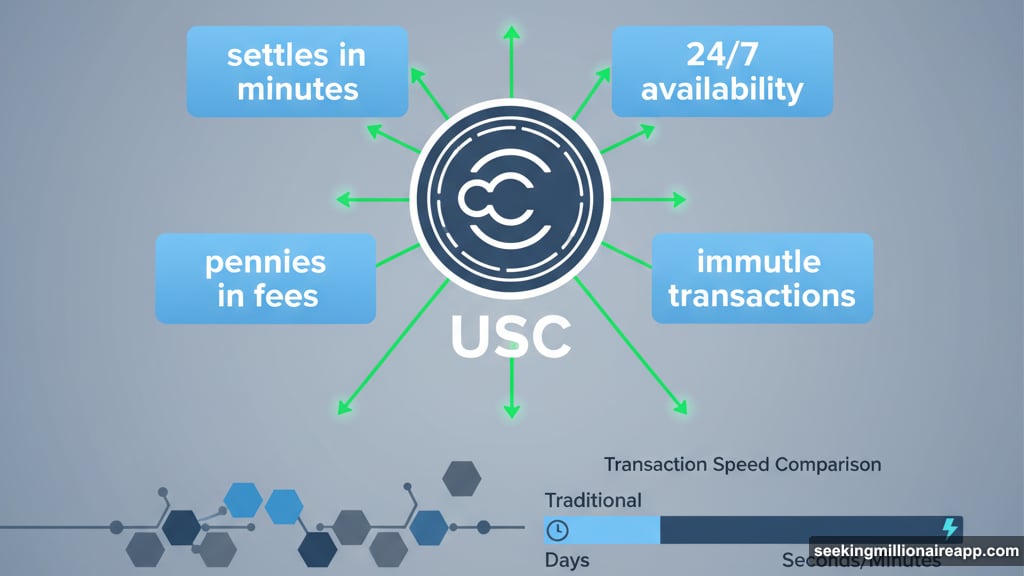

Stablecoins operate on fundamentally different rails. They settle transactions in minutes, not days. Fees drop to pennies instead of percentages.

Here’s the real advantage: 24/7 availability. Traditional banks close for weekends and holidays. Stablecoins don’t care. Your payment moves whenever you need it to move.

Circle’s USDC exemplifies this shift. Each token represents exactly one U.S. dollar. No exchange rate uncertainty. No conversion fees. Just instant, verifiable value transfer on blockchain rails.

William Blair highlighted several technical benefits. Transactions are immutable once confirmed. They’re programmable, enabling smart contract automation. And they eliminate most intermediary involvement entirely.

That last point matters most. Fewer intermediaries mean lower costs and faster settlement. The economic model simply works better than what correspondent banks offer.

Circle and Coinbase Win Big

William Blair named Circle and Coinbase as “the highest-quality public crypto companies” positioned for this transition. That’s significant praise from a traditional investment bank.

Circle issues USDC, the second-largest stablecoin by market capitalization. As stablecoin adoption grows, Circle captures transaction fees and earns interest on reserve assets. Their business model scales beautifully with increased usage.

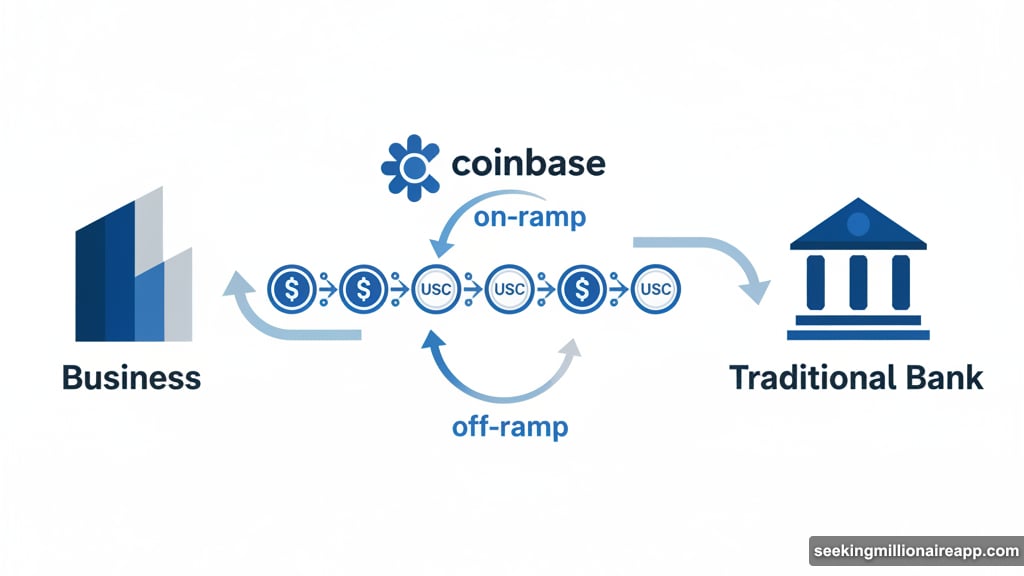

Coinbase operates as a primary on-ramp and off-ramp for stablecoin activity. Businesses buying USDC typically use Coinbase. So do those converting back to traditional currency. Plus, Coinbase builds infrastructure that enterprises need for stablecoin integration.

The report predicts market consolidation around a few dominant tokens. Liquidity demands and network compatibility force convergence. USDC stands positioned to become one of those dominant standards.

Other potential winners include Visa, Mastercard, and payment processors like Corpay. These giants are building stablecoin support into their existing networks. Smart move, since they’d rather adapt than get disrupted entirely.

Traditional Banks Face Existential Pressure

Here’s where it gets uncomfortable for legacy institutions. Even if correspondent banks integrate stablecoin rails, they won’t capture the economic upside.

That value flows to newer entrants instead. Companies building on digital infrastructure own the rails. Banks that merely facilitate access become commoditized intermediaries again.

William Blair was blunt about this dynamic. Stablecoins don’t complement the existing system. They threaten to replace core components entirely.

Think about the economics. Today, correspondent banks earn fees from every international transfer. Those fees generate billions annually. Stablecoins eliminate the need for correspondent banking relationships in many scenarios.

Banks could theoretically compete by offering stablecoin services themselves. But they’d be competing against infrastructure designed from scratch for digital transactions. Legacy systems create inherent cost disadvantages.

Regulation Clears the Path Forward

The GENIUS Act and similar legislation provide crucial regulatory clarity. Stablecoins need clear rules to achieve mass adoption. Governments increasingly recognize this reality.

However, William Blair emphasized that regulation alone won’t drive adoption. Corporate demand must grow. Digital infrastructure must mature. Traditional financial giants must finish building stablecoin support.

These catalysts are developing simultaneously. Major corporations increasingly struggle with cross-border payment inefficiencies. Digital infrastructure improves constantly. And as mentioned, Visa and Mastercard actively build stablecoin capabilities.

The pieces are falling into place. Not overnight, but consistently. William Blair predicts a “golden age of stablecoin commerce” once these elements fully align.

That said, the bank warned about short-term risk. Investors in Coinbase and Circle stocks might grow impatient with adoption pace. Market sentiment could turn negative if growth doesn’t materialize quickly enough.

The Real Risk Is Moving Too Slow

Traditional financial institutions face a classic innovator’s dilemma. They can see the threat coming but struggle to respond effectively.

Their existing infrastructure generates enormous revenue. Cannibalizing that revenue by adopting stablecoins feels dangerous. Yet not adopting feels more dangerous long-term.

Meanwhile, companies without legacy baggage move faster. Circle doesn’t need to maintain correspondent banking relationships. Coinbase doesn’t need to protect wire transfer fees. They build for the future without protecting the past.

This dynamic plays out across industries when new technology emerges. Incumbents hesitate. Upstarts attack. By the time incumbents react decisively, they’ve lost significant ground.

William Blair’s report signals that sophisticated observers recognize this pattern playing out in payments. The question isn’t whether stablecoins disrupt cross-border payments. It’s how quickly disruption occurs and who captures the value.

Smart money buys positions in clear winners during moments of market doubt. If you believe stablecoins will dominate international payments, weakness in Coinbase and Circle stock represents opportunity rather than risk.

The correspondent banking system survived for decades because no viable alternative existed. Now one does. And it works better in almost every measurable way.