Coinbase just rolled out a new way for companies to handle payments. The platform runs entirely on USDC stablecoins and promises to make vendor payments simpler while cutting out traditional banking headaches.

Named “Coinbase Business,” this service targets companies tired of dealing with chargebacks and clunky payment systems. Plus, it comes with accounting integrations that crypto-native businesses actually need.

What Coinbase Business Actually Does

The platform lets businesses send and receive USDC directly. That might sound simple. But it tackles several pain points at once.

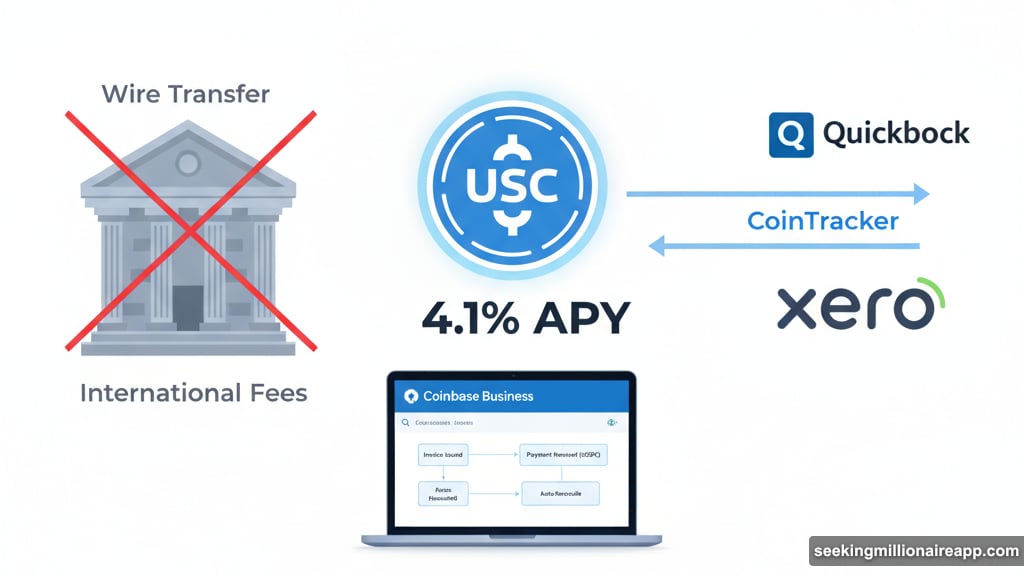

First, vendor payments become straightforward. No more wire transfer delays or international payment fees. Second, chargebacks disappear entirely since blockchain transactions are final. Third, API integrations mean developers can build payment flows without starting from scratch.

Here’s the financial hook. USDC balances sitting in Coinbase Business earn 4.1% APY automatically. So idle cash actually generates returns. Moreover, businesses can cash out anytime to their linked bank account via wire or ACH.

The accounting piece matters too. All transactions sync with QuickBooks or Xero through CoinTracker integrations. That means finance teams can adopt crypto payments without abandoning their existing workflows.

The Stablecoin Competition Heats Up

Coinbase isn’t operating in a vacuum here. The stablecoin payment space is getting crowded fast.

Circle, Coinbase’s partner in USDC, launched its own Circle Payment Network earlier this year. That created an interesting dynamic. Coinbase and Circle split revenue 50/50 on USDC yield. Yet now they’re building overlapping services.

Tom Duff Gordon, Coinbase’s VP of international policy, addressed this directly. He said there’s “high tolerance” for exploring different business directions. Some paths will overlap. Others will diverge. Both companies seem comfortable with this approach.

USDC holds a $76 billion market cap, making it the second-largest stablecoin. So bringing more USDC volume onto Coinbase’s platform makes economic sense. Even if that means some friendly competition with Circle.

Meanwhile, Coinbase has reportedly held talks to acquire BVNK, a stablecoin payments firm, for around $1.5 billion. Duff Gordon declined to comment on that deal’s status. But the signal is clear. Coinbase is betting big on stablecoin utility beyond just trading.

Base and AI Payments on the Horizon

Coinbase is thinking beyond basic cross-border payments. The company is exploring how stablecoins work with AI-driven commerce.

Their Base network, an Ethereum layer-2 system, serves as the testing ground. Coinbase has been working on X402, an open-source protocol for stablecoin transactions between AI agents. That sounds futuristic. But Duff Gordon believes programmable micro-payments will become crucial.

“I think agentic commerce, machine-to-machine, X402, and the use of stablecoins for things like micro programmable payments in that environment is going to be very interesting,” he said. “It won’t necessarily scale overnight, but it’s absolutely part of the future.”

This reveals Coinbase’s broader strategy. They’re not just building a payment platform for today. They’re positioning USDC as the settlement layer for AI-to-AI transactions tomorrow.

Stablecoin Payments Hit Mainstream

The timing of Coinbase Business reflects a larger trend. Stablecoins are transitioning from crypto-native tools to mainstream business infrastructure.

KPMG recently reported that stablecoins can cut cross-border payment costs by 99% compared to traditional methods. That kind of efficiency gain catches attention in corporate finance departments. Moreover, regulatory clarity is improving in key markets, making stablecoin adoption less risky for businesses.

Coinbase is clearly positioning itself to capture this shift. By offering competitive yield, accounting integrations, and instant settlement, they’re addressing the practical concerns that kept businesses on the sidelines.

The question now is execution. Can Coinbase convince enough businesses to switch payment rails? The platform looks solid on paper. But actual adoption depends on sales, support, and whether the promised efficiencies materialize in practice.

Where This Leads Next

Coinbase Business represents more than just another product launch. It signals how crypto exchanges are evolving into full-service financial platforms.

Traditional crypto exchanges made money from trading fees. Now they’re expanding into custody, staking, payments, and business services. Stablecoins provide the bridge. They’re familiar enough for traditional businesses but crypto-native enough to unlock blockchain benefits.

For businesses considering crypto payments, Coinbase Business offers a relatively low-risk entry point. USDC’s stability removes volatility concerns. The 4.1% yield beats most business savings accounts. And the accounting integrations mean finance teams don’t need blockchain expertise to manage transactions.

However, challenges remain. Regulatory uncertainty persists in some jurisdictions. Not every vendor or customer is ready to transact in stablecoins. And the space is getting competitive with Circle, PayPal, and others building similar services.

Still, the pieces are coming together. As more businesses adopt stablecoin payments, the network effects kick in. That creates momentum. And momentum in payments is hard to reverse once established.

Coinbase is making its bet. Now we’ll see if businesses follow.