The crypto market just wiped out over $1.1 billion in leveraged positions. Most of that money came from retail traders betting on a quick recovery that never arrived.

After the sharp crash on October 11, retail investors piled into long positions across Bitcoin, Ethereum, Solana, and other major cryptocurrencies. They expected prices to bounce back fast. Instead, the market kept sliding. Now those bullish bets are turning into mounting losses.

The data tells a brutal story about what happens when optimism collides with reality.

Retail Traders Are All-In on Long Positions

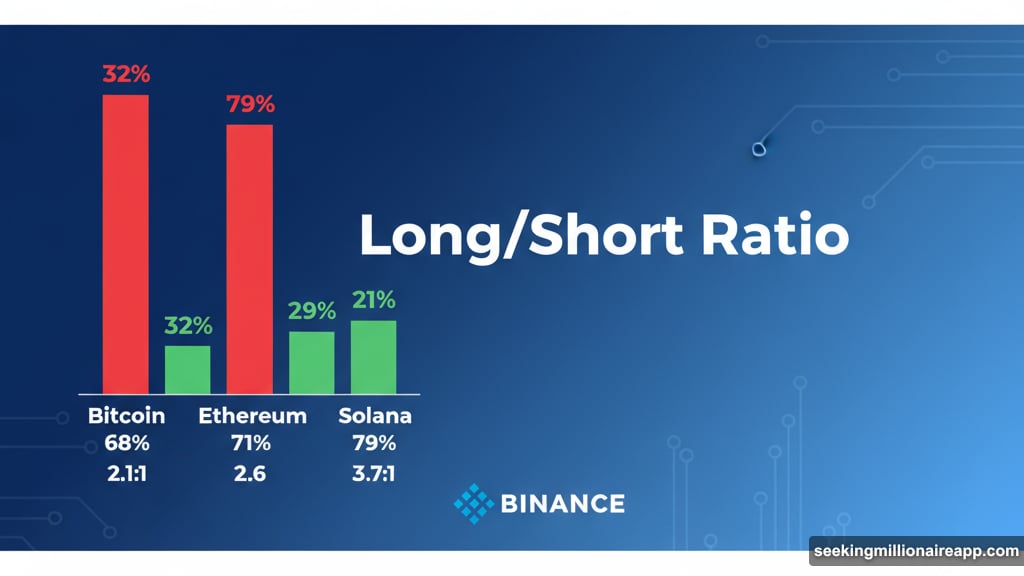

Numbers from Hyblock Capital show just how lopsided retail positioning has become. Between 68% and 79% of retail accounts are holding long positions on major cryptocurrencies right now.

Bitcoin sits at 68% longs, placing it in the 97th percentile historically. Ethereum reached 71%, hitting the 96th percentile. Solana topped the chart at 79% longs—the 98th percentile. Even HYPE token shows 68% long positioning.

Translation? Nearly everyone betting small money thinks prices will go up. Very few are betting against the market.

Binance data confirms this one-sided positioning. The platform’s Long/Short Account Ratio shows 2.1-to-1 for Bitcoin, 2.6-to-1 for Ethereum, and a staggering 3.7-to-1 for Solana. For every trader betting on lower prices, multiple traders are betting on higher ones.

That kind of crowded trade rarely ends well.

When Everyone Bets the Same Way, Someone Gets Crushed

Here’s where it gets worse. Hyblock’s correlation data reveals a troubling pattern between long ratios and actual prices.

Bitcoin shows a -0.93 correlation. Ethereum comes in at -0.86. Solana hits -0.87.

What does negative correlation mean? As more retail traders go long, prices actually tend to fall. The more bullish retail gets, the more the market drops.

So retail traders are essentially buying into weakness. Their aggressive positioning isn’t driving prices higher. Instead, it’s creating fuel for liquidations.

Those liquidations already started hitting hard.

$1.1 Billion Vaporized in Forced Sell-Offs

CoinGlass data shows that nearly 290,000 traders got liquidated recently. Total liquidations reached $1.11 billion, with $873 million coming specifically from long positions.

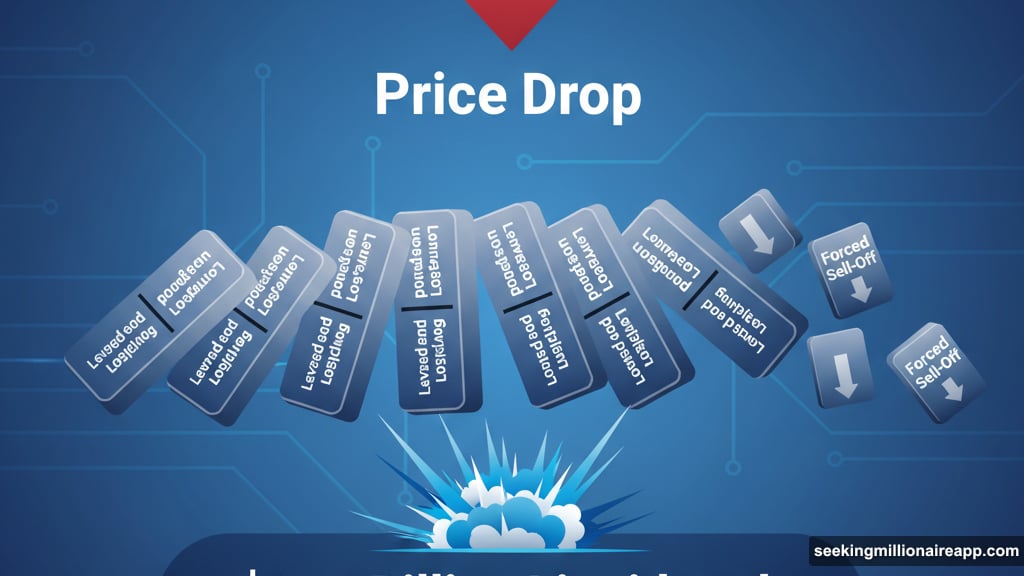

Liquidations happen when leveraged positions move against traders. Exchanges automatically close those positions to prevent further losses. But those forced closures create selling pressure that pushes prices even lower.

That creates a cascade. Lower prices trigger more liquidations. More liquidations push prices down further. The cycle feeds on itself.

The total crypto market cap dropped below $3.6 trillion and kept falling. That suggests the liquidation pain isn’t over yet.

Why the Recovery Keeps Stalling

Many retail traders expected a V-shaped recovery after the October 11 crash. Prices would drop sharply, then bounce back just as quickly. That’s what happened in previous corrections, so why not this time?

But markets don’t repeat patterns just because traders expect them to. Plus, the extreme bullish positioning works against a quick recovery.

Think about it. If retail traders already went all-in on long positions and prices still aren’t rising, who’s left to buy? Large institutional players aren’t stepping in to rescue retail positions. They’re probably waiting for better entry points at lower prices.

Meanwhile, retail traders are bleeding capital through liquidations. Even if cryptocurrencies drop to more attractive prices later, many won’t have money left to buy back in. They’ll be sitting on the sidelines with empty accounts.

That makes a strong rebound unlikely in the near term. Instead, expect choppy, range-bound trading at depressed levels while the market digests all this selling pressure.

The Dangerous Game Retail Keeps Playing

Retail traders love leverage. It amplifies gains when trades work out. But it also amplifies losses and can wipe out accounts completely.

The current situation shows what happens when leverage meets crowded positioning. Everyone betting the same direction creates imbalance. Markets hate imbalance and tend to punish it aggressively.

Plus, retail traders often lack risk management discipline. They see prices falling and think “bargain opportunity” instead of “potential further decline.” So they keep adding to losing positions rather than cutting losses.

Professional traders do the opposite. They scale out of losing trades quickly and wait for clear confirmation before re-entering. That’s why institutional accounts typically avoid the extreme positioning ratios we’re seeing in retail.

The lesson here? When 70-80% of accounts are positioned one way and the market keeps moving against them, maybe the crowd is wrong.

What Happens Next Depends on Liquidation Pressure

Market direction now hinges on how much more liquidation fuel remains. If enough retail long positions get closed out, selling pressure could finally exhaust itself. That would create conditions for a sustainable bounce.

But if retail traders keep doubling down on long positions at every slight dip, they’re just adding more ammunition for the next liquidation cascade. Each new wave of forced selling pushes prices lower and sets up the next round of pain.

So far, the data suggests retail hasn’t learned the lesson. Long ratios remain extremely elevated even after $1.1 billion in liquidations. That implies more capital sits exposed to downside risk.

Smart money is probably waiting on the sidelines. They’ll let retail exhaust itself through liquidations, then step in to buy when positioning normalizes and prices reach genuinely attractive levels.

The question is how much lower prices need to fall before that happens. Based on current positioning extremes, we might not have hit the bottom yet.

Position sizing matters. Risk management matters. Following the crowd into overleveraged trades rarely ends well. This market crash is teaching that lesson again, one billion-dollar liquidation at a time.