Bitcoin crashed hard last Friday. But something unexpected happened next.

Instead of panic selling, investors held tight. That’s a massive shift from previous market drops. In fact, the data reveals behavior we haven’t seen in past cycles.

On-chain metrics show retail conviction is back. Plus, the market structure looks fundamentally different than 2020 or 2021. Let’s dig into what changed and why it matters for the current bull run.

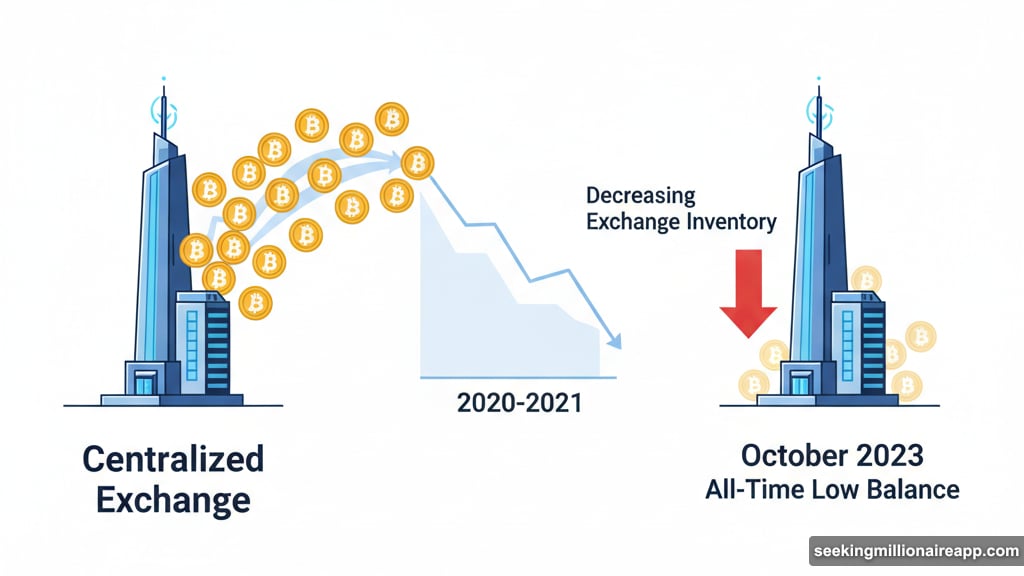

Exchange Balances Tell the Real Story

Here’s the critical difference. During 2020 and 2021 crashes, cryptocurrency balances on centralized exchanges surged. That meant one thing: investors rushing to sell.

This time? Exchange balances hit all-time lows.

CryptoQuant analysts spotted this trend immediately. Low inventory on exchanges means fewer coins available to dump. So sustained price drops become harder to maintain.

The data gets more interesting. When exchanges hold minimal Bitcoin, sellers have limited ammunition. That creates natural price support during downturns.

Moreover, this low-balance environment suggests investors moved coins to cold storage. They’re planning to hold long-term, not flip for quick profits.

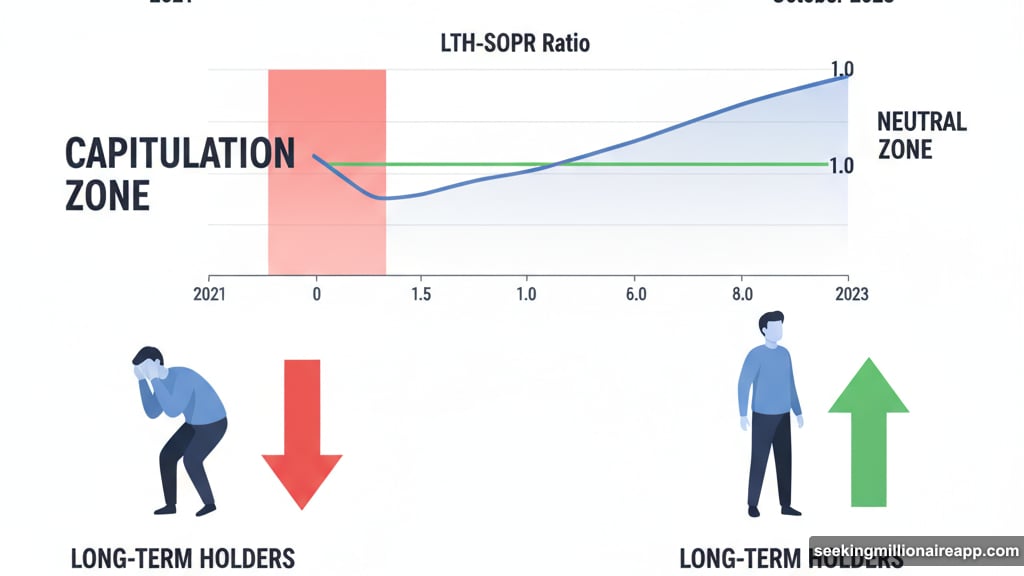

Long-Term Holders Stopped Capitulating

Remember 2021? Long-term holder behavior looked ugly during crashes.

The Long-Term Holder SOPR (LTH-SOPR) stayed below 1 for months back then. That ratio tracks whether long-term investors sell at profit or loss. Below 1 means they’re taking losses out of fear.

But this October? The ratio barely moved from neutral.

Long-term investors aren’t panic selling anymore. Instead, they’re taking reasonable profits without capitulating. That stability strengthens the entire network.

Think about what that means. These holders survived previous bear markets. They know volatility comes with crypto. So they’re not shaken by a single bad day.

Whales Slow Down, Small Investors Step Up

The whale activity chart reveals another shift. Large holders (1,000+ BTC) were selling aggressively earlier this year. Now that distribution is slowing.

Meanwhile, smaller holders are buying like crazy. Glassnode’s accumulation data shows strong buying from investors holding 1 to 1,000 BTC. That’s the retail and intermediate investor range.

This pattern matters for market health. When whales control too much supply, volatility increases. But when smaller investors accumulate, ownership distributes more evenly.

Plus, aggressive buying from smaller holders suggests confidence in Bitcoin’s future. These investors are betting on higher prices ahead.

Historical Patterns Point to Recovery

Past crashes followed a consistent pattern. Leverage gets flushed out. Whales accumulate near the bottom. Then prices recover in a V-shape.

Take May 2021 as an example. Bitcoin dropped 30% after Tesla news and Chinese regulatory concerns. Whales sold 50,000 BTC during the panic.

But here’s the twist. Those same whales bought back 34,000 BTC near the bottom. They sold high, bought low, and profited from the volatility.

August 2023 showed similar behavior. A 15% correction followed the US debt rating downgrade. The Long-Term Holder SOPR dipped briefly. Then it rebounded fast as accumulation resumed.

Each major drop resolved excess leverage. Then smart money stepped in to buy the dip. This October looks like another example of that cycle.

Why This Time Feels Different

The fundamentals shifted between 2021 and now. Back then, retail investors dominated the space. They panicked easily and sold at losses.

Today’s market includes more institutional players. They understand volatility is normal. So they don’t rush to exit positions over short-term price moves.

Additionally, the infrastructure improved dramatically. Better custody solutions exist. Tax implications are clearer. Regulatory frameworks matured in many countries.

All these factors contribute to more stable investor behavior. People aren’t gambling anymore. They’re investing with conviction in Bitcoin’s long-term value proposition.

What the Data Really Means

Low exchange balances, stable long-term holder metrics, and retail accumulation paint a clear picture. This isn’t 2021’s panic-driven selloff.

Instead, we’re seeing healthy market dynamics. Weak hands already left during the bear market. The investors remaining believe in Bitcoin’s future.

That conviction matters more than short-term price action. Bear markets shake out tourists. Bull markets reward those who held through volatility.

October’s crash tested that conviction. The data shows most investors passed that test. They didn’t panic. They didn’t capitulate. Many even bought more.

So while prices dropped sharply, the underlying market structure grew stronger. That’s the opposite of what happened in previous cycle tops.

Looking Ahead

Nobody knows what comes next. Bitcoin could drop further. It could recover quickly. Markets always surprise us.

But the investor behavior data offers genuine insight. This drawdown doesn’t look like the beginning of a bear market. It looks like a healthy correction within an ongoing bull run.

Exchange reserves staying at all-time lows limits downside risk. Long-term holders maintaining positions adds stability. Small investors accumulating aggressively suggests bottom fishing already started.

The pieces are in place for recovery. Whether that happens next week or next month remains uncertain. But the foundation looks solid.

Watch the on-chain metrics closely. They’ll reveal when whales resume aggressive buying. That’s typically the signal for the next leg up.

For now, the most important takeaway is simple. Investors held during October’s crash. That’s fundamentally different from 2021’s panic selling. And that difference might define this cycle’s trajectory.