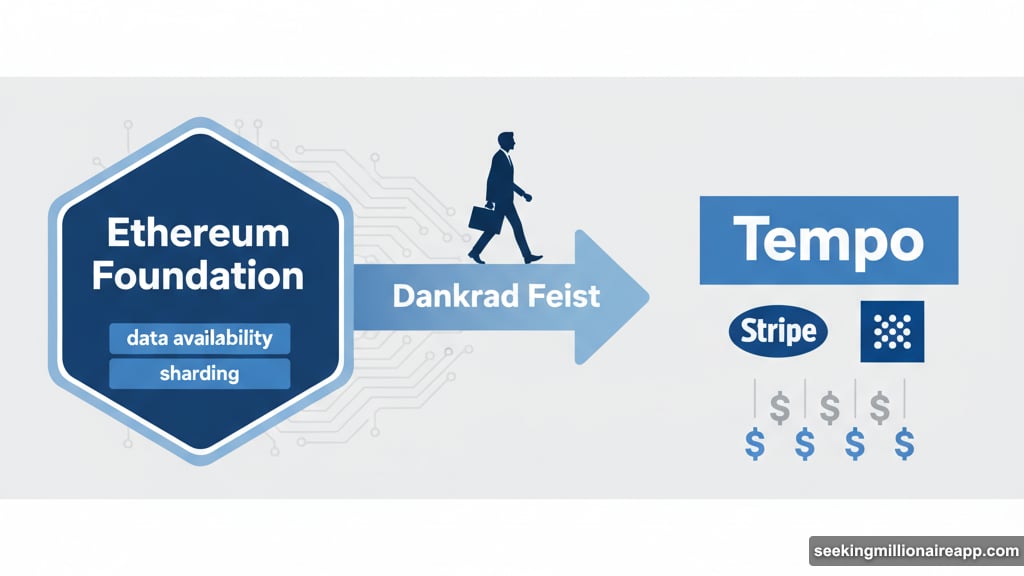

Dankrad Feist just made a move that’s turning heads across crypto. The longtime Ethereum researcher left his full-time role at the Ethereum Foundation to join Tempo, a payments-focused blockchain backed by some serious money.

This isn’t your typical developer job hop. Feist spent six years building core Ethereum technology. Now he’s betting on a project that aims to solve something Ethereum still struggles with: everyday payments. Plus, Stripe and Paradigm are footing the bill.

So what’s really happening here? And why would a core Ethereum developer leave for a competing blockchain?

Why Feist’s Exit Matters

Feist wasn’t just any Ethereum developer. He led critical research on data availability and sharding since joining the Foundation in 2019. These technologies underpin Ethereum’s scaling roadmap.

His departure signals something bigger. Ethereum’s brightest minds are exploring alternatives. Not because Ethereum failed, but because different problems need different solutions.

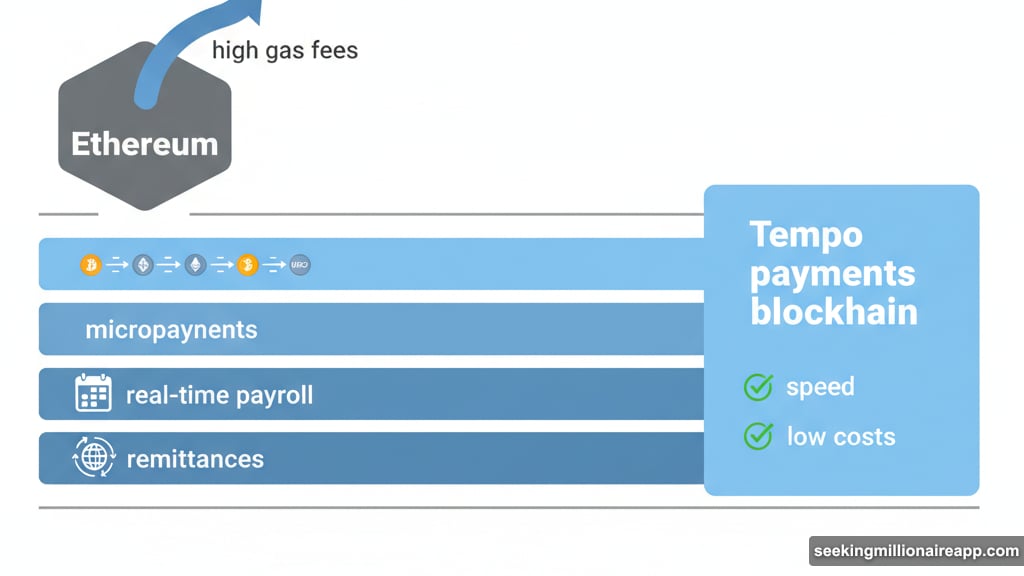

Take payments. Ethereum handles them, sure. But high gas fees and slower settlement times make it impractical for micropayments or real-time payroll. That’s where Tempo comes in.

Feist emphasized he’ll stay involved as a research advisor. Still, losing a full-time core developer to a Stripe-backed project sends a message. The market is fragmenting. Specialized blockchains are gaining traction.

Tempo’s Payments Play

Stripe doesn’t throw money at blockchain projects randomly. The payments giant sees something in Tempo’s approach.

Tempo is building specifically for payments and real-world financial integration. That means optimizing for speed, low costs, and regulatory compliance. Things Ethereum sacrifices for decentralization and security.

The project is still in private testnet. But it’s already attracting attention from major players. OpenAI, DoorDash, and Deutsche Bank provided design input. That’s not typical for crypto projects.

What’s Tempo’s angle? According to Paradigm, they’re targeting global payments, payroll, remittances, tokenized deposits, embedded financial accounts, and microtransactions. Plus, they’re eyeing “agentic payments” for AI systems.

That last part is interesting. AI agents need to make automated payments. Traditional financial rails are too slow and expensive. Blockchain-native payment systems could unlock entirely new use cases.

The Conflict Question Nobody’s Asking

Here’s what bugs me. Feist previously joined EigenLayer as an advisor. Then he stepped down amid conflict of interest concerns. Now he’s joining another blockchain project while staying on as an Ethereum advisor.

Is this a conflict? Feist says no. He describes Tempo as a “complement” to Ethereum. The idea is that Tempo’s open-source technology can feed back into the Ethereum ecosystem.

Maybe that’s true. But it’s also convenient. Every developer leaving for a competing project claims their work will ultimately benefit Ethereum. Sometimes that happens. Often it doesn’t.

The crypto industry needs to get honest about these relationships. Can you really serve two masters? Or does divided attention inevitably lead to divided loyalty?

What This Means for Ethereum

Ethereum isn’t dying. But it’s also not the only game in town anymore.

Specialized blockchains are emerging for specific use cases. Solana dominates DeFi trading. Base owns social applications. Now Tempo is gunning for payments.

That’s actually healthy. Ethereum can’t be everything to everyone. Trying to optimize for all use cases simultaneously leads to compromises everywhere.

The question is whether Ethereum can maintain its position as the foundational settlement layer while letting specialized chains handle specific applications. Or will users and developers migrate entirely to chains built for their needs?

Feist’s move suggests the latter is possible. He could have stayed at Ethereum Foundation and worked on scaling solutions. Instead, he chose a clean-sheet design optimized for one thing.

The Real Story Here

Stripe’s involvement is the headline everyone’s missing. The payment processor has spent years exploring crypto. Now they’re backing a project led by proven Ethereum talent.

That signals something important. Traditional fintech companies aren’t just watching crypto anymore. They’re building competing systems using the same open-source technology and developer talent.

Plus, they’re bringing something crypto projects often lack: regulatory relationships, compliance infrastructure, and partnerships with legacy financial institutions.

Tempo has Deutsche Bank’s input. That’s not accidental. They’re building a blockchain that banks can actually use. Not in theory. In practice. Right now.

Whether that’s good for crypto’s decentralization ideals is debatable. But it’s definitely happening. And Ethereum’s core developers are helping make it real.

The choice is clear. Stay pure and risk irrelevance. Or adapt and potentially compromise founding principles.

Feist made his choice. More developers will follow.