MrBeast wants to manage your money. Yes, that MrBeast.

Jimmy Donaldson, the 27-year-old mastermind behind YouTube’s most-subscribed channel, just filed a trademark for “MrBeast Financial.” The proposed platform would offer banking services with built-in crypto capabilities. Think debit cards, cryptocurrency exchanges, and investment tools all under one brand.

But here’s the catch. MrBeast’s crypto track record includes a messy $10 million controversy involving pump-and-dump schemes. So his jump into regulated financial services raises some obvious questions about credibility and oversight.

What MrBeast Financial Actually Plans to Offer

The trademark filing with the United States Patent and Trademark Office reveals ambitious plans. MrBeast Financial would handle traditional banking alongside blockchain innovation.

Proposed services include issuing credit and debit cards for everyday purchases. Plus, the platform would process cryptocurrency payments directly. Users could also access decentralized exchange features for trading digital assets. Beyond that, general investment services round out the offering.

This represents the first major attempt by a social media influencer to launch a mainstream banking brand in the United States. Most content creators stick to merchandise or energy drinks. MrBeast is jumping straight into financial infrastructure.

The filing uses “intent-to-use” status under trademark law. That signals genuine plans to bring the service to market, not just defensive brand protection. However, USPTO review processes move slowly. Initial examination won’t happen until mid-2026, with final approval possibly arriving before year’s end.

The $10 Million Crypto Scandal Still Haunts Him

MrBeast’s crypto reputation took serious damage last October. Blockchain investigator SomaXBT exposed how the YouTuber allegedly profited over $10 million from backing low-cap tokens through Initial DEX Offerings.

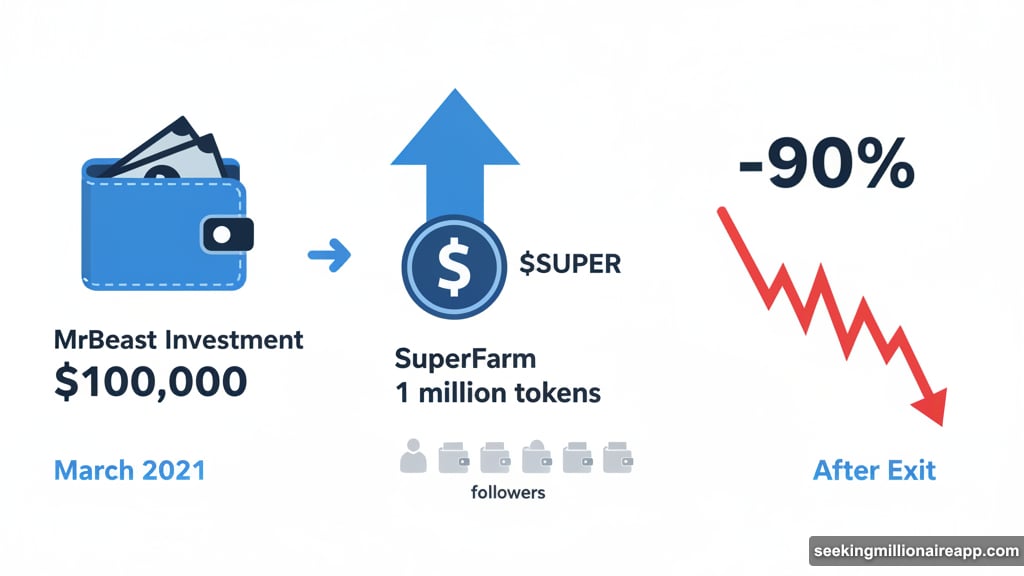

The pattern looked suspicious. MrBeast would invest early in obscure crypto projects promoted by influencers like Lark Davis and KSI. Token prices would spike after his involvement became public. Then he’d exit his positions. Finally, projects would collapse, losing over 90% of their value.

One example stands out. In March 2021, MrBeast invested $100,000 in SuperFarm ($SUPER), receiving 1 million tokens. Influencer Elliot Trades promoted the project heavily. The token value surged shortly after MrBeast’s participation became known. Then it crashed.

A separate investigation by Loock Advising claimed MrBeast made at least $23 million through insider trading connected to rug pulls. These allegations paint a picture of someone exploiting market influence for personal gain while followers lost money.

Now this same person wants to manage banking services. The irony isn’t lost on anyone paying attention.

Why This Banking Venture Feels Different

Traditional influencer business ventures stay in safe territory. Merchandise lines, restaurant chains, energy drinks. These carry minimal regulatory scrutiny and limited consumer risk.

Banking operations face entirely different standards. Federal oversight, consumer protection laws, anti-money laundering requirements, and fiduciary responsibilities all come into play. Plus, adding cryptocurrency features multiplies regulatory complexity.

MrBeast Financial would need to navigate the Consumer Financial Protection Bureau, potentially the Office of the Comptroller of the Currency, and various state banking regulators. Cryptocurrency components add another layer through FinCEN guidance and evolving SEC positions on digital assets.

Most established financial institutions spend years building compliance infrastructure. They hire teams of lawyers, compliance officers, and risk managers. Can an influencer organization realistically build that foundation from scratch?

Moreover, the Federal Deposit Insurance Corporation provides crucial consumer protection for traditional banks. Would MrBeast Financial qualify for FDIC insurance? If not, customers risk losing deposits entirely if the venture fails.

The Bigger Picture for Influencer Finance

MrBeast’s move signals where creator economy might head next. Content creators already sell products, run brands, and influence purchasing decisions. Financial services represent the next frontier.

But influence doesn’t equal expertise. Building trust through entertaining videos differs fundamentally from maintaining fiduciary responsibility. Fans might buy MrBeast burgers on impulse. Trusting him with savings and investments requires entirely different confidence.

Other influencers will watch this closely. If MrBeast Financial succeeds, expect copycats. If it fails spectacularly or faces regulatory shutdown, it might discourage similar ventures.

The trademark filing alone doesn’t guarantee launch. Many companies file protective trademarks that never materialize into actual products. Intent-to-use applications sometimes sit unused after brands change direction or discover barriers.

Regulatory approval poses the biggest hurdle. Banking licenses aren’t granted to anyone with a popular YouTube channel. Applicants must demonstrate financial stability, operational competence, and trustworthiness.

What Happens Next

The USPTO will spend months reviewing the trademark application. Assuming no challenges from existing financial brands, approval could come by late 2026.

But trademark approval doesn’t mean business approval. Banking operations require separate licenses from federal and state regulators. Those processes take years and involve extensive scrutiny of business plans, leadership qualifications, and financial backing.

MrBeast would need to assemble a legitimate financial team. Compliance experts, banking veterans, and technology specialists. No amount of social media influence substitutes for regulatory expertise.

Plus, he’ll need serious capital. Building banking infrastructure costs tens of millions before serving a single customer. Technology platforms, security measures, customer service operations, and compliance systems all require massive upfront investment.

The cryptocurrency components add extra complexity. Regulators remain cautious about crypto-enabled banking services. They want to see robust anti-money laundering controls, customer protection mechanisms, and clear risk disclosures.

MrBeast Financial faces an uphill battle. The concept sounds innovative. The execution requires navigating regulatory mazes that crush most startups. And the founder’s crypto controversy will invite extra scrutiny from both regulators and potential customers.

Whether this becomes reality or joins countless abandoned trademark filings remains unclear. But one thing’s certain: mixing influencer culture with banking regulation creates fascinating territory to watch unfold.